Managing business expenses manually is time-consuming, error-prone and frustrating for SMB finance teams and employees.

From lost receipts to delayed reimbursements, outdated processes slow down your operations and increase compliance risks. Without proper visibility or controls, small but frequent costs can easily add up and slip through the cracks.

This guide explores how expense management software streamlines approvals and improves real-time spending visibility. We’ll cover top tools, must-have features and how to build an efficient system – plus how to do it all with Pipedrive.

What is expense management software, and why is it important?

Software for expenses management is a tool that helps businesses track, approve and reimburse employee expenses in one place.

It reduces manual work, such as data entry or creating expense reports, making it easier to manage spending and follow company policies.

With the right system, finance teams can stop relying on spreadsheets, email threads and disconnected processes.

Take receipts. With traditional processes, employees must keep paper copies, scan them manually, and then email them to finance.

With tools like Xero, employees can instantly scan receipts using a mobile app. The app extracts key details like date, amount and vendor automatically.

Once scanned, the receipt can be forwarded directly to the finance team or added to an expense report for approval.

Below are some important ways that expense management software can support SMB teams:

Save time by automating expense tracking and approvals. Teams can use workflows to route submissions to the right approver and update statuses automatically. Automation cuts down on back-and-forth and speeds up the reimbursement process.

Improve visibility into company expenses. Real-time dashboards help managers and finance teams see where money is going. With clearer insights, teams can spot unusual spending patterns and intervene as needed.

Enforce company policies without added admin. Expense management software flags out-of-policy claims or duplicate charges before approval to keep compliance management in check without burdening employees or finance.

Reduce errors from manual data entry. When tools sync with corporate cards or bank accounts, expenses flow in automatically. Instant submissions keep records accurate, minimize double entries and simplify monthly bookkeeping.

By replacing manual processes with an all-in-one expense management system, teams can reduce admin work, control spending and make smarter business decisions.

Download Pipedrive's Basic expense report template

Top 5 dedicated expense management software tools

Whether you need a full-featured platform, travel and expense management software or a simple way to track employee expenses, these five expense management solutions have you covered.

Note: We selected tools based on ease of use, automation capabilities, accounting system integrations, real-time financial reporting and policy enforcement features. Each brings a unique approach to simplifying the expense management process.

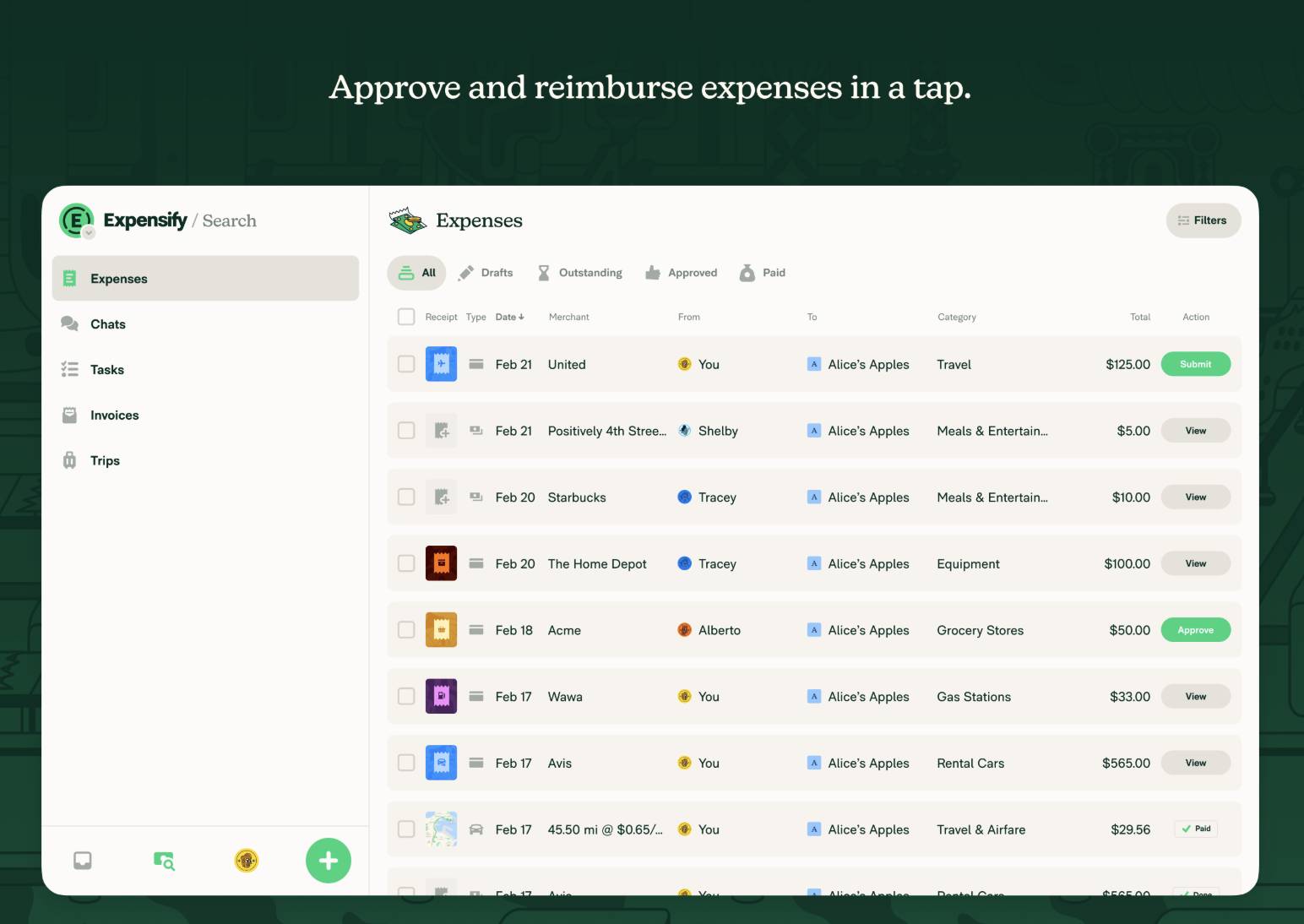

1. Expensify: Best for growing teams

Expensify is a well-known expense management platform that simplifies how companies handle employee expenses.

It’s built for ease of use and automation, helping teams capture receipts, categorize transactions and process reimbursements with less manual work. Its mobile app and real-time syncing with bank accounts make it especially convenient for employees on the go.

Customers appreciate how easy it is to snap a photo of a receipt, submit it and move on without delays.

The setup can initially feel complex, especially for companies with layered approval rules. Once teams configure the system, it runs smoothly and reduces time spent on expense admin.

Key features:

Mobile app for on-the-go receipt capture

Automatic expense categorization and policy enforcement

Credit card and bank account syncing

ACH reimbursements to employee bank accounts

Customizable approval workflows

Integrations with accounting software like QuickBooks and Xero

What users are saying:

“I love the ease of use of Expensify, especially the SmartScan feature, which allows me to take a picture of a receipt and have the data automatically extracted – it saves a lot of time.” – G2 reviewer

Who Expensify is best for:

Expensify is a good fit for growing teams that want to streamline expense reports without hiring more admin help. It’s especially useful for companies with remote employees or frequent travel expenses that need a mobile-first, automated solution.

2. Payhawk: Best for expense automation

Payhawk is an all-in-one expense management platform built for automation and control.

It combines corporate cards, spend tracking and bill payments in one system, giving corporate finance teams a real-time view of employee spending. Businesses benefit from the platform when they want to replace fragmented tools with a single solution.

Users like how Payhawk automates the entire expense lifecycle, from receipt capture to reconciliation. Its ability to set spend limits, define approval workflows and connect directly with ERP systems makes it a powerful choice for finance teams that want to eliminate manual work.

Some users mention that smaller teams may not need the full range of features Payhawk offers. However, the platform’s flexibility means it can scale as companies grow.

Key features:

Corporate cards with built-in spend controls

Automated receipt capture and categorization

Real-time dashboards for tracking expenses

Custom approval workflows and multi-level approvals

Integration with ERP and accounting systems like NetSuite and SAP

Support for multiple entities and currencies

What users are saying:

“Payhawk makes managing business expenses incredibly efficient. The integration with our accounting software (Exact Online) was quick and smooth. Team members love having their own company cards, and it’s easy to manage spending limits or pause cards when needed.” – G2 reviewer

Who Payhawk is best for:

Payhawk is ideal for mid-sized and larger businesses that want to automate their expense management process from start to finish. Its deep functionality and ERP integrations make it a strong choice for companies with complex finance operations.

3. QuickBooks Online: Best all-in-one option

QuickBooks Online is a widely used accounting software with built-in expense management tools. It’s designed for small businesses that want a centralized platform to handle bookkeeping, invoicing, payroll and expense tracking without juggling multiple systems.

Users appreciate how QuickBooks makes it easy to connect bank accounts, track expenses by category and attach receipts. It automatically pulls transactions from linked credit cards or bank accounts and helps teams stay organized for tax time.

Users may feel overwhelmed at first, especially with so many features in one place. However, the all-in-one setup is a major advantage for businesses that want a full financial overview.

Key features:

Expense tracking with receipt capture and categorization

Direct bank and credit card syncing

Customizable expense policies and approval workflows

Reports and dashboards for spending insights

Integration with apps like Expensify and PayPal

Mobile app for expense tracking on the go

What users are saying:

“Quickbooks online is a fantastic tool for accounting firms. Its user-friendly interface makes it easy to navigate, even for those who aren’t tech-savy.” – G2 reviewer

Who QuickBooks Online is best for:

QuickBooks Online is a good fit for small businesses that want an all-in-one accounting system with built-in expense management. It’s best for teams needing financial visibility and simplicity without adding another platform to their stack.

4. Ramp: Best for corporate controls

Ramp is a corporate card and expense management solution focused on helping companies automate workflows, reduce waste and enforce tighter spend controls.

Ramp stands out by helping companies enforce expense policies automatically. Admins customize approval workflows and define rules for employee spending, ensuring compliance without manual oversight.

The platform also integrates with ERP systems like NetSuite and SAP, as well as accounting software such as Xero and QuickBooks.

Ramp’s mobile app allows employees to capture receipts and track expenses in real time, simplifying the reimbursement process and cutting down on manual work.

Its focus on eliminating redundant or wasteful spending makes it particularly appealing to CFOs and finance leaders looking for long-term efficiency.

Key features:

Corporate cards with automated spend limits

Real-time expense tracking and approval notifications

AI-powered insights to reduce unnecessary spending

Receipt capture and categorization via a mobile app

ERP and accounting system integrations

Automated reimbursements and ACH payments

What users are saying:

“Ramp makes it easy to record and manage expenses while I’m on the go via SMS. I love how Ramp texts me after I use my card, prompting me to upload a receipt and then providing a reason for the transaction.” – G2 reviewer

Who Ramp is best for:

Ramp is a great fit for fast-growing companies and mid-market teams wanting to control employee expenses and reduce unnecessary spending. Its built-in policy enforcement and AI recommendations make it a powerful expense management tool for scaling financial operations.

5. Spendesk: Best for scalability

Spendesk is a travel and expense management software solution for companies ready to scale.

It offers an all-in-one expense management platform that handles everything from receipt capture and expense approvals to reimbursement workflows and credit card controls.

One of Spendesk’s strengths is its ability to centralize financial data across teams while maintaining flexibility. Whether it’s travel expenses, SaaS CRM subscriptions or client meals, businesses use Spendesk to categorize and track every type of employee expense with ease.

By syncing Spendesk with their accounting software or ERP, finance teams can automate approval workflows, set company policies and eliminate manual data entry. Spendesk also includes robust dashboard features to monitor spending patterns.

Key features:

Physical and virtual corporate cards for employee spending

Integrated approval workflows and expense reimbursement tracking

Customizable company policies and spend limits

Mobile app for expense submissions and receipt capture

Seamless integration with tools like Xero, QuickBooks and NetSuite

User-friendly dashboard to analyze financial data and expense reports

What users are saying:

“I like that it simplifies the completion of expense reports and makes it easier to schedule business travel in one place. Easy to upload receipts and very convenient.” – G2 reviewer

Who Spendesk is best for:

Spendesk is ideal for scaling startups and small businesses that need a flexible expense management system with strong automation and visibility features. It’s especially useful for companies with distributed teams and multiple spend categories to manage.

What should you look for in expense management software?

The best expense management software helps your team save time, enforce policies and make smarter financial decisions. But not all tools offer the same functionality, especially for small business needs.

Before choosing a provider, compare how each platform handles core expense workflows such as approvals, expense tracking and reimbursements.

Here’s a breakdown of the key features to look for and what each one means for your expense management process:

Feature | Description |

|---|---|

Automated expense tracking | Captures and records expense data from receipts, credit card transactions and bank accounts. Automated data capture reduces manual data entry. |

Mobile access | Lets employees submit expenses, capture receipts and view approval status from a mobile app. Ideal for travel expenses and remote teams. |

Custom approval workflows | Enables you to define multi-step approval paths based on employee roles or expense types, speeding up processing and ensures accountability. |

Integrations | Connects with accounting software (e.g., Xero), ERP tools (e.g., NetSuite) and corporate cards to centralize financial data. |

Policy enforcement and compliance | Automatically flags out-of-policy expenses and duplicate claims, helping teams follow company policies and streamline audit readiness. |

These features give your finance team the control and visibility it needs while simplifying the reimbursement process for employees.

How to create an expense management system with Pipedrive

Not every small business needs software for expense management. If your team already works in Pipedrive, adding another tool for tracking reimbursements or vendor costs might create more complexity than value.

With pipeline management, customizable data fields and workflow automations, you can build a capable expense software for better small business management directly inside your CRM.

Pipedrive is a good option for small businesses that want to streamline their expense workflows, stay organized and gain visibility into spend management without switching tools or paying for overlapping software.

Here’s how to set it up:

1. Centralize expense-related activities in custom pipelines

Pipedrive makes it easy to create a visual workflow for handling business expenses, from submission to approval.

For example, an agency might create a pipeline to manage employee expense reports. Team members log each reimbursement request as a new deal, and finance or admin staff move the deal through predefined stages as they review and approve each submission.

To create a custom pipeline for expenses:

Go to the “Deals” tab and click the dropdown arrow next to your current pipeline

Select “+ Add new pipeline” and name it something like “Expense Approvals”

Add deal stages like “Submitted”, “Under review”, “Approved” and “Paid”

Use filters to view expenses by category, amount or employee

Using custom pipelines gives your team a clear, real-time view of where each request stands, reducing back-and-forth and ensuring no expense falls through the cracks.

2. Use custom fields to capture key expense data

To keep your expense tracking organized and actionable, you need more than just notes in a deal card. Pipedrive’s custom fields let you log the details you need without cluttering your CRM with irrelevant data.

To add custom fields for expenses:

Go to “Company settings” and click on “Data fields” under the “Manage fields” section

Choose “Deals” as the data type and click “+ Add custom field”

Create fields such as “Expense Amount”, “Category”, “Employee Name” and “Payment Method”

Use field types like dropdowns for categories and currency for amounts

Add these fields to your custom pipeline layout so they’re visible on every deal card

Your finance team can quickly filter and report on expense data, making it easier to spot trends and ensure expenses align with company policies.

3. Automate approvals and reminders with workflows

Manually chasing approvals or tracking reimbursement statuses can drain your team’s time and slow the reimbursement process. Pipedrive’s workflow automations help you eliminate these delays by automating repetitive admin tasks.

For instance, a tech startup might set up a workflow that notifies a manager when an employee submits a new expense.

Once approved, the deal stage can automatically move forward, and the finance team receives a task to process the payment.

To set up an expense approval workflow:

Go to “Tools and apps” in the main menu and click “Workflow Automation”

Click “+ Create new workflow”

Choose a trigger, like “Deal enters stage ‘Submitted’”

Add an action, such as “Send email to manager” or “Create task for finance team”

Add additional actions like changing the deal stage or sending a Slack notification

Name your workflow and activate it

Teams use approval workflows to keep every expense on a consistent approval process.

4. Integrate with accounting and expense tools via Zapier or native apps

While Pipedrive can manage the approval process, you may need to sync expense data with your accounting system or automate reimbursement tasks. Integrating Pipedrive with tools like QuickBooks or Xero helps close the loop between your CRM and finance stack.

For example, the Rexpense Pipedrive integration lets you manage and report expenses directly within your CRM.

It helps teams log expenses faster, attach receipts and assign costs to specific deals or projects, making it ideal for service-based businesses that want to track spending across clients.

To integrate Pipedrive with accounting and expense tools:

Visit the Pipedrive App Marketplace

Search for the app you want to connect (e.g., “QuickBooks”, “Xero” or “Google Sheets”)

Set up the trigger in Pipedrive (e.g., “Deal moves to stage ‘Approved’”)

Define the action in your connected tool (e.g., “Create new expense in QuickBooks”)

Test and activate your integration

You can use integrations to streamline bookkeeping and sync financial data across platforms.

Note: You can also use Pipedrive’s Projects tool to manage expenses tied to specific client work or internal initiatives. By linking tasks, files and expense-related activities within a single project, teams can track progress, assign responsibility and stay on budget.

Final thoughts

Managing business expenses doesn’t have to be time-consuming or error-prone.

Pipedrive offers a flexible, user-friendly way to build a custom expense management system inside your CRM – no extra tools required.

Start your free 14-day trial of Pipedrive and see how easy it is to centralize approvals, track employee spending and reduce manual work from day one.