Wealth Management CRM

Simplify client portfolio tracking in wealth management

Organization and trust are key to portfolio management, tracking interactions and meeting client goals.

A CRM for wealth management centralizes client data, automates follow-ups and ensures every customer gets timely, personalized attention.

Use Pipedrive’s wealth management CRM to track every portfolio in one location. Boost team productivity, strengthen client relationships and deliver consistent, high-quality service.

4.5/5

4.2/5

4.3/5

4.5/5

4.5/5

4.7/5

What to look for in a CRM for wealth management

The best CRM for wealth management includes these key functions:

Contact management. Sync customer data from any source to provide a personalized experience.

Data security and privacy. Protect sensitive data at all times.

Customizable fields and workflows. Standardize processes and activities to manage specific clients.

Workflow automation. Automate follow-ups, reminders and meeting scheduling.

Ease of use. Navigate the user-friendly system quickly to minimize training time, boost adoption and enhance scalability.

Wealth management CRM features

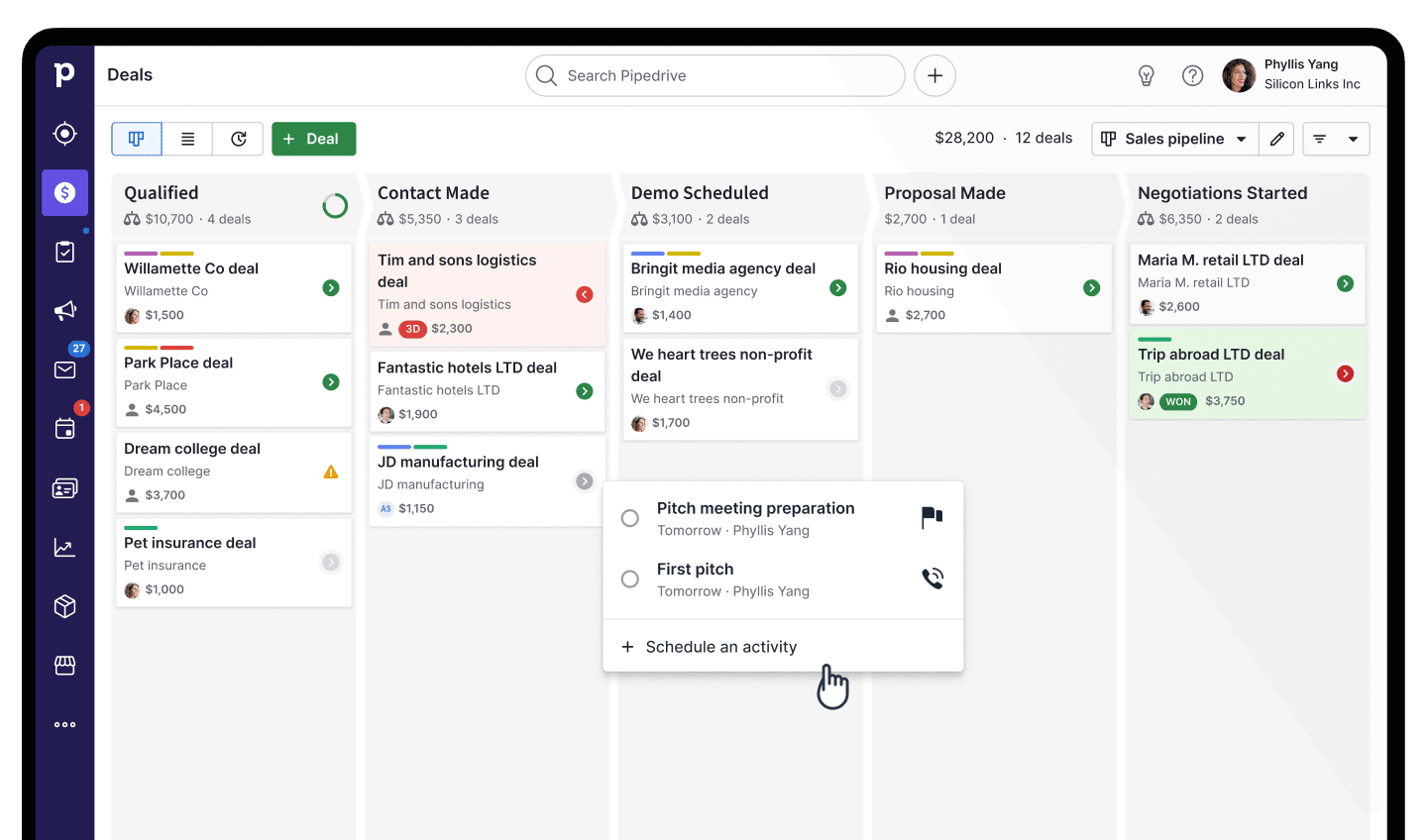

Capture, qualify and prioritize leads in one place

Wealth managers often rely on scattered spreadsheets or inboxes to track referrals and prospects, leading to missed opportunities and slow follow-ups.

Wealth management CRM software captures every inquiry, giving teams a clear system to turn inquiries into clients.

Pipedrive organizes, qualifies and prioritizes leads in one place. Act at the perfect moments to close more deals and strengthen client relationships.

See how Pipedrive manages leads

Stay organized with a unified activity calendar

Advisory firms juggle client calls, review meetings and compliance deadlines. Tasks easily slip through the cracks and affect client satisfaction.

An activity calendar in a wealth management CRM system unifies tasks, appointments and reminders, organizing teams and ensuring no client or deadline is missed.

Pipedrive’s activity calendar outlines every task and meeting so advisors stay on top of client management and deliver consistent service.

View Pipedrive’s activity calendar

Make data-driven decisions with powerful insights

Without clear performance visibility, it’s hard to know which advisors, client segments or activities drive growth.

Insights and reports let financial advisors track assets under management (AUM) growth, pipeline health and conversion trends to guide smarter decisions.

Pipedrive’s insights and reporting tools visualize key metrics so teams can optimize performance and grow assets more effectively.

Get actionable insights with Pipedrive

Focus on high-impact activities and goals

Spending too much time on low-priority tasks can affect client satisfaction and revenue growth.

A CRM software for wealth management helps teams organize daily tasks, set clear priorities and track progress to ensure every action contributes to measurable results.

Pipedrive’s activities and goals feature keeps advisors organized and focused on what matters most, driving results and stronger client outcomes.

Learn about Pipedrive’s task management

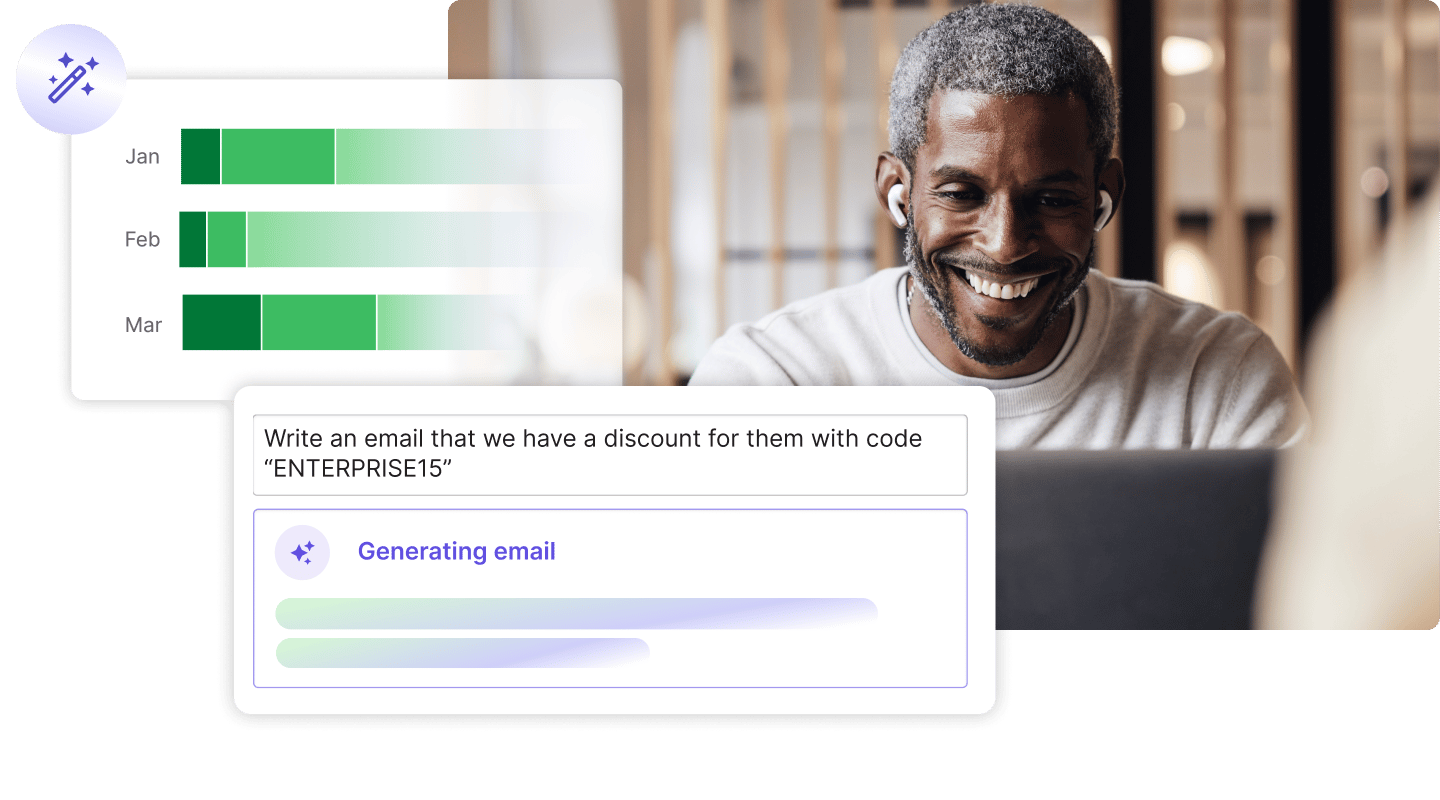

Automate tasks with AI-powered software

Manual admin work slows advisors down, taking time away from client service and growing assets.

AI-powered automation handles repetitive tasks, scheduling and reminders, letting teams focus on client relationships and strategic growth.

Pipedrive’s AI features streamline workflows, reduce manual tasks and enable advisors to deliver faster, more personalized service.

Discover Pipedrive’s AI tools

Over 500+ integrations

Expand the capabilities of Pipedrive with hundreds of apps and integrations

How Pipedrive helped Network Financial Planning boost efficiency by 50%

Network Financial Planning used scattered systems and a CRM that didn’t meet their needs. Tracking leads, client journeys and projects was a challenge.

The team used Pipedrive to centralize client data, map touchpoints, automate workflows and streamline operations. As a result, the wealth management firm completed 50% more activities and delivered a tailored user experience.

“Every day, we keep growing and improving our and our clients’ experience by using Pipedrive.”

Streamline client paperwork with Smart Docs

Use Pipedrive’s Smart Docs to create, send and track client documents directly from your CRM, reducing manual work and improving accuracy.

Key features include:

Autofill documents. Pull client data straight from Pipedrive to eliminate manual entry and reduce errors.

Real-time tracking. See when clients open, view or sign proposals so you can follow up at the right moment.

E-signatures. Collect legally binding signatures instantly – no printing or scanning required.

Templates and collaboration. Create reusable templates and share them with your team for consistent, compliant documentation.