Price skimming can deliver quick, early revenue under the right conditions.

For many businesses, it risks customer frustration, brand damage and ethical questions around fairness.

In this article, you’ll learn how the price skimming strategy works, the pitfalls to watch for and customer-friendly alternatives that drive sustainable growth and loyalty. You’ll also see how CRM tools like Pipedrive can help you attract and retain customers without relying on short-term pricing tactics.

Price skimming definition

Price skimming is a pricing strategy that sets high price points when a new product enters the market, then gradually decreases them as the product progresses through its lifecycle and experiences more competition.

This strategy improves revenue by:

Maximizing profit margins in early lifecycle stages through high initial price tags

Maximizing sales volumes in later stages by incremental product price decreases

Price skimming is a common tactic in innovation-driven industries like tech, pharma and fashion.

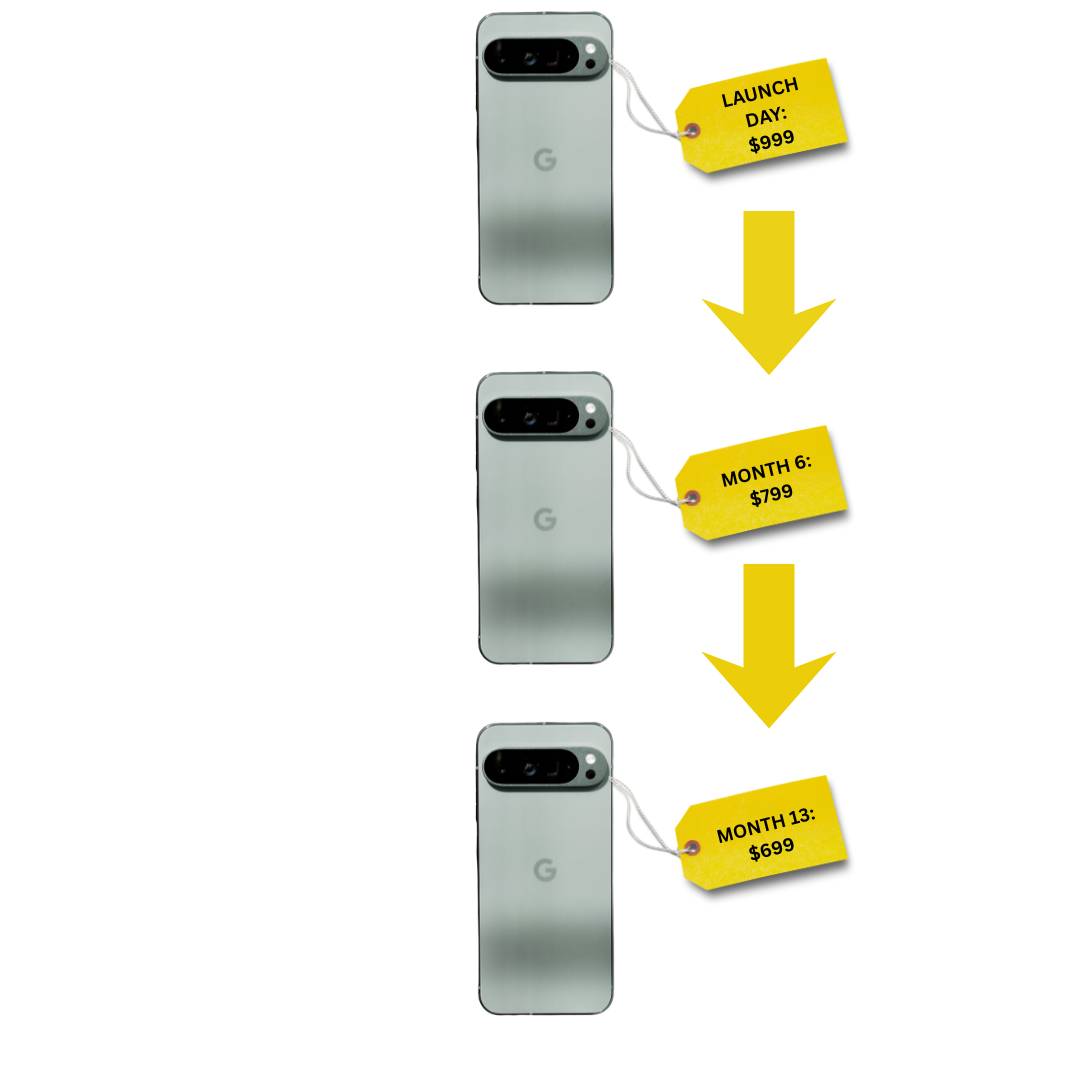

To better explain price skimming, here’s a graphic showing Google Pixel 9 Pro’s pricing throughout its lifecycle, from launch day until shortly after the new Google Pixel 10 lineup release.

The Google Pixel 9 Pro release is priced at an all-time high. Pricing then gradually drops until it reaches an all-time low, shortly after Google launches a new flagship model.

Price skimming enables Google to capture two distinct consumer segments simultaneously: early adopters willing to pay a premium for brand-new releases and price-conscious buyers seeking good deals.

How price skimming works

The price skimming strategy involves a staged process, usually covering three steps.

The first phase sets high price tags to improve a product’s perceived value. Consumers associate expensive products with quality, a sense of scarcity and a feeling of exclusivity.

Prices then drop in phases two and three, where the focus shifts from maximized profit margins to increased sales volumes.

Here’s a brief outline of how price skimming works:

Phase one. Releases products at high price points to generate and capture enthusiasm among early adopters. Products have low market share but high profit margins.

Phase two. Decreases prices once product enthusiasm diminishes and competitors enter the market. It captures new customer segments with lower profit margins but higher market shares and sales volumes.

Phase three. Prices drop further as products near the end of their lifecycle to capture the final segments, typically price-conscious buyers.

Phase three usually coincides with new product launches, where the price skimming cycle restarts.

Is price skimming ethical?

Price skimming can sit in an ethically grey area, especially when it lacks transparency or is too aggressive.

Its phased approach brings maximum revenue across each lifecycle stage by design. By contrast, pricing for regular product lifecycles adjusts naturally in response to competition and market demand.

Initial stages also inflate a product’s perceived value, persuading customers to pay a premium to become early adopters rather than wait for future prices to normalize.

Consumers can consider this tactic exploitative. Early adopters may feel like they overpaid once prices decrease, which can generate negative sentiment and impact a brand’s reputation.

Even when businesses execute it carefully, price skimming is often a company-centric practice rather than a customer-focused one.

Price skimming disadvantages and limitations

Price skimming’s ethical concerns also bring a series of disadvantages and limitations, especially around brand reputation and customer loyalty.

Here are some of the most important drawbacks to consider:

Disadvantage | How it impacts businesses |

1. Discourages customer loyalty | Decreases customer lifetime value (CLV) and retention by driving negative sentiment in early adopters as products progress to the final stages. |

2. Impacts brand reputation | Poorly justified high price tags often generate backlash among audiences, especially when repeated or if products fail to meet consumer expectations. |

3. Can end product lifecycles prematurely | Intense backlash from premium customer segments may influence buying decisions for phase two and three audience segments. |

4. Drives more aggressive competition | Encourages competitors to take over through undercutting. |

5. Not a universally-compatible approach | Likely won’t work in competitive markets, small businesses without well-established, emotionally connected customer bases or when a product has elastic demand. |

Price skimming can be particularly risky in the business-to-business (B2B) sector.

The B2B sales cycle is lengthier, more rational and customer retention-driven. On the other hand, price skimming is acquisition-focused and captures initial audiences through emotional factors such as scarcity and exclusivity.

Higher-than-usual prices are also harder to justify to B2B audiences, as you must demonstrate that your products will still bring customers a good ROI.

The limited use cases and a focus on quick profit gains don’t favor long-term success for price skimming. SMBs feel these effects more because reputational damage and customer churn disproportionately affect smaller operations.

Note: Price skimming is effective and ethical only in select scenarios. Companies with highly innovative products can apply this strategy to attract small customer segments and test products before full-scale release. Businesses can justify high prices to recover research and development costs.

Price skimming alternatives

The good news is that some alternatives do exist that successfully fill the gaps left by price skimming.

Below, you’ll learn about each possible alternative alongside their advantages, disadvantages and real-world applications.

1. Penetration pricing

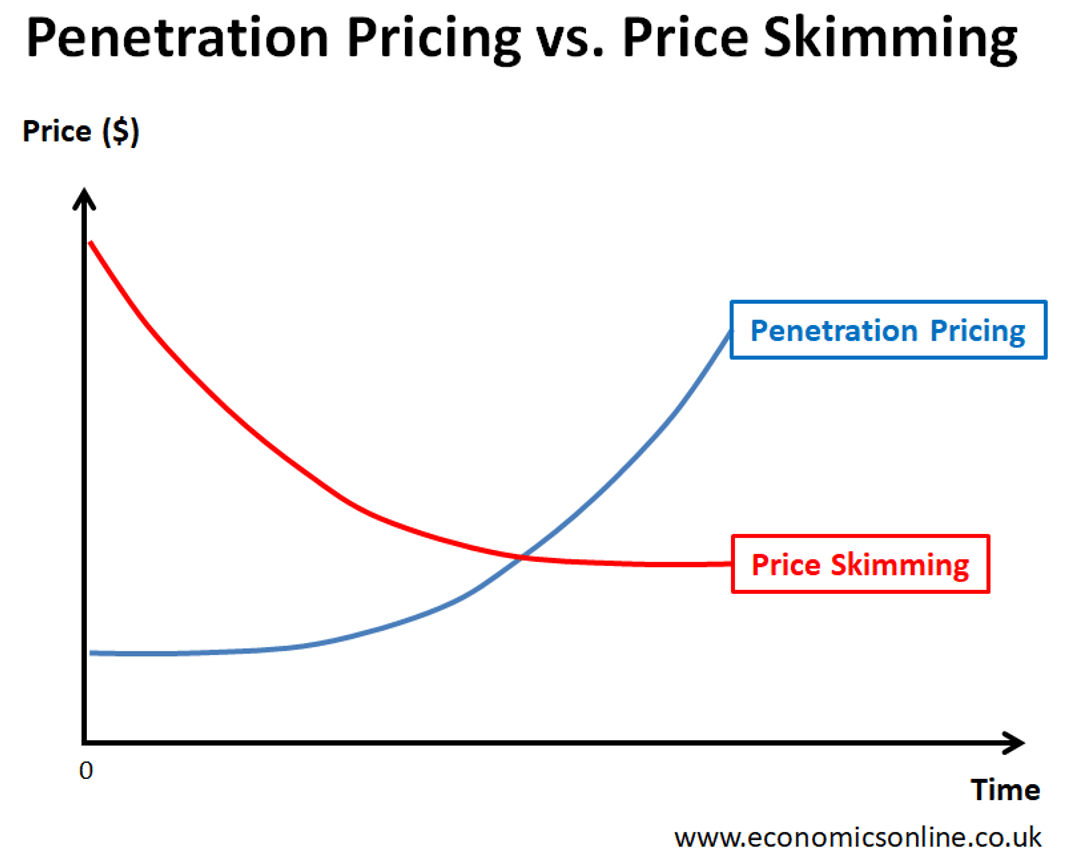

Penetration pricing is the exact opposite of price skimming, particularly useful in competitive markets.

Penetration pricing sets low initial prices to capture attention, customers and market share fast.

Once companies establish a foothold in their markets, prices increase to improve profit margins.

Here’s a graph that illustrates the difference between penetration pricing and price skimming:

Like price skimming, penetration pricing also has disadvantages. The following table provides an overview of the main pros and cons of this pricing strategy.

Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Who penetration pricing is useful for: Established companies looking to break into new but highly competitive markets. Penetration pricing requires large investments but generates a lot of buzz, acquires new customers quickly and boosts brand reputation.

For example, the new Affinity 3.0 release under the Canva brand made headlines in the graphic design world. Affinity’s product is similar to Adobe Creative Cloud’s, but it offers an almost full-featured free version. Affinity’s paid subscriptions are also significantly more affordable.

The release generated numerous comparisons between Adobe and Affinity in design communities, while Affinity’s free plan drove large influxes of new customers. A significant portion of these new customers were previous Adobe users.

2. Tiered pricing

Tiered pricing categorizes a product’s or service’s price into multiple levels based on features, usage or quantities.

Like price skimming, tiered pricing can target high-end, mid-range and budget-oriented consumer segments, but separately.

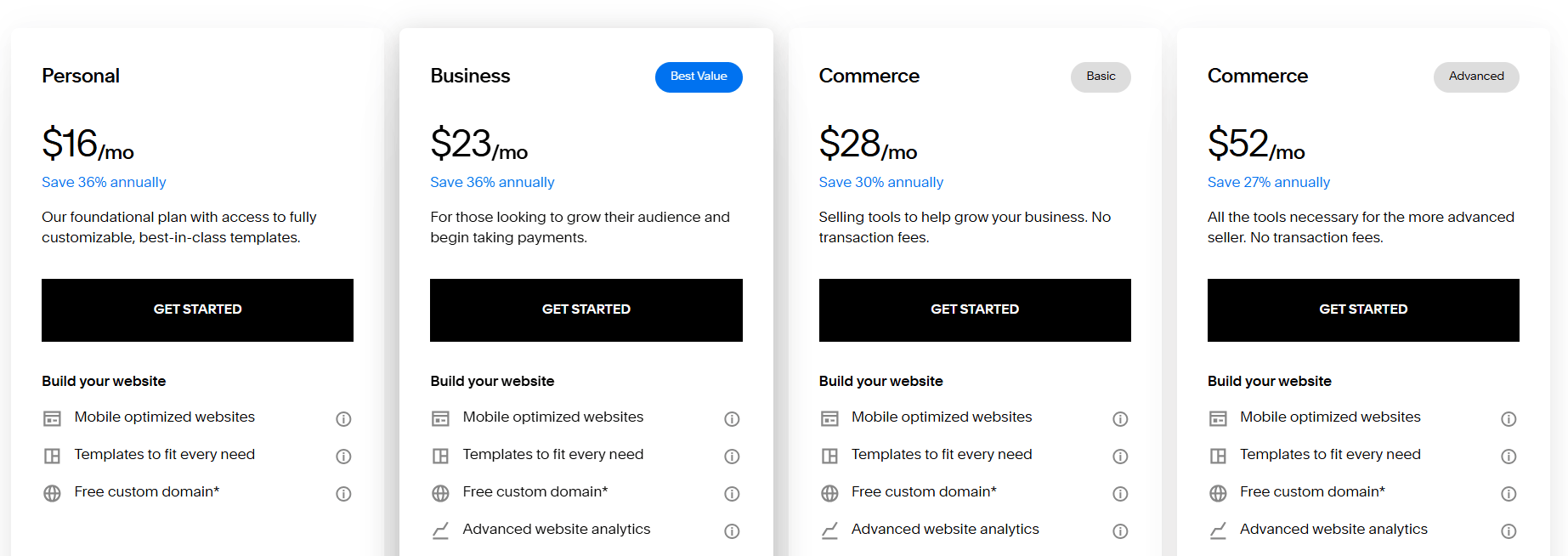

For example, SaaS companies can offer entry-level, mid-level and enterprise-specific versions of the same product. To illustrate, here’s a screenshot of Wix’s pricing structure:

Each pricing plan adjusts the platform’s features to provide optimal value for its intended customer segment.

This strategy addresses the primary concern of price skimming – having the same product pass through all customer segments, where phase three customers receive significantly more value than phase one segments.

Wix’s approach to tiered pricing is called feature-based tiered pricing. There are also two other variants to this strategy suitable for different business models:

Usage-based tiered pricing, where customers pay more based on product or service consumption

Quantity-based tiered pricing, where customers pay less per unit once the number of products purchased exceeds particular thresholds

For example, AI platforms can include tiered credit-based systems that charge users based on how often they use their AI tools. Wholesale retailers can use quantity-based tiered pricing to encourage customers to buy more units.

Here’s a table with tiered pricing’s main advantages and disadvantages:

Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Who tiered pricing is useful for: SaaS companies and subscription-based businesses. Tiered pricing is the go-to strategy for companies in this sector as it provides optimal value to customers spanning multiple budget levels. This pricing helps maximize profitability across the board, with no compromise on brand reputation.

Tiered pricing is also common for physical tech products. For example, smartphone companies often sell premium, standard and entry-level configurations of the same product.

3. Competitive pricing

Competitive pricing aligns with or slightly undercuts market leaders’ prices.

This pricing strategy aims to undercut competitors by either offering:

More value than competitors, but at the same price

The same value as competitors, but at a lower price

Competitive pricing is similar to penetration pricing, but less aggressive and more long-term-oriented.

For example, Squarespace is one of Wix’s main competitors. Both companies offer generally similar products, but Squarespace’s pricing plans are more affordable, especially in high-tier packages.

This approach indicates that Squarespace likely aims to undercut Wix primarily in high-end customer segments.

Below, explore some of the positives and negatives of competitive pricing:

Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Who competitive pricing is useful for: SaaS companies and online stores operating in competitive markets. Extra value or slightly lower prices are often enough to maximize sales volume in these scenarios. It persuades customers to migrate from competitors to your offering.

4. Cost-plus pricing

Cost-plus pricing is a simple strategy that calculates a product’s or service’s final sales price by adding a fixed markup percentage to all related expenses.

The cost-plus pricing formula looks like this:

Sales price = total product expenses + markup

These expenses can cover production, marketing, overhead, transport and so on. The markup represents the profit margin you want to gain from that product.

For example, if a unit’s total expenses are $10 and you want to add a 20% profit margin, then the sales price for that specific product would be $12.

Here’s what may and may not work with a cost-plus pricing approach:

Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Who is cost-plus pricing useful for: New businesses testing the market. It’s an easy-to-implement pricing strategy that requires minimal market research.

Cost-plus pricing also serves as a good baseline when testing prices for new products. You can gradually increase or decrease profit margins to see how pricing tweaks impact your sales.

Download Your Guide to Sales Performance Measurement

5. Value-based pricing

Value-based pricing bases prices on the consumers’ perception of a brand and its products.

Companies use value-based pricing to maximize profits and maintain a positive brand image.

This approach works well with unique product offerings or markets with underserved audience segments.

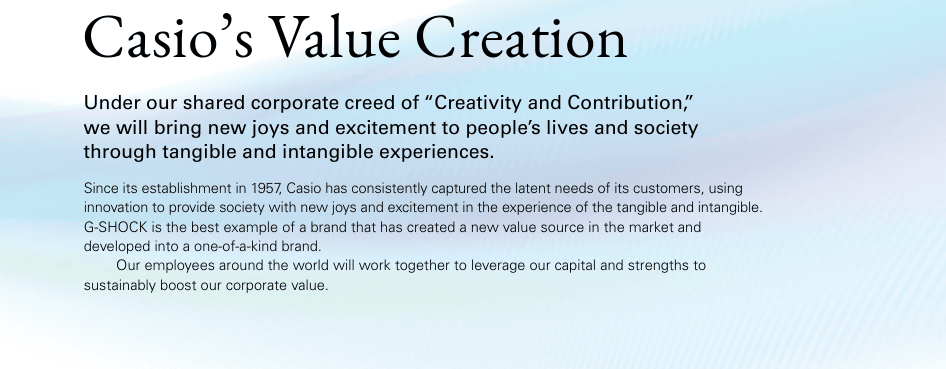

For example, Casio G-Shock’s rugged watch lineup stands out in an industry otherwise dominated by luxury brands.

Its unique value proposition targets a previously untapped market segment. Customers in that segment are willing to pay extra.

Check out some key value-based pricing benefits and drawbacks:

Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Who value-based pricing is useful for: Companies selling unique or premium products that appeal to niche segments. Consumers will find higher price tags fully justified in this case.

Value-based pricing also works as an effective competitive strategy. You can capitalize on competitor shortcomings and use higher prices to position yourself as a premium or niche-specific alternative.

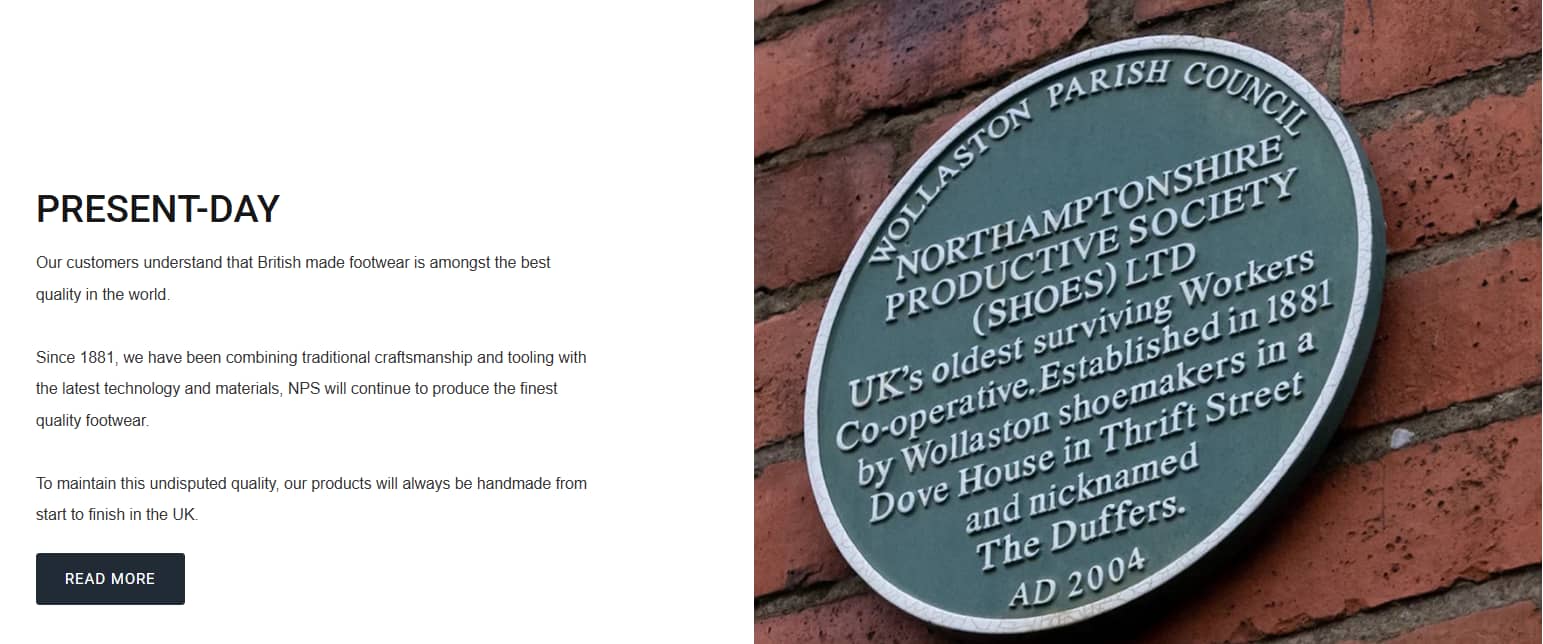

For instance, Doc Martens and Solovair are direct competitors. Doc Martens fans noticed drops in quality after the company moved its production offshore. Solovair uses that to position itself as the high-quality, 100% UK-made alternative to Doc Martens.

Solovair products are more expensive than Doc Martens across the board, but the company’s unique value proposition justifies the added cost.

To sum up, the price skimming alternatives listed above are safer and ethical. However, you’ll need substantial data to pick the strategy that enables your business to be truly customer-centric.

How Pipedrive supports ethical, sustainable customer acquisition

While Pipedrive’s CRM system won’t choose your pricing strategy for you, it provides sales and marketing teams with a single source of customer intelligence to uncover all they need to know about their audience.

The platform unifies lead pipelines, customer segmentation and product performance visibility – all CRM-driven workflows – to help you make informed pricing decisions for your customer base.

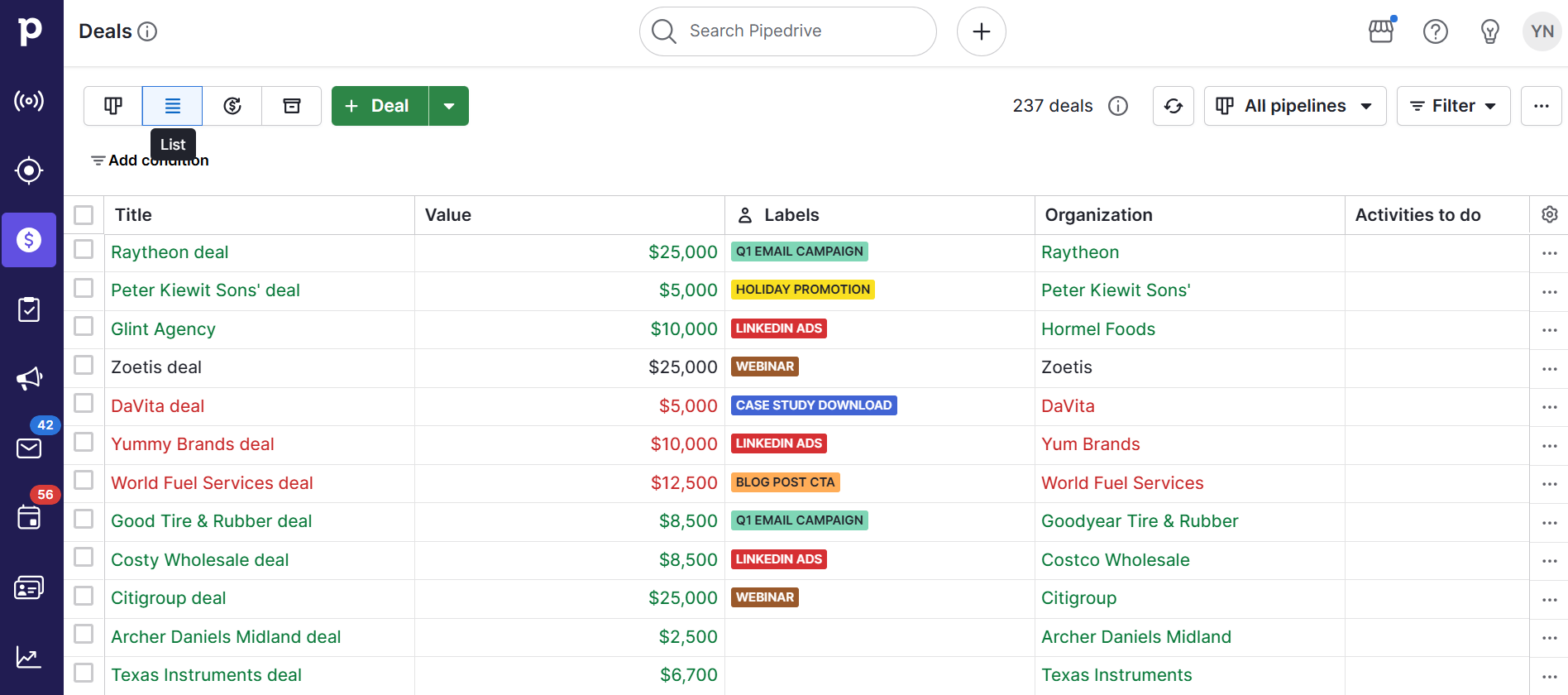

For example, Pipedrive’s list views provide complete outlines of all contacts in your sales pipelines.

Filters help you organize contact data based on deal value, pipeline stages, industry and job titles. Click on a particular contact to see additional details.

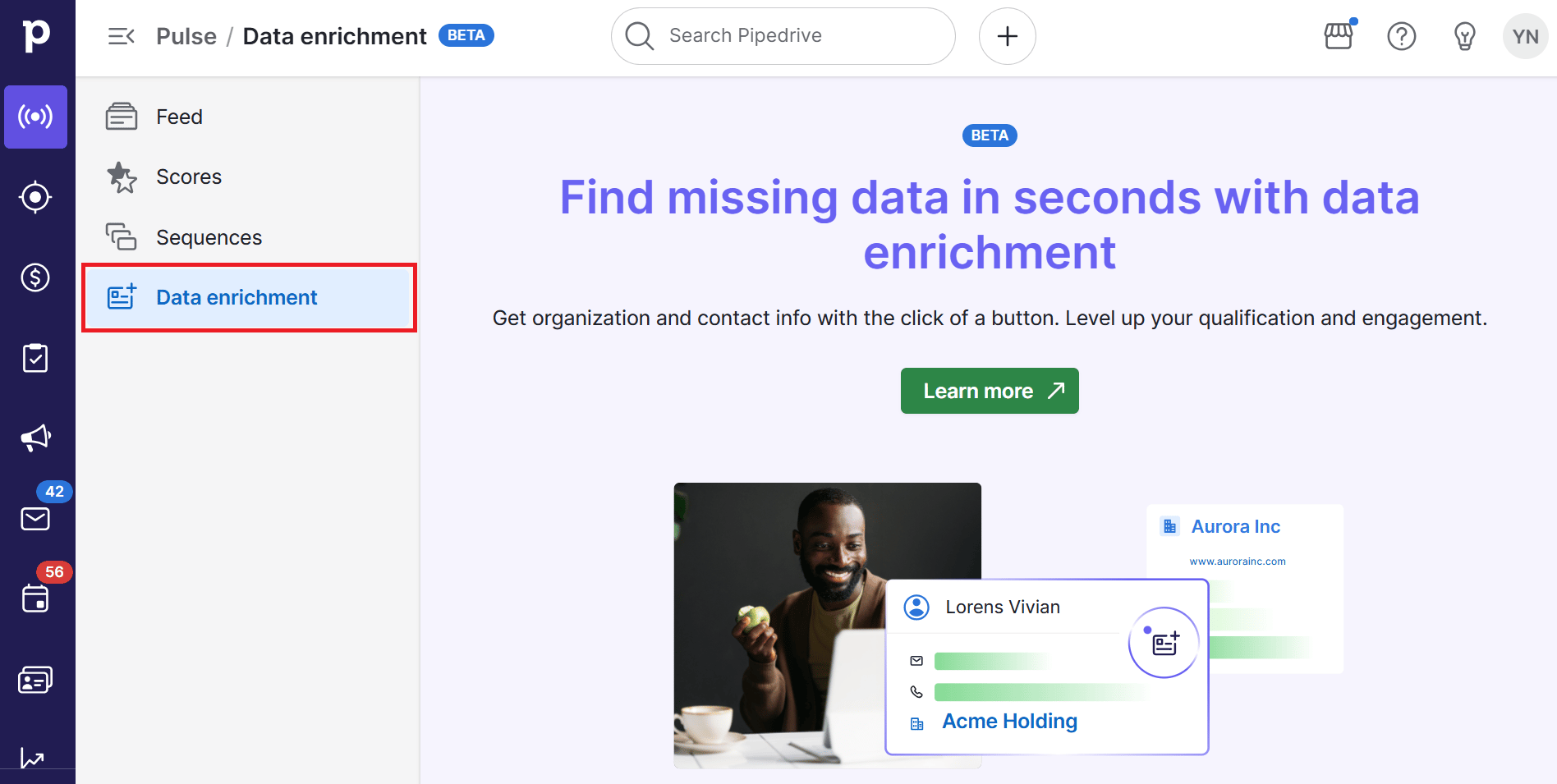

Pipedrive’s Pulse Data Enrichment feature automatically captures missing details about your prospects, like company size and industry, while the Web Visitors add-on tracks their page-browsing behavior.

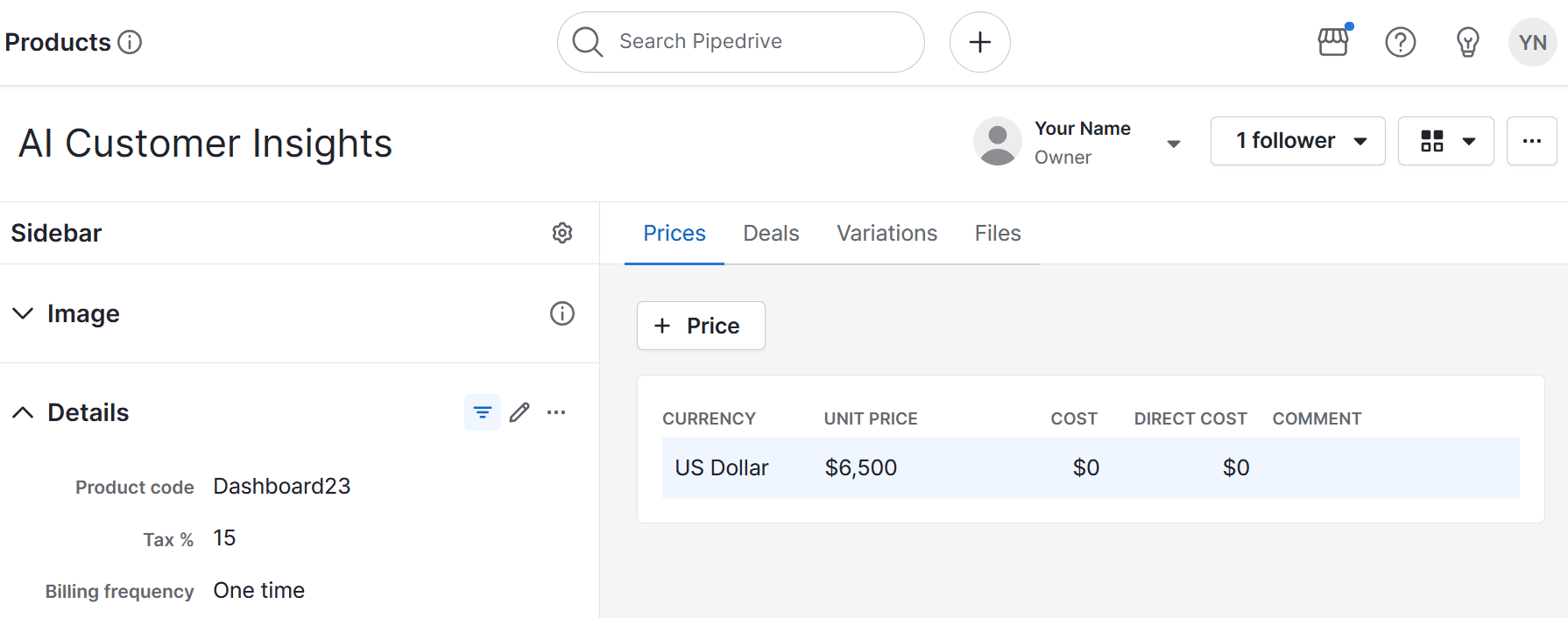

Most importantly, Pipedrive’s product catalogues allow you to add descriptions, prices, tax (or profit margin) percentages and categories to each product.

The “Variations” tab is useful for tiered-pricing models – you can set different prices for versions of the same product.

The contact, pipeline and product views are interlinked. That means you can use Pipedrive Insights to create custom reports and connect the dots between top-selling products and the types of customers that buy them.

For example, you can identify patterns between products sold and your customers’ job titles to spot the right pricing strategy.

If a product is particularly popular among customers with high-income job titles, value-based pricing may be the most effective approach. If a product attracts customers across different income levels evenly, consider implementing tiered pricing.

Pipedrive in action: CreativeRace, a marketing agency, used Pipedrive’s centralized databases, reports and sales pipelines to boost YoY customer acquisition by 600%. Read the full case study to see how you can achieve similar results.

Once you have your pricing strategy in place, use Pipedrive’s LeadBooster and Campaigns add-ons to create omnichannel, customer-centric buyer journeys that put your acquisition efforts on overdrive.

Price skimming FAQs

Final thoughts

Pricing skimming can work in a select few scenarios, but other pricing strategies are more ethical, effective and actually focus on customer retention, not just acquisition.

Either way, prioritizing your customers’ needs and encouraging healthy, transparent relationships is what’s most important here. A CRM platform like Pipedrive naturally embeds these factors into your workflows.

It centralizes customer data, product management, marketing automation, omni-channel communications and powerful analytics into an intuitive platform.

Try Pipedrive free for 14 days and see how easy it is to make customers choose you over your competitors.