Business ownership can be an exciting, fulfilling and lucrative journey.

However, there’s so much to consider when planning your route that it’s easy to miss or forget important details. You risk wasting time and any early investment.

We created this business ownership guide to help you navigate those daunting first stages. Keep reading to learn why becoming a business owner is worth all the effort, how to make it happen and how to thrive once you’re the boss.

What is a business owner?

A business owner is someone who controls the operational and financial aspects of a business, including any organization that sells goods or services for profit.

Note: Some business owners also produce their products. They can sell these to consumers or other businesses to use or resell.

Business owners oversee companies of all sizes, from freelance operations to multinational corporations. They can also work alone or alongside co-owners to manage their companies’ strategies, hiring efforts, training and day-to-day business operations.

You might also hear business owners referred to as:

Proprietors

Founders

Chief executive officers (CEO)

Directors

Managing directors

While these roles often overlap, the terms aren’t interchangeable. A business owner can appoint a separate managing director, for example, or a founder (someone who starts a company) may sell to a new owner.

Business owner vs. entrepreneur: what’s the difference?

Entrepreneurs are often business owners, and vice versa, but, as the business owner job description above shows, the two terms are different. Understanding them will help you describe yourself correctly and have more productive conversations with peers and investors.

Non-entrepreneurial business owners typically start or operate companies built on proven ideas, like running a music venue, e-commerce store or cafe.

Entrepreneurs focus more on innovation. They take risks pursuing ideas that solve everyday problems and often start companies that disrupt established business models.

For example, two entrepreneurs founded the financial technology company Chime to simplify basic banking services for US consumers – and are now business owners. Were they to sell the company, they’d still be entrepreneurs but no longer business owners.

Here’s a simple table to show the key differences:

| Business ownership | Entrepreneurship |

Established businesses or business models | Start-ups and new ventures |

Focused on operational management and growth | Focused on innovation, risk-taking and new ventures |

Generally lower risk exposure | Embraces higher risk for innovation |

The main role is manager and leader | The main role is visionary and risk-taker |

The benefits of business ownership

Having your own business gives you the autonomy to make decisions, implement your vision and enjoy the rewards of your hard work.

It leads to a long list of more specific benefits, including:

Financial freedom. Build a sustainable, successful business to control your income and grow your wealth and security.

Job creation. Contribute to your community and local or regional economy by building a workforce and supporting local supply chains.

Passion pursuit. Turn passions and interests into a professional pursuit, increasing your job satisfaction.

Challenges. Expose yourself to new challenges and responsibilities to build valuable skills and fast-track your personal growth.

Flexibility. Choose when, where and how you work to find the perfect work-life balance for your lifestyle.

Legacy building. Create a lasting legacy for future generations through a thriving and sustainable business, family tradition or both.

Of course, becoming self-employed isn’t without its challenges. There are almost always legal and financial risks to consider, while market competition and other uncontrollable factors can make success difficult to achieve.

You can minimize these issues to create the smoothest journey possible by building your new business in a careful, sustainable way.

How to become a business owner: step-by-step

Speak to any business owner and they’ll have a unique story about how they became their own boss. After all, every company and business plan is different.

However, most business owners and partnerships follow a similar general path initially. Treading the same proven steps can prevent avoidable mistakes and help you succeed sooner.

1. Find a great business idea

Whichever market you plan to enter, identify a product or service that fulfills a common or niche demand.

You could use an established business idea or disrupt a market with a unique solution. The former is easier to achieve as you’ll have a proven model to follow and plenty of inspiration, although you’ll likely face more competition.

Market research is essential at this stage. Study your target audience, competitors and industry trends to learn which products sell well and try to find what people are missing.

You can do this through personal conversations, industry media and social listening. Social listening means analyzing online conversations to learn more about your audience (it’s a form of customer observation).

Validate ideas by seeking feedback from potential customers, friends and industry experts. You may be able to access expert advice via a local or online business hub or incubator.

2. Choose and register your business name

Once you have a business idea, pick a name.

While your business name is a very personal choice, it must be:

Memorable

Distinctive

Compliant with local regulations

Different countries and regions have their own laws on using the names of other businesses but it’s generally not permitted. Check what’s available to ensure you don’t face any legal complaints from other companies further down the line.

In the US, business registration happens at a state level. You can search your state’s business entity database – like this one for New York – for existing businesses and often file your incorporation information there, too.

In the UK, registration happens nationally through Companies House, which has a “name availability” register. There’s more information on UK business naming requirements on the Companies House website.

3. Register your domain name

Look for a domain name to represent your new business, identical to your business name if possible. You’ll use this for your company website and email addresses.

You can build your website at any stage before launching but buying the domain name now ensures no one else can take it.

There are a couple of ways to purchase a domain name:

Through a dedicated domain registrar. Companies like GoDaddy and Namecheap offer simple, affordable packages for an annual fee – often with security features bundled in.

Via a website builder. Accessible website and e-commerce store builders like Squarespace and Shopify let you register your domain name as part of their website packages.

Whichever route you choose, there will be many different providers to consider. Compare them based on price, support options, security credentials and online reviews.

Another choice to make is your domain suffix, which is the final part of your domain after the last dot.

For example, Pipedrive’s domain suffix is “.com” as in: “pipedrive.com”

Using .com is one of the most common options and is ideal for global businesses as it’s geographically neutral.

On the other hand, regional suffixes like “.co.uk” (UK), “.de” (Germany) and “.com.za” (South Africa) tie your business to a specific place, which can make your company feel more authentic and trustworthy to local browsers.

There are also industry-specific suffixes. For example, “.io” (based on the computing term “input/output”) is synonymous with tech businesses.

You can even use “.pizza” or “.fashion” to make your web address hyper-relevant.

Note: If you have a very common business name, your domain might be taken. Consider creative ways to get a domain as close to your business name as possible, like using a regional suffix for local businesses or adding “co” for “company” (as in “baltimorepizzaco.com”).

4. Build a business plan

A well-structured business plan serves as a roadmap for your company’s success. You’ll use this to guide your decision-making first and foremost, but potentially also to attract investors and secure funding.

Business plans typically contain the following core information:

Business description

Key objectives

Market analysis

Risk assessment or overview

Business structure

Launch products or services

Marketing and sales strategies

Financial projections

If you want to use your business plan to seek investment, add a “funding request” section detailing how much you need and what you’ll use it for. Your financial projections should support your ability to repay any loans if you choose to borrow.

The information within your plan will be unique but aim to make it accurate and easy to understand. Stick to realistic goals, research your market thoroughly and back your financial projections with plenty of data on costs and the performance of similar businesses in your field.

5. Obtain any relevant licenses and permits

Research the licenses and permits required for your specific industry and location.

If you launch without getting the correct paperwork, you risk serious legal action that could quickly end your business journey.

For example, many American cities and counties require a general business license. In most countries, you’ll need additional verification to sell restricted products like alcohol, tobacco and medicines.

The list of licenses and permits that could apply is nearly endless, as every jurisdiction differs. Your local business authority should be able to tell you what you need before launching and guide you through the application process.

6. Arrange insurance and bank accounts

Business insurance and a company banking account will help you protect and organize your assets.

There are various types of insurance to consider, including:

General liability insurance | Coverage for claims of third-party injury or |

Professional liability insurance | Protection against claims of negligence or |

| Personal liability insurance | Insurance for personal financial protection in |

| Property insurance | Coverage for damage to physical property and |

These are just some of the insurance types available. Check in with other business owners in your location and field to learn about specific policy types.

If you don’t have any relevant contacts yet, consider joining a local business community on LinkedIn or Facebook. There, you can ask the question to see if anyone has useful insights.

Business banking accounts are a more straightforward proposition, as the main aim is to have somewhere to keep your company’s money. You still have a few options, so here are the key types of business products to have on your radar:

Business checking account | Separates personal and business finances, |

Business savings account | Allows saving for future business needs, like taxes |

| Merchant services account | Enables secure processing of credit card payments |

| Business credit card | Aids expense and cash flow management, |

| Payroll account (for employers) | Essential for managing payroll, tax withholding |

Most major banks offer business products. Inquiring with your personal account provider is a quick way to create a new company account but shopping around can get you better interest rates and rewards.

You could also consider a digital-first provider. The below graphic from Fintech America News shows some of these key “challenger banks” worldwide:

Many digital-first providers promise faster set-up processes, ultra-convenient apps and customer-centric service.

However, this convenience often comes at the expense of in-person service, so stick to a traditional provider if you value the ability to visit your local branch.

7. Launch and slowly build your business

Now that you’ve done the necessary groundwork, it’s time to launch your business.

Depending on your business type and scale, you may need to hire employees before launching, or you can start alone and build your team as you expand.

Either way, begin with a soft launch (i.e., only selling a small volume to select customers) to gather valuable feedback on your products and services, so that you can address any issues before you scale up.

As you gain momentum, focus on marketing and growing your customer base. Implement marketing strategies to reach your target audience and build strong online and offline presences.

The following digital marketing techniques benefit new businesses:

Search engine optimization (SEO). Making your website search-friendly will put you higher in Google’s search results pages, helping internet users find your business for the first time. It takes time to see results, so it’s best to start early.

Pay-per-click (PPC) advertising. PPC ads on search and social media sites offer immediate results with minimal financial risk, as you only pay when someone clicks your link.

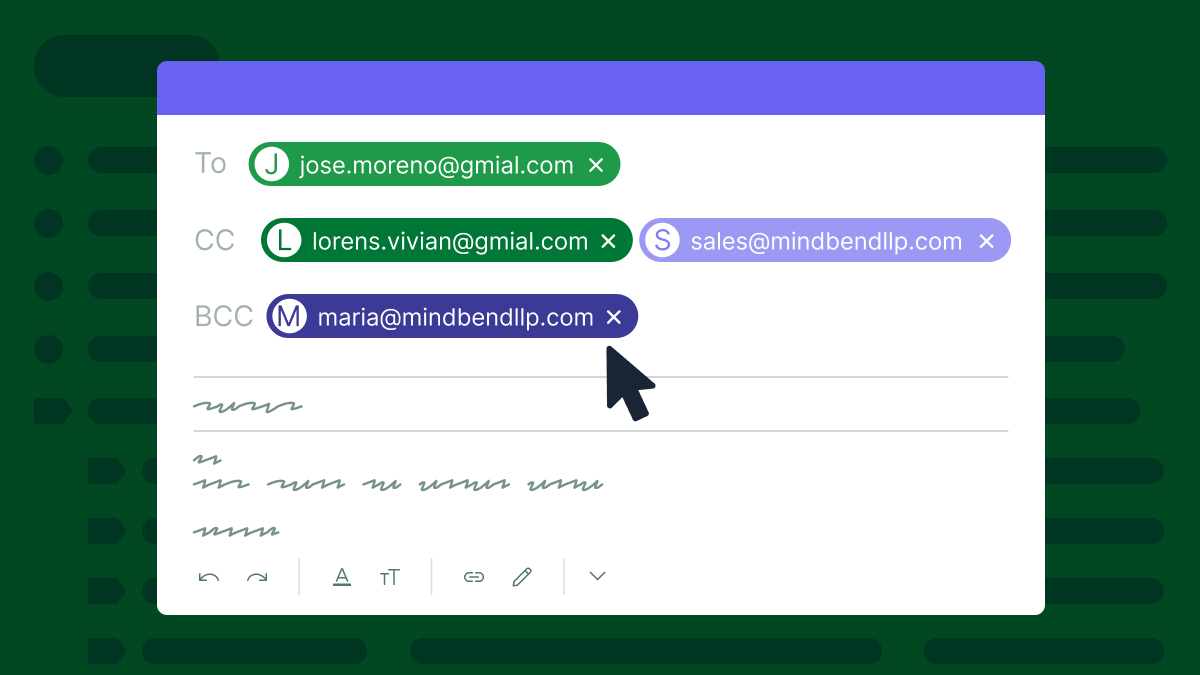

Email marketing. Building an email list of consenting subscribers lets you directly communicate with your audience. Use it to send company updates, promotions, targeted offers and more.

Social media marketing. Connect with your ideal customers on the platforms where they’re most active. Facebook, Instagram and X (formerly Twitter) are great starting points.

There’s plenty of technology available to support your early sales and marketing efforts.

For example, you can use email marketing software to manage your promotional email campaigns and a customer relationship management (CRM) system to measure the impact on sales. We’ll cover new business technologies in more detail shortly, but you can also read our dedicated page on the benefits of a CRM for business owners.

8. Map out your key business owner responsibilities

Now you know the steps to becoming a business owner, create a guide for yourself that is specific to your business idea.

Start with the responsibilities of the role and the actions you’ll have to take, which could include:

- Registering your business with the relevant governmental body

- Creating an online presence for your business

- Developing a business plan

- Obtaining all the necessary licenses and permits

- Setting your business up financially

- Making sure you have an address for mail, even if you don’t have a physical premises

Further down the line, once you’ve established your business, you may also need to build a team and make sure you have payroll sorted.

Being successful as a small business owner: 4 invaluable tips

Your business ownership journey is just getting started.

Once you’re up and running, the following tips will help you thrive at the helm of your own company.

Prioritize customer centricity

Above all else, focus on delivering exceptional customer experiences (CX) and building strong relationships so that you can:

Gain an excellent reputation that convinces people to try your products

Turn first-time customers into loyal buyers

Turn loyal buyers into brand ambassadors who feed your excellent reputation

Notice how these three outcomes form a cycle. It’s a repeatable process that’s the most efficient, sustainable way to market your business.

CX has many aspects but studies repeatedly prove that customer service and convenience are two of the most important.

In a 2023 US consumer survey, almost half (47%) of respondents said they’d pay more for a product if they knew they’d get great customer service and 91% consider convenience an essential factor.

So make your products easy to buy and your support services easy to access.

Manage your finances carefully

Keeping meticulous financial records is vital. It involves documenting all income and expenses, saving receipts and invoices and organizing financial data.

Clear records make it easier to monitor your company’s financial health and ensure compliance with tax regulations.

Careful budget control should be a priority here.

A budget outlines your expected revenue and expenses, helping you allocate resources effectively. Regularly reviewing your budget lets you identify areas where you may have to cut costs or increase investment.

For example, if after your first year, you’re generating more revenue than expected, you could invest more heavily in:

Repaying small business loans

Expanding your salesforce to close more deals

Supportive technology, like CRM and marketing software

Managing business finances will get more time-intensive as your company grows. Many people assume it’s a non-negotiable part of every small business owner’s job description, but outsourcing these responsibilities to a professional bookkeeper or accountant gives you more time to spend on day-to-day operations.

Use technology to streamline your processes

Zylo reports that the average organization uses 291 different pieces of software (dropping to 172 for those employing 500 people or fewer).

For a new business, this might be excessive, but it shows how much-established companies depend on and benefit from technology.

A collection of carefully chosen applications will:

Streamline your processes

Keep your company and customer data secure

Turn data into insights you can use to make better business decisions

The enterprise tech market can be daunting if you don’t know what you’re looking for. The best system types for a new business to prioritize are project management, CRM and marketing:

Project management software helps businesses plan, execute and track projects efficiently, ensuring everyone completes tasks on time and within budget.

Customer relationship management (CRM) software enables businesses to manage and track sales performance and customer interactions so they can optimize customer service and sales processes to strengthen buyer relationships.

Marketing software helps businesses plan, implement and measure various marketing campaigns, including email, social media and content marketing.

Investing in software covering multiple functions can simplify your tech stack. It’ll also speed up your processes by preventing the need to switch apps for different tasks.

For example, Pipedrive is a sales CRM tool with built-in email marketing software.

Practice self-care to stay at your best

Leading a business, whatever its size, takes plenty of energy and resilience. Caring for your physical and mental health ensures you have enough of both.

Balancing self-care and business is a struggle many company owners face. A Simply Business study found that 56% of UK small business owners have experienced poor mental health over the past 12 months, with financial stress being the most common cause.

In another business owner survey, 50% of respondents said stress and mental health issues affect the success of their business.

Even small self-care actions can make a big difference. These include:

Taking regular time off

Delegating tasks to employees (or outsourcing)

Limiting your working hours

Talking to friends and family

Professional help is valuable too, as She Means Profit founder Melissa Houston explains in this Forbes article:

For ideas of where to find mental health support, speak to your GP or check out mental health charities’ websites. The US-based Mental Health America and UK-based Mind are great starting points.

Final thoughts

Business ownership at any level is a journey. Patience and persistence are key ingredients for long-term success.

Be prepared for challenges and setbacks as the early stages of business ownership often involve a learning curve. It’s important to keep learning from the experience and expanding your skill set.

As long as you keep putting customers first, leverage the right technology and continuously refine your business strategy, you’re almost certain to find success.

Still looking for information? Here are some frequently asked questions (FAQs) on becoming a business owner: