No single marketing mix modeling software can do it all.

Rather than chasing the “best” tool in an overwhelming listicle, high-performing SMBs build a connected tech stack that collects accurate data, validates it and leads them to action.

In this post, you’ll learn five steps to build a marketing mix modeling stack (including tool suggestions) that helps you make data-driven decisions and grow revenue.

Key takeaways for marketing mix modeling software

Marketing mix modeling software analyzes marketing and sales data to estimate each channel’s impact on overall business growth.

While MMM software provides long-term, evidence-based insights, it only works alongside clean data and a layered technology stack.

Combine MMM with experiments, revenue tracking and decision tools to extract reliable insights that influence decisions.

Pipedrive acts as the revenue reality layer of your MMM stack to confirm whether modeled lift becomes actual sales – try it free for 14 days.

Why one marketing mix modeling (MMM) platform isn’t enough

MMM software must be part of a technology stack to accurately measure marketing effectiveness.

Most dedicated tools struggle because modern measurement and attribution are messy and often inaccurate.

Small business owners and marketing leaders now have to deal with:

Nonlinear decision-making. Customer buying journeys don’t follow a straight line from ad to purchase. They switch channels, devices and timing.

Privacy and tracking limits. Cookie opt-outs and platform restrictions reduce the accuracy of user-level data.

Fragmented, platform-owned data. Each channel reports performance differently, and those numbers rarely agree.

Three typical paths available to small companies include:

Type of marketing mix modeling software | What it is |

Open-source platforms | Transparent, customizable models you control. |

Dedicated SaaS products | Packaged platforms that promise faster results. |

A stack-based approach | A combination of MMM, experimentation, revenue data and planning tools. |

Instead of trying to find one tool that fits your unique needs, build a software stack with MMM layered in.

5 steps to create the best MMM software stack (including tools)

High-performing SMBs design measurement systems that reflect reality, validate what generates revenue and support crucial marketing decisions.

Here are five steps, along with tool suggestions, to help you pinpoint growth-driving channels and turn insights into real revenue.

1. Start with an MMM layer to explain growth

Tool category: Open-source MMM frameworks or consultancies.

A marketing mix modeling layer helps small businesses estimate which channels will drive growth over time – not just clicks or short-term conversions.

It should also take external factors into account (e.g., how seasonality or competitor promotions influence performance).

MMM software helps you answer questions like:

Where should we spend more?

Which channels look promising but don’t affect revenue?

How long does marketing impact really take?

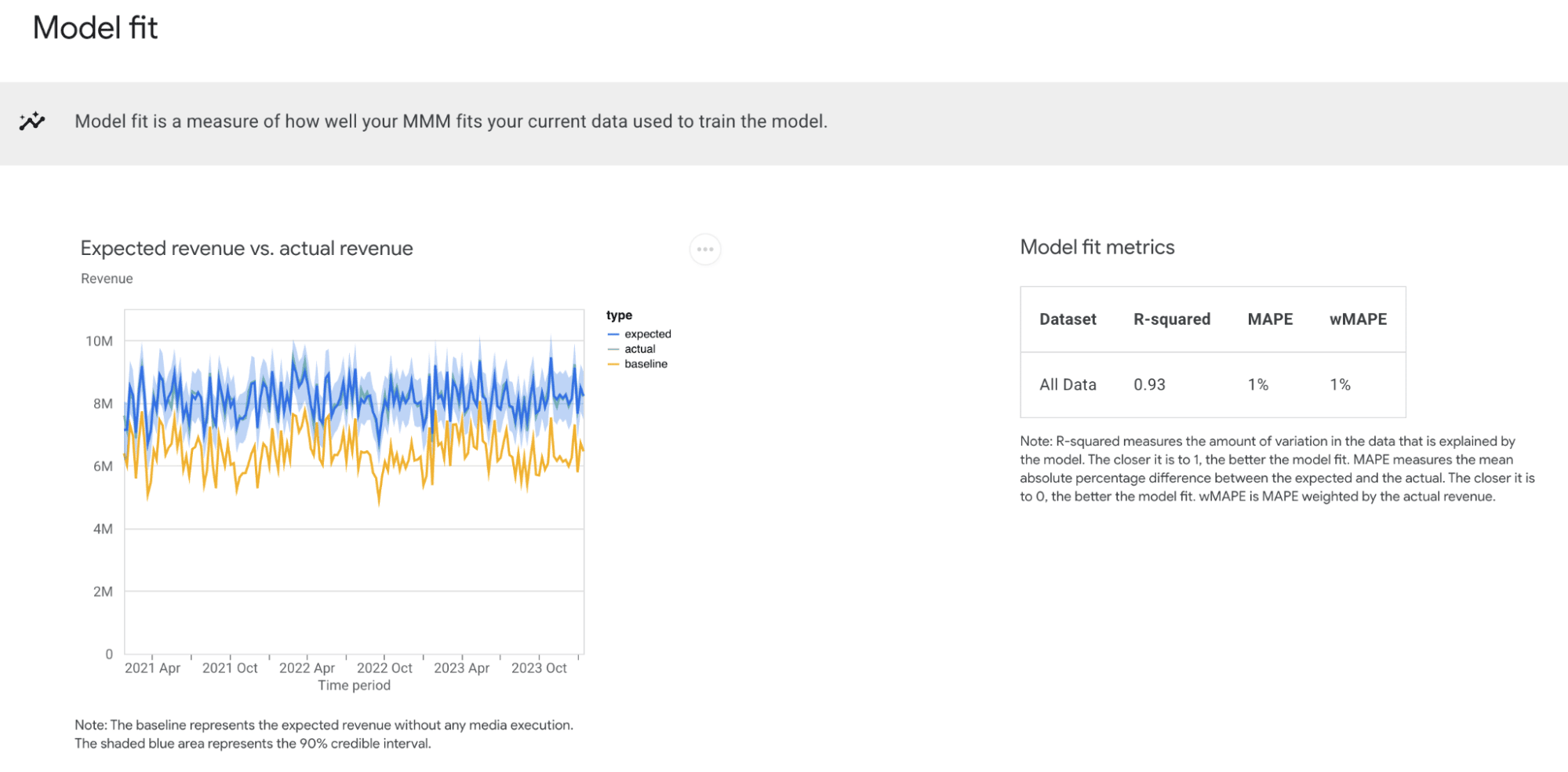

For example, Google’s Meridian (replacing Google LightweightMMM) analyzes past marketing spend and performance to estimate long-term channel impact:

By highlighting channels that contribute to business growth or diminishing returns, this MMM tool informs budget and marketing decisions.

Some of the best marketing mix modeling vendors and tools for SMBs include:

Best SMB-friendly MMM solution | Why you’d choose it |

Google Meridian | This Bayesian MMM framework is a practical starting point for small marketing teams. As it’s open-source, it requires in-house or freelance data science skills. |

A powerful MMM platform with machine learning features (also open-source). | |

Boutique MMM consultancies | Human-to-human, tailored models without enterprise overhead. |

A successful MMM layer gives stakeholders clarity to optimize everything from budget allocation to media planning.

2. Include an experimentation layer to reinforce causality

Tool category: Incrementality testing and experimentation platforms.

Experiments help you uncover which channels actually drive incremental lift (measurable impact beyond natural results).

While MMM estimates long-term channel impact, experiments reinforce whether those channels actually impact growth.

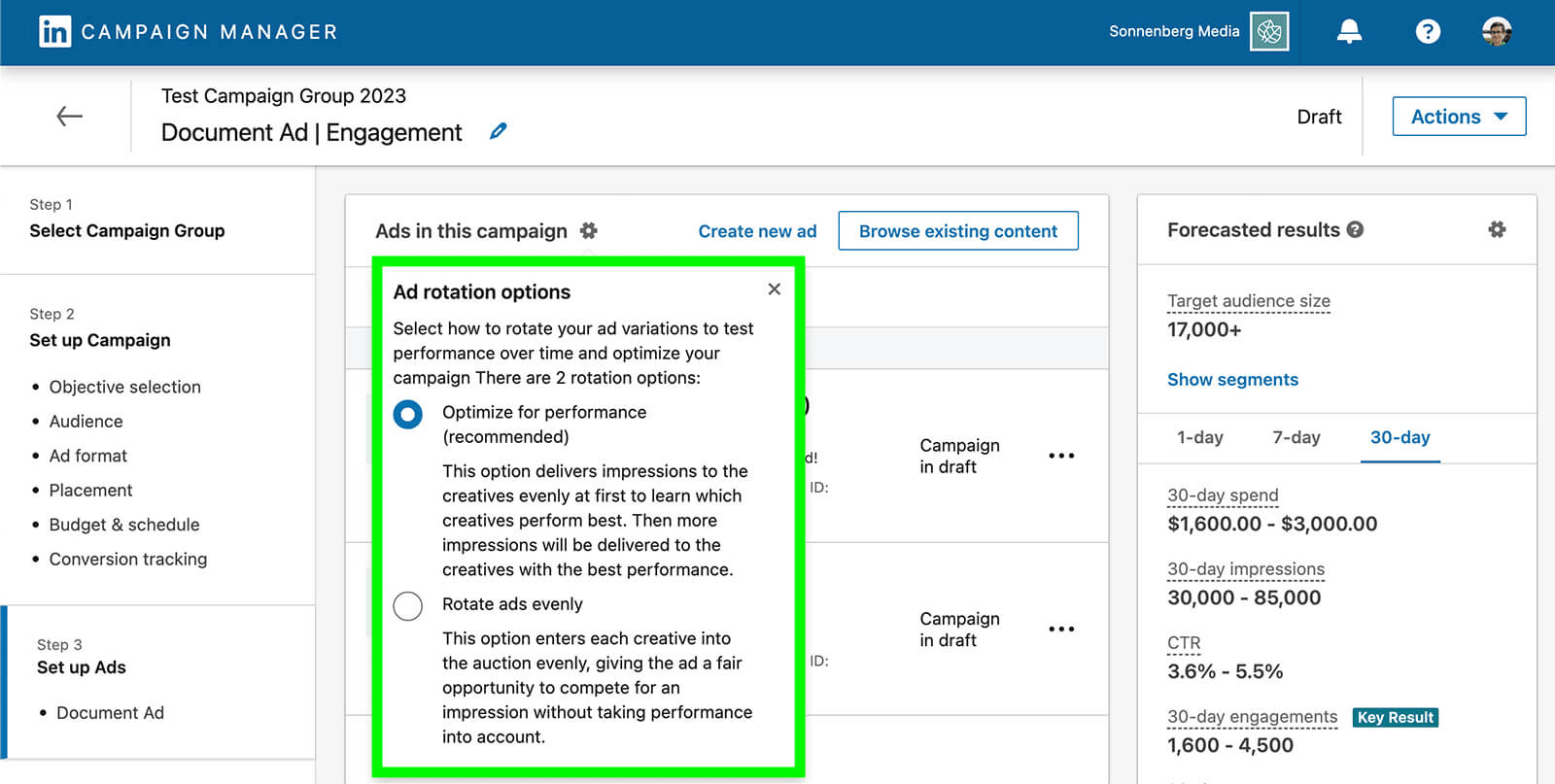

For example, you can run A/B tests on social post visuals or messaging using Meta or LinkedIn tools:

By measuring differences in conversion or engagement, you can validate channel effectiveness.

Without experiments, MMM tools can create false confidence (especially when privacy changes or tracking gaps limit the data they feed on).

Some of the best SMB-friendly experimentation methods include:

Platform-native lift studies. Google Ads, Meta Ads and other ad platforms offer built-in incrementality testing.

Regional holdout or geo experiments. Test incremental lift by holding back marketing spend in certain regions.

Optimizely or VWO. Web and CRO experimentation tools are useful for testing landing pages or conversion flows (not core channel-level validation).

Your experimentation layer reinforces that your modeled channels are producing real, measurable growth.

3. Add a revenue layer to tie marketing to real business outcomes

Tool category: Customer relationship management (CRM) and revenue tracking platforms.

Your revenue layer tells you whether MMM insights and experiments actually impact marketing performance and your bottom line.

Modeled lift must translate into healthier pipeline or sales to influence decisions.

Do “high-performing” channels create real opportunities? Is increased spend improving pipeline quality (not just volume)?

A CRM like Pipedrive answers these questions.

Note: While a CRM doesn’t prove causality in a statistical sense, it suggests whether the modeled impact has real commercial results.

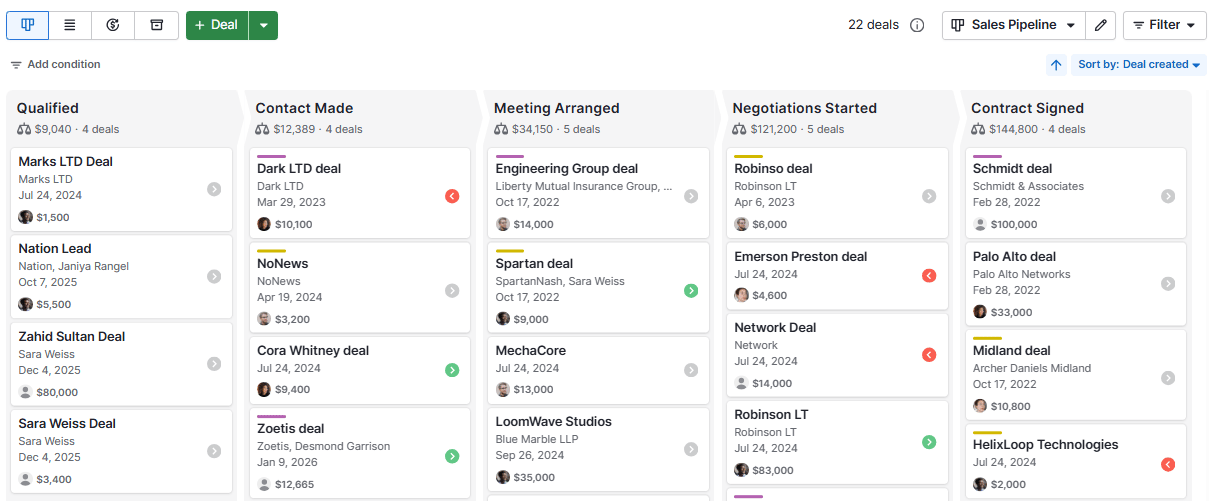

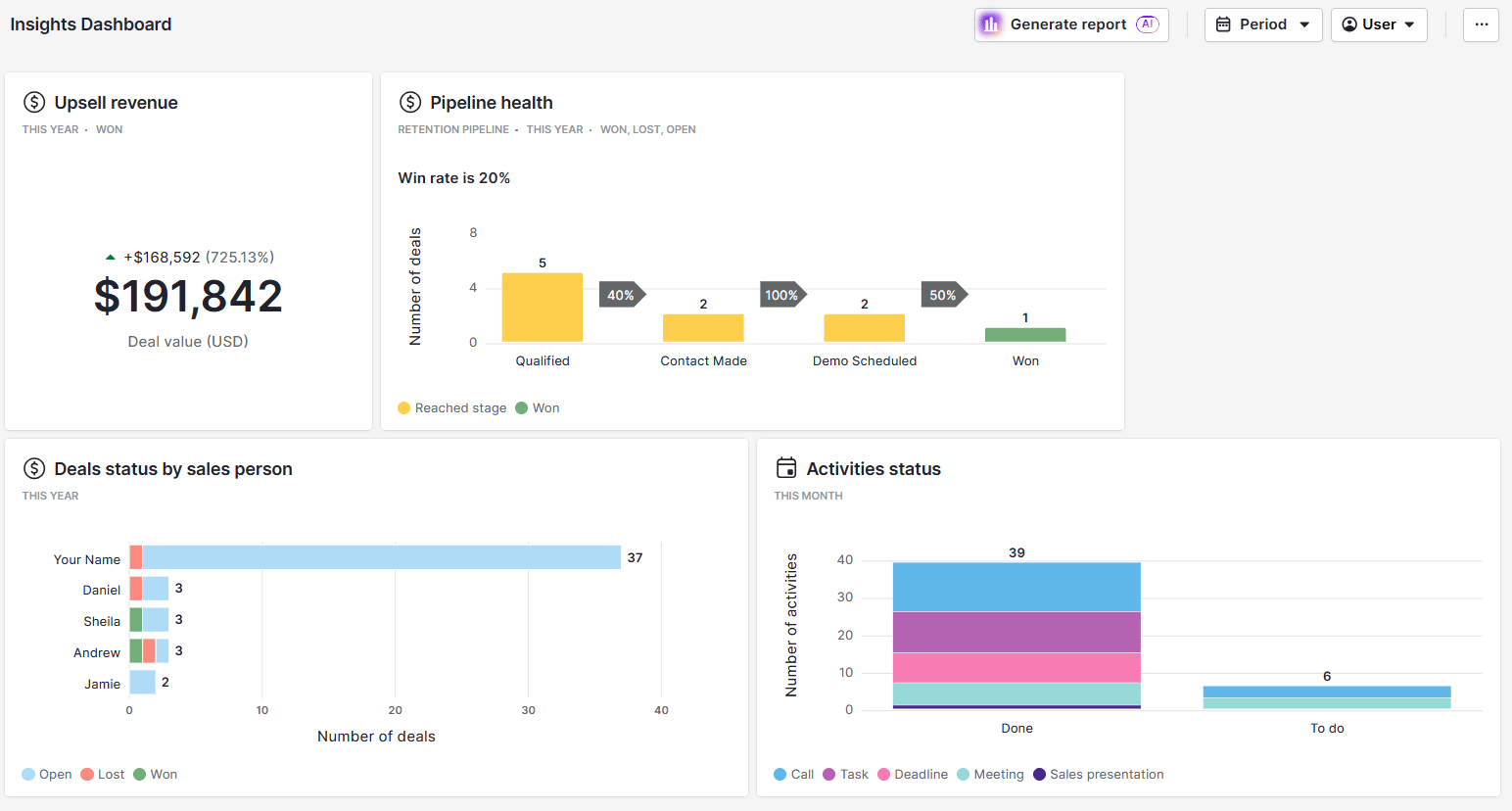

Pipedrive helps you manage deal progress, values and stages to confirm whether marketing efforts generate revenue.

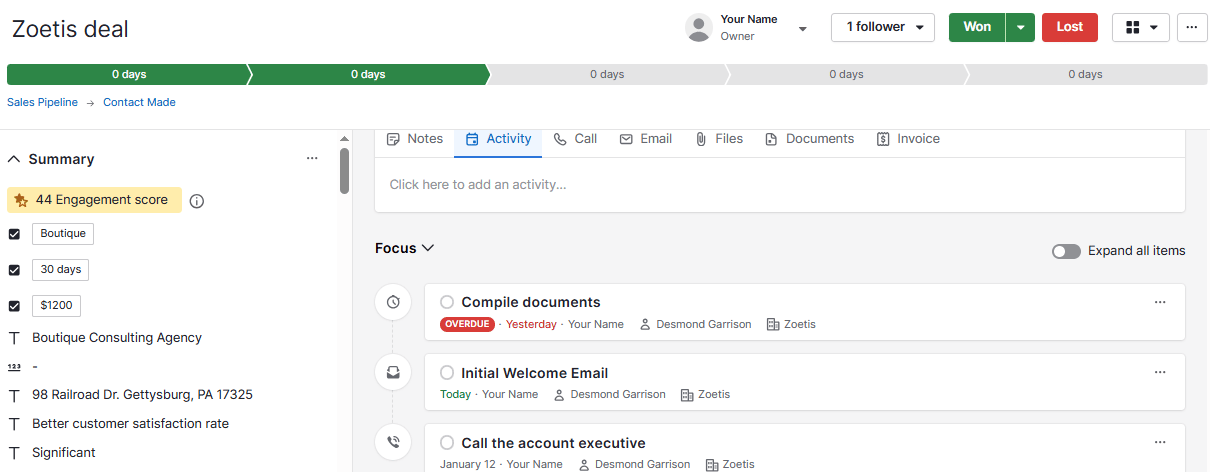

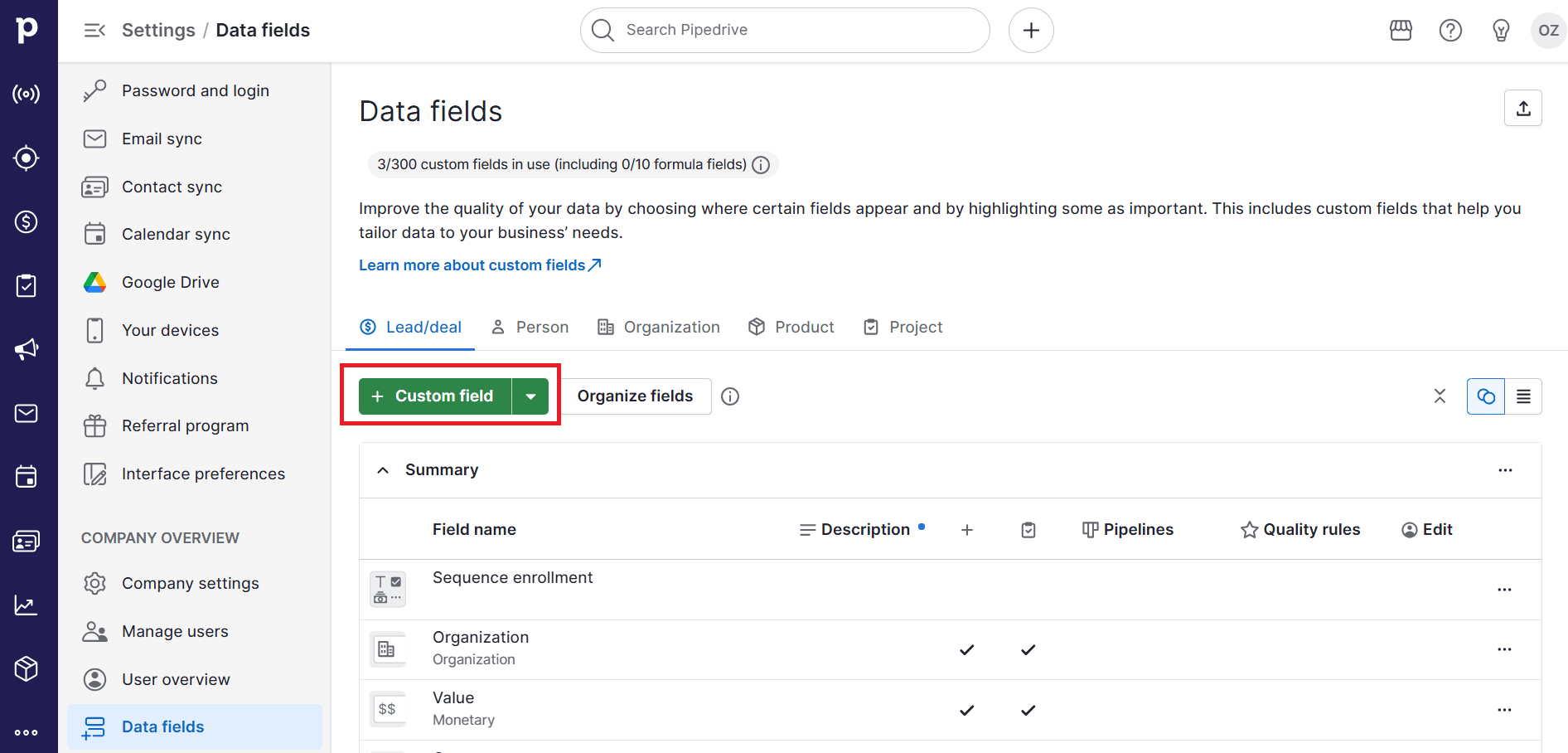

It’s also extremely customizable:

With Pipedrive’s real-time insights, you can validate other tool layers and make confident strategy decisions.

Some top tools for building this revenue layer include:

Best SMB-friendly revenue tool | Why you’d choose it |

Pipedrive | A powerful, user-friendly tool for tracking deal-level outcomes, pipeline movement and velocity. |

This subscription analytics platform shows how marketing impacts revenue trends like MRR, churn and expansion over time. | |

Another subscription analytics platform that’s useful for understanding CLV, churn and revenue quality when testing new channels or pricing strategies. |

A tool like Pipedrive ensures your measurement system stays grounded in outcomes your business actually cares about.

4. Use a data layer to feed models with clean, reliable inputs

Tool category: Data integration, extract-transform-load (ETL) or customer data platform (CDP).

A data layer ensures that every model and experiment works from the same, clean inputs. For small businesses, this aids consistency and scalability.

It also prevents MMM from failing due to incomplete, inconsistent or out-of-sync marketing data.

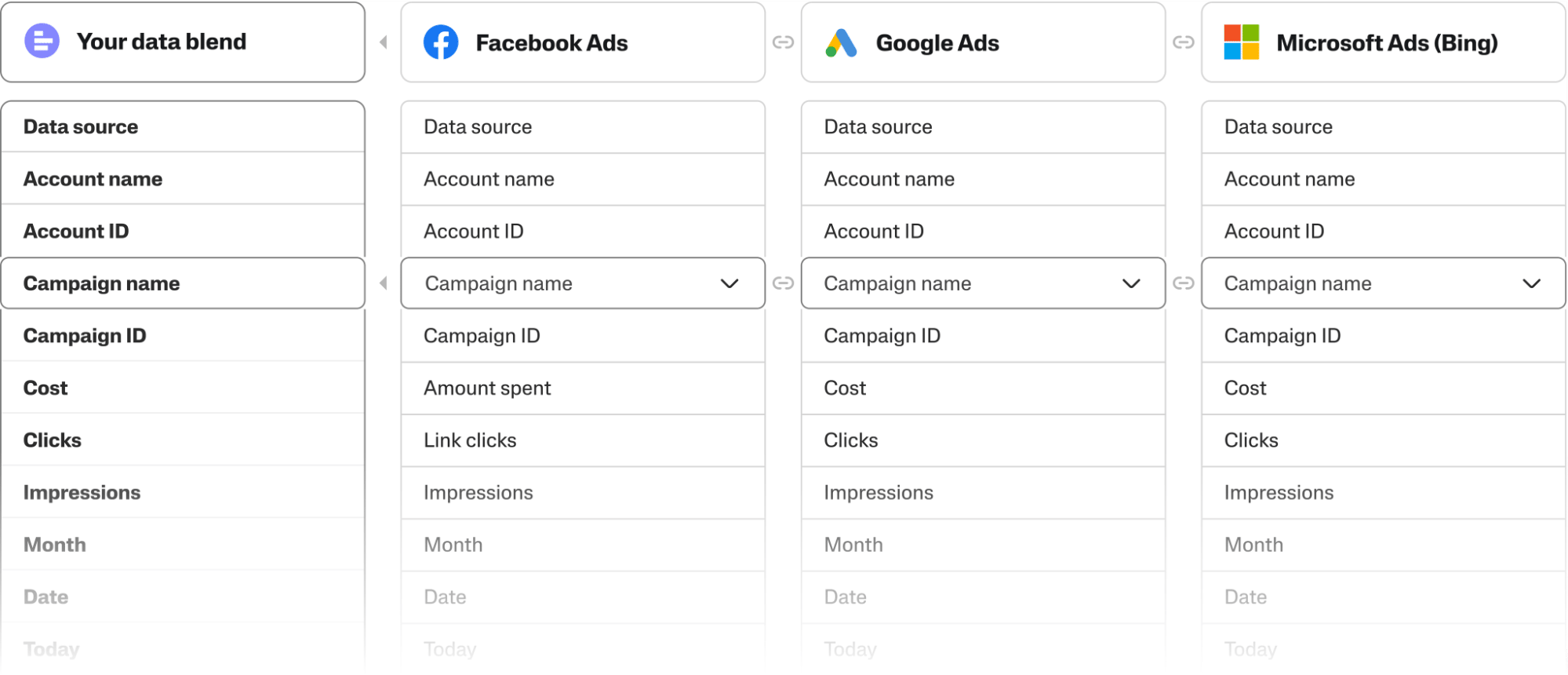

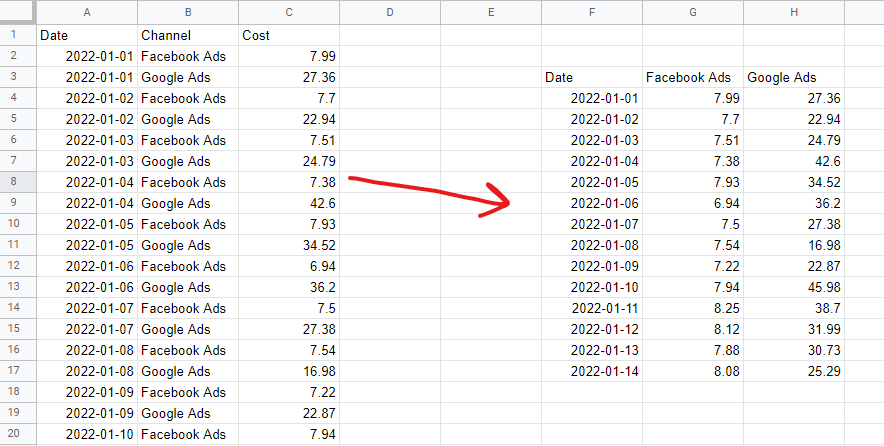

For example, tools like Supermetrics pull, clean and combine insights from multiple sources:

This type of software ensures:

You standardize marketing spend and performance insights

Inputs stay consistent across MMM, experiments and revenue reporting

Updates happen regularly without manual cleanup each time

Your data layer helps quietly determine the reliability of everything else in your stack.

Some of the top data aggregation platforms for SMBs include:

Best data aggregator | Why you’d use it |

Supermetrics | Pulls advertising and marketing analytics data directly into Google Sheets or reporting tools. |

A simple, no-code way to connect apps and automate data flows. For example, sending ad spend or CRM updates into a spreadsheet or dashboard. Zapier also integrates with Pipedrive. | |

Manual CSV imports | Common for early-stage teams, though best treated as a temporary stopgap rather than a long-term approach. |

When data is consistent and repeatable, every actionable insight will be more trustworthy and have tangible impact.

Download Your Sales and Marketing Strategy Guide

5. Finish with a decision layer to turn insights into action

Tool category: Planning, forecasting and activation tools.

The decision layer offers visibility to turn insights into concrete decisions. Otherwise, all your analysis just sits in a report.

This software helps you answer questions like:

Where should we reallocate marketing investments this quarter?

Which campaigns or channels should we scale or pause?

How do we adjust our marketing strategy based on actual results?

For busy SMBs, this layer can be as simple as a spreadsheet that consolidates MMM insights, experiment results and revenue datasets.

For example, this MMM spreadsheet compares Facebook Ads to Google Ads performance:

If you can easily spot where to spend, pause or scale marketing, you’ll move and improve faster.

Here are some of the top decision-stage MMM solutions for smaller teams:

Best SMB-friendly decision tool | Why you’d use it |

Flexible, low-cost and widely used. Great for small teams to track marketing budgets, plan campaigns and make quick updates. | |

Adds lightweight database functionality to planning. Teams can organize marketing activities, track media spend and visualize changes. | |

A more structured planning tool for teams who are ready to scale. Allows scenario modeling, forecasting and deeper insights without enterprise complexity. |

By closing the loop on your marketing measurement stack, your MMM strategy will inform real decisions that lead to tangible results.

How Pipedrive connects MMM outputs to pipeline and revenue

Pipedrive serves as the revenue and reality layer of your marketing measurement system.

Small teams use this powerful CRM to:

Connect marketing spend to actual pipeline and revenue

Validate assumptions

Make snappier decisions based on data

For example, Pipedrive lets you track every opportunity in your pipeline, from first contact to close:

Deal tracking features ground MMM outputs in real sales data, showing which channels actually produce deals rather than just clicks or leads.

You can also automatically log calls, emails and meetings tied to each deal

Complete and accurate activity data ensures a reliable revenue layer to feed into the rest of your loop.

Pipedrive in action: Web design and marketing agency Accentuate used Pipedrive to oversee and grow revenue by 1,000%. By mapping out unique processes and engaging deals, the team integrated its favorite tools, automated tasks and scaled alongside customer needs.

Custom fields let you tag deals with the originating campaign, source or marketing channel

By validating whether incremental lift actually converts, MMM insights become actionable for both analysts and growth teams.

You can also create custom reports to visualize pipeline velocity, deal conversion and revenue trends:

These dashboards turn modeled and experimental insights into real, actionable guidance for budget allocation and scenario planning.

Final thoughts

Building a modern MMM stack helps you identify revenue-driving channels, validate assumptions through experiments and make faster decisions.

Try Pipedrive free for 14 days to adjust marketing budgets, campaigns and channels based on actual deals and pipeline.