Crafting effective invoices is essential for turning completed work into tangible income. A well-designed invoice template provides a clear structure for detailing services, products and payments, helping clients pay you on time and keeping your financial records clean.

In this guide, you’ll learn how to create and use various basic invoice templates serving different business needs. Mastering these templates will streamline your billing processes and reinforce your professionalism, ensuring your business continues to thrive.

10 basic invoice templates to download and customize

Understanding how to write a basic invoice is a critical skill for every business owner, but there’s no need to start from scratch every time. With the proper templates, you can save time and reduce errors in your billing process.

Here are 10 blank invoice templates you can download and customize to fit your needs. You’ll learn what each free invoice template includes and when it’s most effective to use.

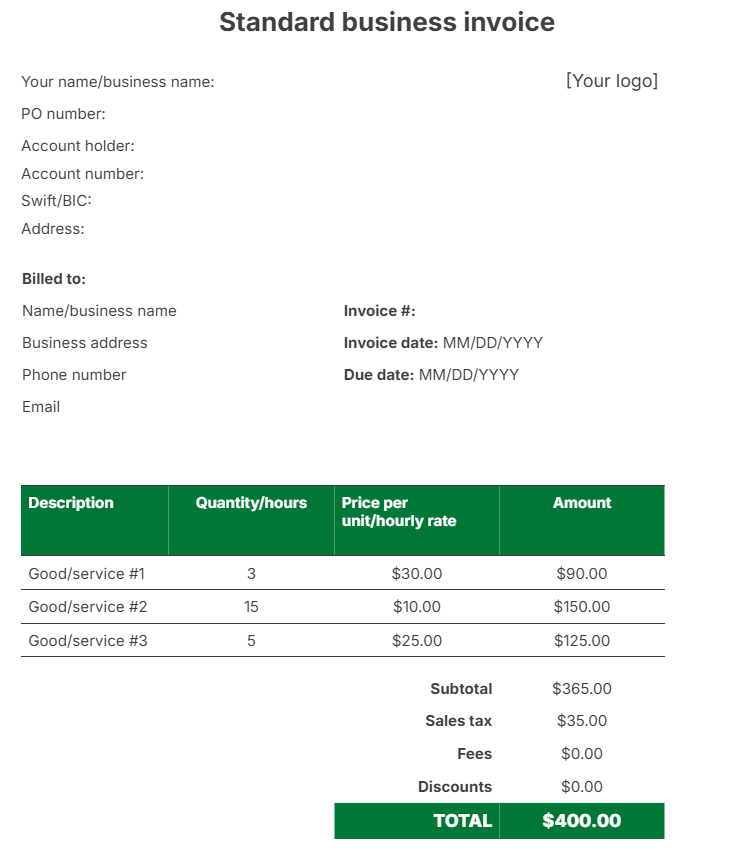

1. Standard invoice

A standard sales invoice is an everyday billing tool you send clients once you’ve wrapped up a project or shipment. It’s clear, straightforward and captures all the necessary details for clients to pay you without hiccups.

Here’s what a standard invoice should include:

Key information | Details to include |

Your business information | Your business name, logo and contact details so your invoice is easily identifiable. |

Client information | The client’s name and contact details to personalize the invoice. |

Invoice details | A unique invoice number and the issue and due dates. |

Description of goods and services | Itemize what you’re billing for, including descriptions, quantities and rates. |

Totals | The subtotal, sales taxes and the final total amount due. |

Payment terms | How and when you expect the client to pay you (e.g., whether you accept online payments by credit card), making it easy for the client to pay on time. |

Use this invoice template when billing for goods or services. It helps you organize your financial records and inform your clients about what they owe and when.

Download Pipedrive’s standard invoice template

Inform clients about due payments for goods and services using this standard invoice template.

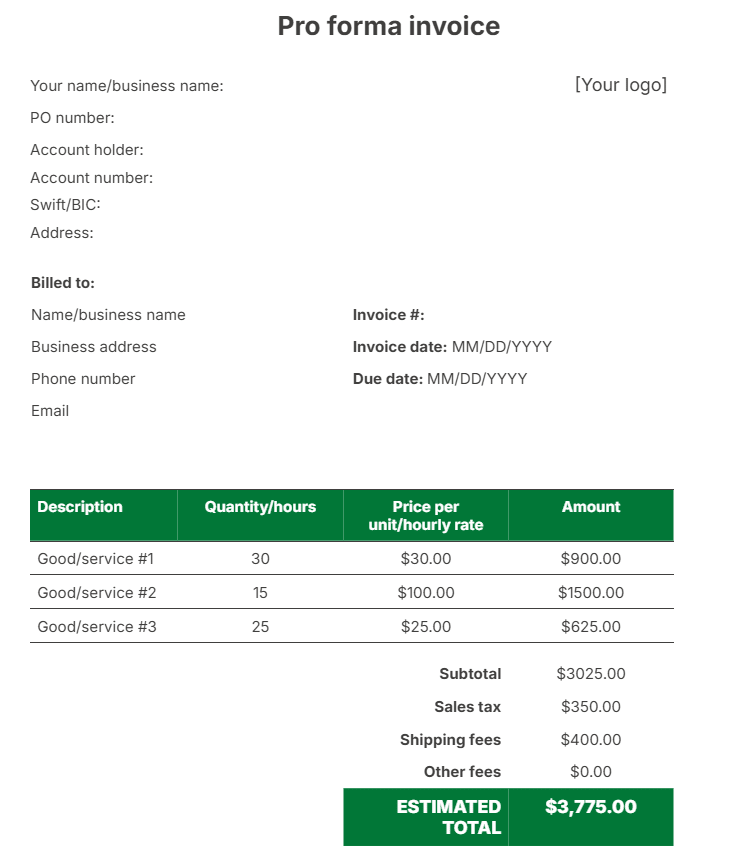

2. Pro forma invoice

A pro forma invoice is a sneak peek into a future transaction, giving your client a detailed quote or estimation of costs before the actual sale takes place. It’s mainly useful in export sales to declare the value of goods for customs and provide a clear breakdown of the expected charges.

Here’s what a pro forma invoice typically includes:

Key information | Details to include |

Your business information | Your company name, business logo and contact information. |

Client information | Your client’s name and address. |

Invoice details | Label the document as “Pro Forma Invoice” to distinguish it from a standard invoice. Include the invoice number, issue date and expiration date for the offer. |

Description of goods and services | A detailed list of what you’re billing for, including descriptions, quantities and rates. |

Estimated costs | The subtotal, potential taxes, shipping fees and total estimated amount to give the client a full financial preview. |

Payment terms | Expected payment terms and conditions to help the client understand what they must do upon finalizing the sale. |

You typically send a pro forma invoice before providing a service or shipping goods. The document outlines the estimated costs and can be useful for approvals, budgeting or securing financing for a project.

Download Pipedrive’s pro forma invoice template

Provide a preliminary invoice to inform clients about potential costs with this pro forma template.

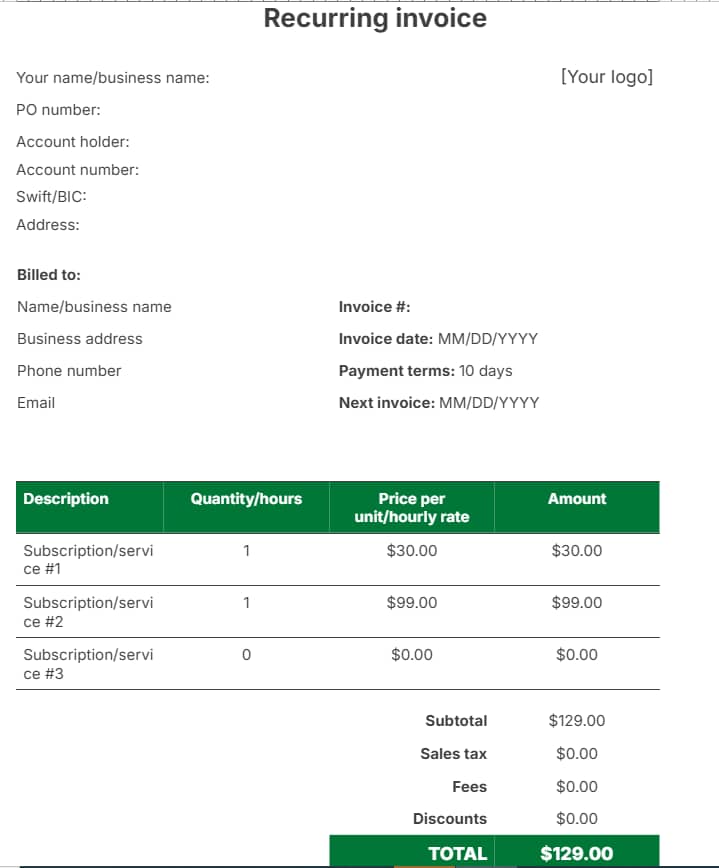

3. Recurring invoice

A recurring invoice is necessary when you have regular billing arrangements with clients for ongoing services or subscriptions. It automatically charges your clients at set intervals, saving you time and effort.

These are details to add to your recurring invoices:

Key information | Details to include |

Your business information | Your business name, logo and contact details. |

Client information | The client’s name and contact details. |

Invoice details | A unique invoice number with a clearly highlighted issue date, due date and next invoice date. |

Description of goods and services | Itemize what you’re billing for, including descriptions, quantities and rates. |

Totals | The subtotal, taxes and the final total amount due. |

Payment terms | How and when you expect the client to pay you, including how often you’ll send the recurring invoice (e.g., every 15 days). |

Recurring invoices suit businesses that offer subscription-based services, memberships or ongoing projects. They ensure timely payments and help maintain a stable cash flow for recurring revenue without the hassle of manual periodic invoicing.

Download Pipedrive’s recurring invoice template

Simplify regular billing using this template for ongoing services or subscriptions.

4. Credit invoice

A credit invoice or credit memo is what you send when you need to adjust a previous invoice because of errors, returns or sales promotion discounts. It helps correct the record and ensures your client receives credit toward their account.

Here’s what to feature in a credit invoice document:

Key information | Details to include |

Business information | Your business name, logo and contact details. |

Client information | The client’s name and contact details. |

Credit invoice details | A title, labeling the invoice as a “Credit Invoice” or “Credit Memo”. Include a unique credit invoice number and date. |

Original invoice reference | A reference to the original business invoice number and date, so there’s no confusion about the transaction you’re adjusting. |

Reason for credit | The reason why you’re issuing the credit – whether for returned items, a billing error or an agreed discount. |

Adjustments | The items, quantities and amounts you’re crediting, along with any taxes affected. |

New total | The new outstanding balance after applying the credit. |

You use credit invoices to officially reduce the amount the client owes. Reasons for this include returned goods, overpayments or billing errors. Credit invoices serve as documentation for changes, keeping financial records accurate – although you shouldn’t confuse them with credit sales.

Download Pipedrive’s credit invoice template

Notify clients about credit notes or refunds with this professional credit invoice template.

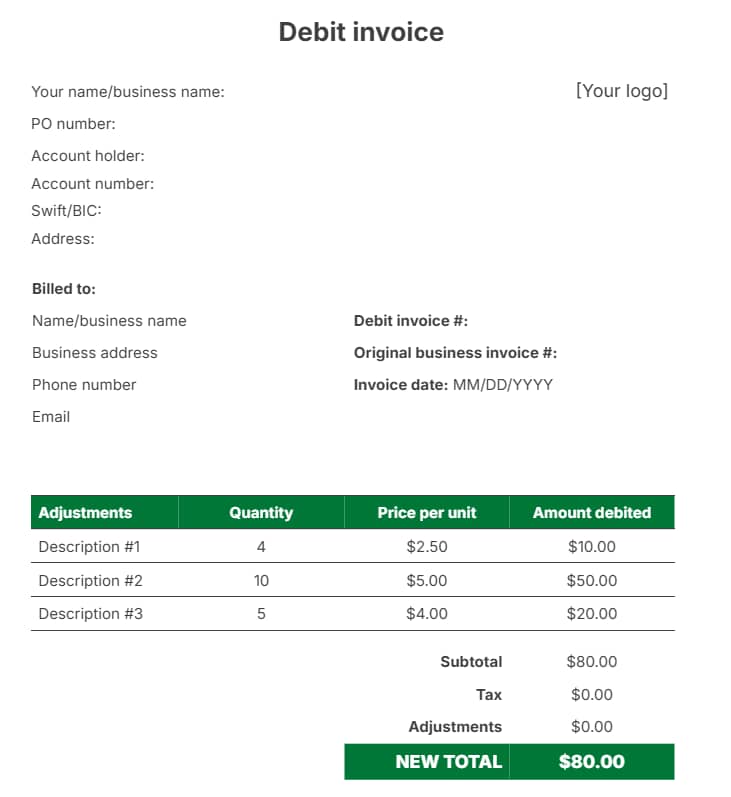

5. Debit invoice

Issue a debit invoice or debit memo to increase the amount a client owes you. You might send one after accidentally underbilling the client or if you provided additional services. It’s the opposite of a credit invoice.

Here are the essential details your debit invoices should show:

Key information | Details to include |

Business information | Your business name, logo and contact details. |

Client information | The client’s name and contact details. |

Credit invoice details | A title, labeling the invoice as a “Debit Invoice” or “Debit Memo”. Include a unique debit invoice number and date. |

Original invoice reference | A reference to the original business invoice number and date to eliminate any confusion about the transaction you’re adjusting. |

Reason for credit | The reason why you’re issuing the debit – whether for a billing error or to add new charges to the invoice. |

Adjustments | The items, quantities and amounts you’re debiting, along with any taxes affected. |

New total | The new outstanding balance after applying the debit. |

Debit invoices adjust previously issued invoices when you need to fix an error or apply new charges. Like credit invoices, they ensure your bookkeeping records reflect the actual amount your client owes you.

Download Pipedrive’s debit invoice template

Request payment adjustments using this easy-to-use debit invoice template.

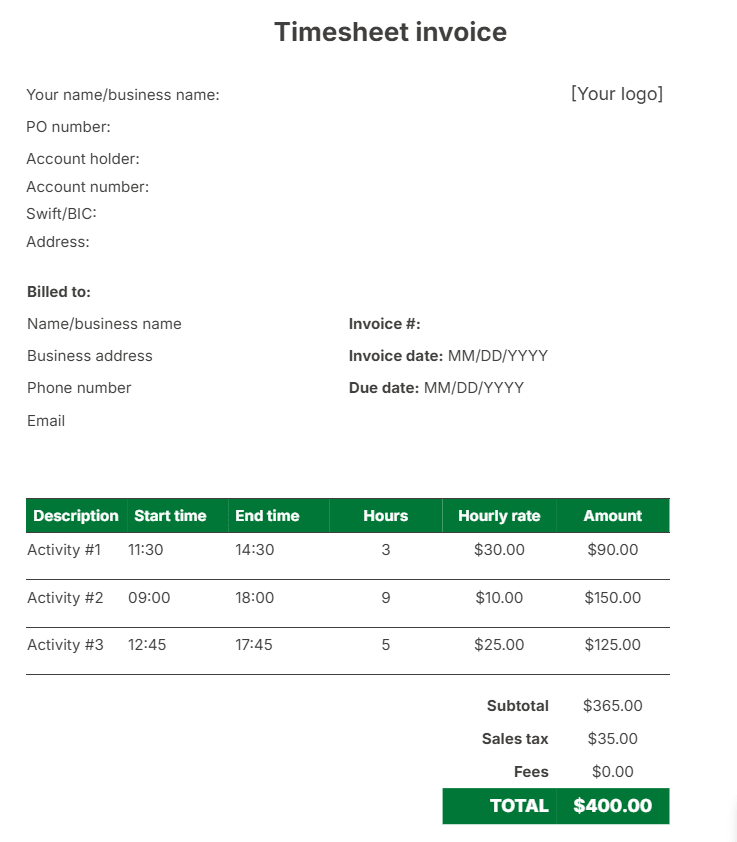

6. Timesheet invoice

A timesheet invoice bills clients based on hourly or daily work. It provides a detailed breakdown of how much time you allocated to different tasks or projects.

Timesheet invoices typically feature:

Key information | Details to include |

Business information | Your business name, logo and contact details. |

Client information | The client’s name and contact details. |

Invoice details | A unique invoice number and issue date. |

Time tracking details | A detailed breakdown of the tasks or services performed, including dates, hours worked and a description of key activities. |

Hourly or daily rates | Your rate per hour or day. |

Total charges | The total amount due based on the hours or days worked, including taxes or fees if applicable. |

Payment terms | How the client can make a payment and the due date. |

Timesheet invoices are handy when you need to charge a client for services according to the number of hours or days worked. They’re particularly convenient for freelance invoices, consultants or service-based businesses that measure their output via time management.

Download Pipedrive’s timesheet invoice template

Bill your clients for hourly services with this timesheet invoice template.

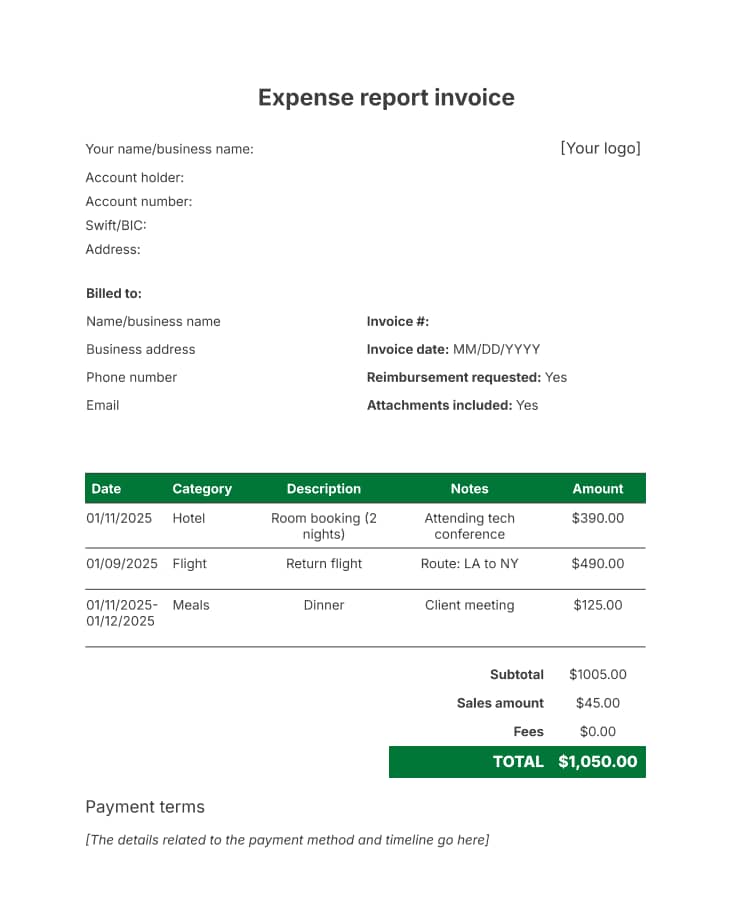

7. Expense report invoice

An expense report invoice bills clients for reimbursable expenses you incurred as part of a project or service rendered. It provides detailed documentation of what you spent, ensuring transparency and accountability.

Here’s what an expense report invoice should include:

Key information | Details to include |

Business information | Your business name, logo and contact details. |

Client information | Your client’s business name and contact information. |

Invoice details | A unique invoice number and issue date. |

Expense details | Enter each expense with a description, date of purchase, vendor name and the amount spent. If possible, add a section for categories like travel, lodging, meals, etc. to facilitate accounting. |

Receipt attachments | Attach sales receipts or documentation that validate expenses and substantiate your claims. |

Total reimbursement amount | Sum up the expenses to show the total amount you’re requesting. |

Payment terms | Include the payment method and timeline. |

Freelancers and consultants frequently use expense report invoices to pass on costs like travel, materials or meals to their clients.

Download Pipedrive’s expense report invoice template

Reimburse employee or business expenses with this comprehensive expense report template.

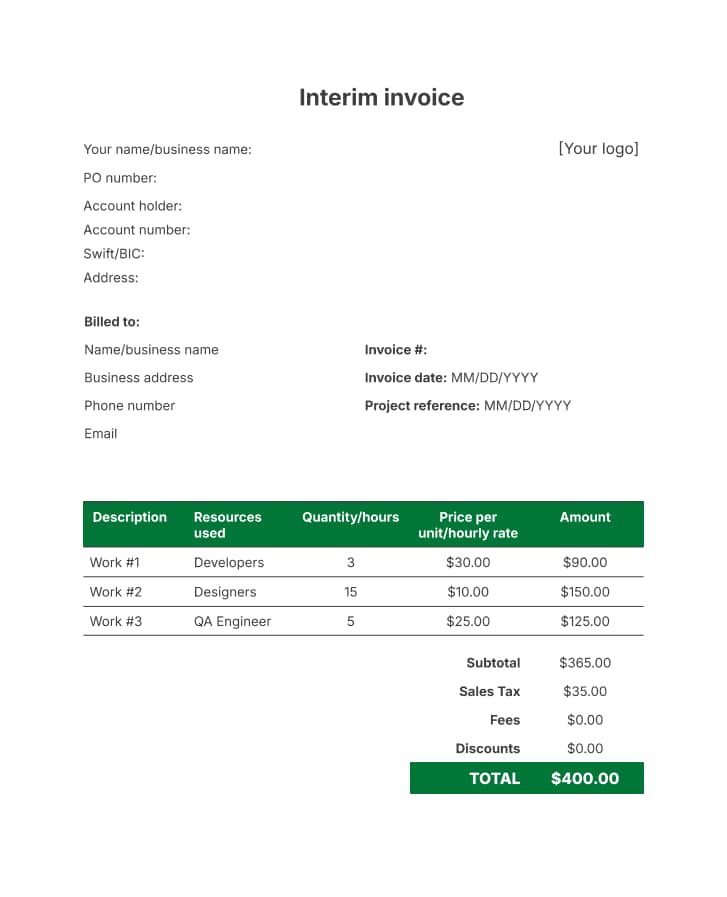

8. Interim invoice

An interim invoice charges clients at various project stages, especially in longer-term or larger-scale agreements. It helps manage cash flow and ensures you receive funds periodically as the work progresses.

Interim invoices usually contain the following essentials:

Key information | Details to include |

Business information | Your business name, logo and contact details. |

Client information | Your client’s business name and contact information. |

Invoice details | A unique invoice number and issue date. |

Project reference | A reference to the specific project or contract, including details like the project name or number. |

Work description | Detail the work or milestones completed in this billing period. Break down specifics like tasks accomplished, hours worked and resources used. |

Amount due | Calculate the current billing amount based on the work completed to date. |

Cumulative overview (optional) | Summarize the total project value, amounts previously billed and remaining balance to give the client a complete view of the project’s financials. |

Payment terms | Payment methods and deadlines. |

Interim invoices are ideal when managing projects that span weeks, months or longer. They allow you to bill the client for work completed up to a certain point rather than waiting until the project concludes to receive full payment.

Download Pipedrive’s interim invoice template

Use this simple interim invoice template to collect payments for ongoing projects.

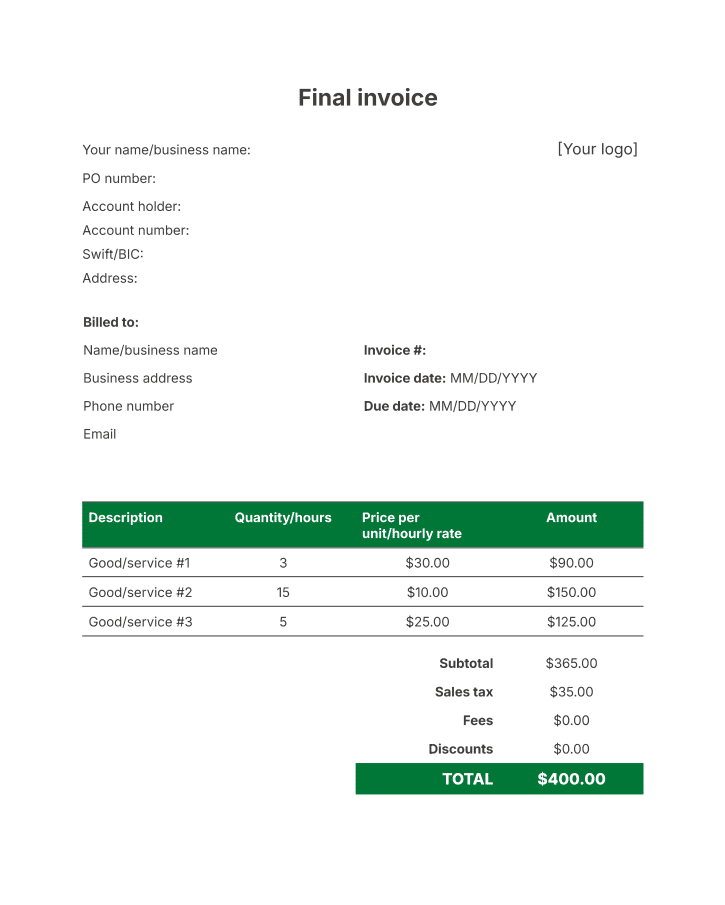

9. Final invoice

A final invoice is the last billing document you send upon completing delivery or at the end of a project or long-term contract involving multiple invoices. It summarizes all completed work, indicates the total amount due and marks the official end of the transaction between you and your client.

Here’s what a final invoice should contain:

Key information | Details to include |

Business information | Your business name, logo and contact details. |

Client information | Your client’s business name and contact information. |

Invoice details | A unique invoice number and issue date. |

Itemized goods and services | A list of all services rendered or products delivered with descriptions, quantities, rates and previously invoiced amounts. |

Total amount due | The final amount due. |

Payment terms | How and when the client should make the final payment. |

Final notes | A concluding message or thank-you note to express appreciation for the client’s business. |

Next steps (optional) | If you require maintenance agreements or follow-ups, outline these to provide a smooth transition post-project. |

Final invoices request payment for the remaining balance after you complete all work and account for previous interim invoices. They provide a comprehensive record of the entire transaction for both parties.

Download Pipedrive’s final invoice template

Conclude projects professionally by billing clients with this final invoice template.

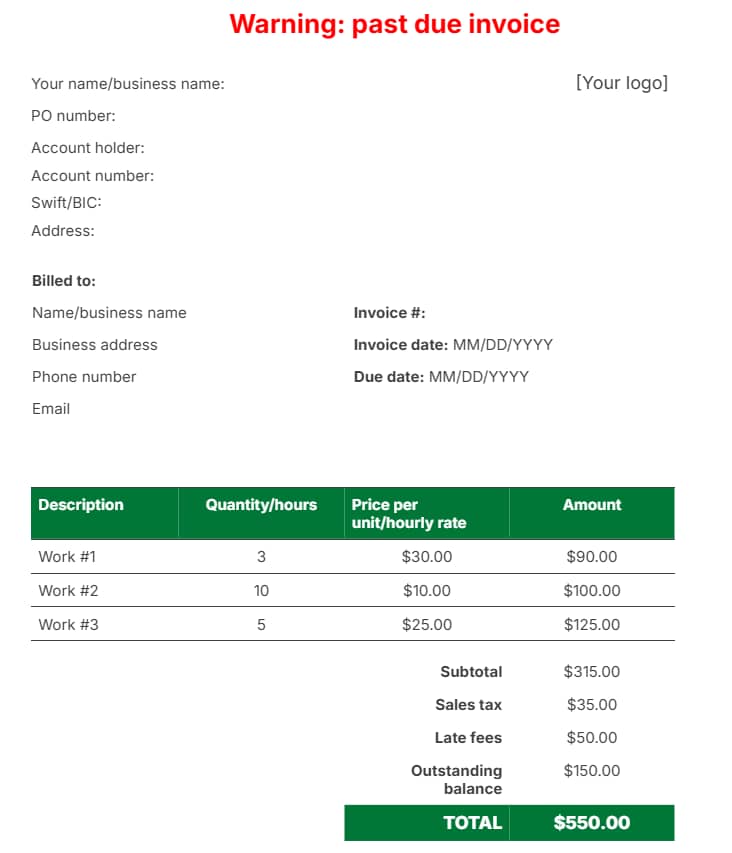

10. Past due invoice

Past due invoices are for clients who miss their payment deadlines. They issue a formal notice of the late payment status, often including late fees or penalties as stipulated in the original sales contract.

Here are the typical line items for past due invoices:

Key information | Details to include |

Business information | Your business name, logo and contact details. |

Client information | Your client’s business name and contact information. |

Invoice details | A unique invoice number and issue date. |

Outstanding balance | The amount that is overdue, including a breakdown of the original charges, payments received and late fees. |

Payment instructions | Reiterate payment method options and provide clear instructions for settling the invoice, making it as easy as possible for the client to pay. |

Due date | Highlight the new due date, emphasizing the need for the client to take immediate action. |

Consequences for non-payment | Outline any consequences for continued non-payment if your terms authorize penalties or collections actions. |

Past due invoices serve as payment reminders and prompt clients to settle their outstanding balances, helping you maintain a healthy cash flow.

Download Pipedrive’s past due invoice template

Remind clients of overdue payments with this past due invoice template.

8 steps to create your own basic invoice template

Here are eight essential steps for tailoring any of the above custom invoice templates to represent your brand and facilitate smooth transactions:

Download a basic template. Begin by downloading one of the above basic invoice templates in Google Docs. It will prompt you to make a copy of the online invoice, giving you full control over its contents.

Open and review. Open the template and review its default components. These standard templates include sections for your business details, client information, invoice number, date, description of goods or services and total amount due.

Customize your business details. Replace the default branding with your own invoice design, including your business name, logo and contact information.

Insert client information. Update the template with your client’s details, including their name, address and contact information.

Change key invoice elements. Update the invoice number, issue date and payment terms. Make sure each invoice has a unique number for tracking purposes, and clarify the payment due date to set clear expectations.

Detail the goods and services. Modify the itemized section to describe the goods or services you’ve provided, including quantities, rates and taxes.

Adjust the color scheme and fonts. Change the color scheme and font style to match your brand’s visual identity and create a professional-looking invoice.

Save and reuse. Save your customized template as a master copy. Each time you generate a new invoice, update the relevant client and service details while maintaining the overall format.

Note: Once finished, download your basic invoice template in PDF format. You can open a PDF invoice template on mobile devices – they’re easy to print or share with your clients. You could also export the invoice in DOCX format to open your basic invoice format in Word.

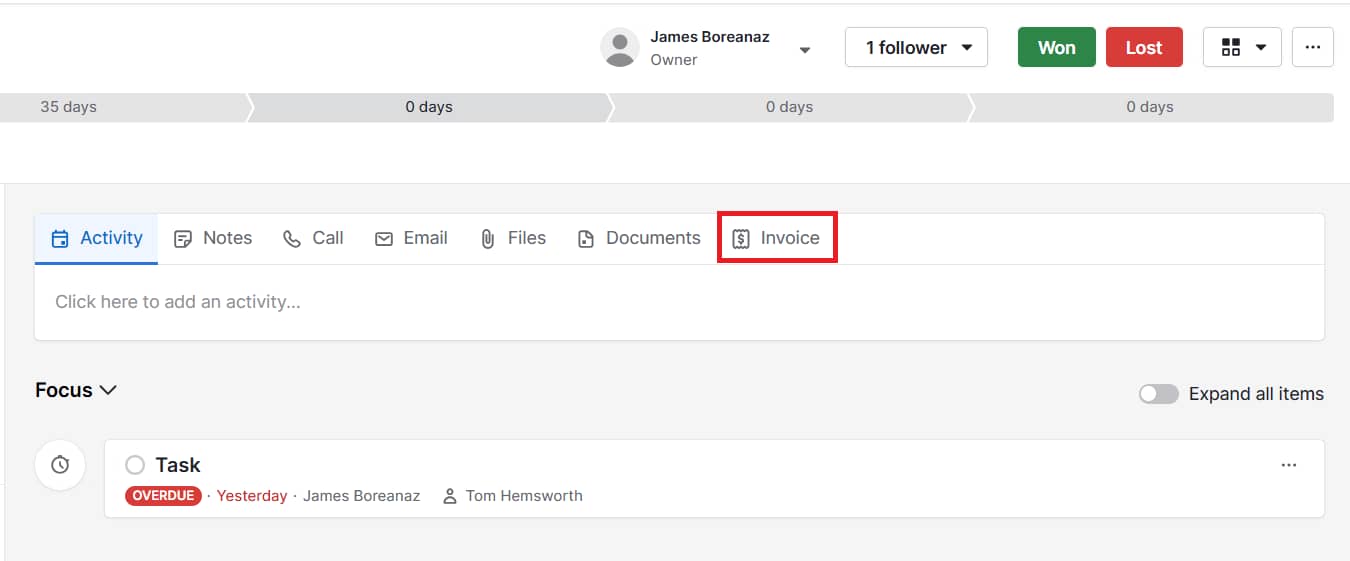

How to make invoices using Pipedrive

With Pipedrive’s invoice generator, you can create and manage invoices directly from the CRM’s interface to streamline your workflow and reduce manual work.

Here’s how to leverage Pipedrive for invoicing.

Getting started with Pipedrive invoicing

To begin, connect the QuickBooks invoicing app to your Pipedrive account. This integration requires an active paying or trial account with Pipedrive and QuickBooks.

Once set up, you can create CRM invoices that automatically include pre-configured details from your deals, like customer information and organization data.

Note: Here’s how to enable the QuickBooks integration to help you maximize Pipedrive’s invoicing functionality.

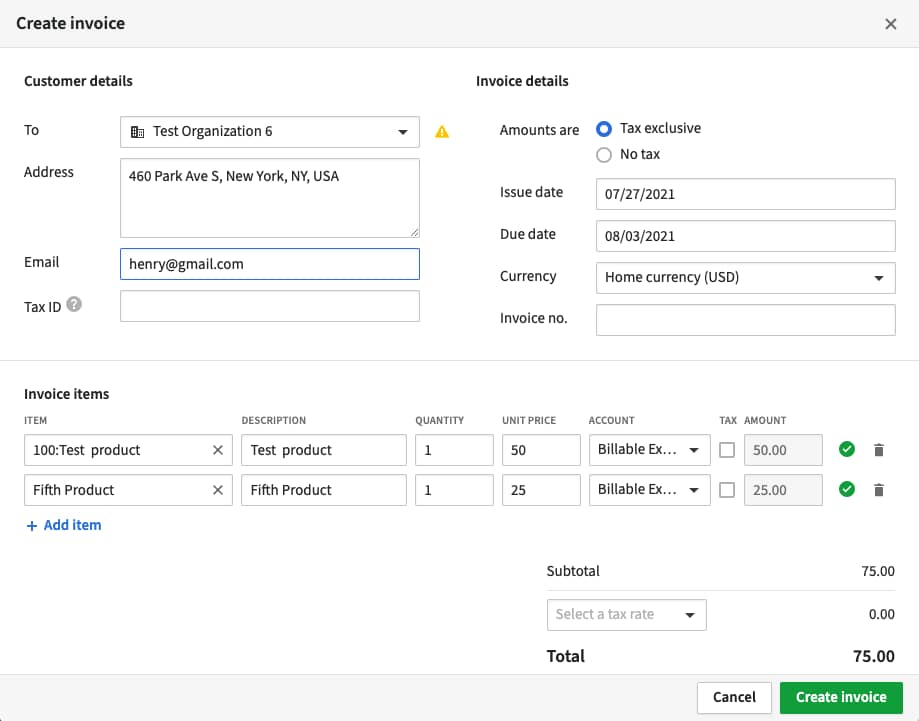

Creating and sending invoices

From the detail view of any deal in Pipedrive, you can create an invoice using the pre-filled deal details. Open the detail view, then click on the “Invoice” tab and select “+ Invoice” from the drop-down menu.

Pipedrive will automatically populate your invoice with customer details based on the customers linked to your deal. If you manually link each product in the CRM to its corresponding item in QuickBooks, the invoice will automatically pull the relevant product information.

You’ll then get a prompt to manually fill out the invoice details (like currency and invoice number). QuickBooks will automatically assign an invoice number beginning with 1001 unless you enter your own.

Next, click the “Create Invoice” button.

When Pipedrive generates and saves the invoice, it automatically sends it to your QuickBooks account. You can continue and finalize the invoicing process from the QuickBooks app.

Crush your manual admin with this sales automation guide

Managing invoices

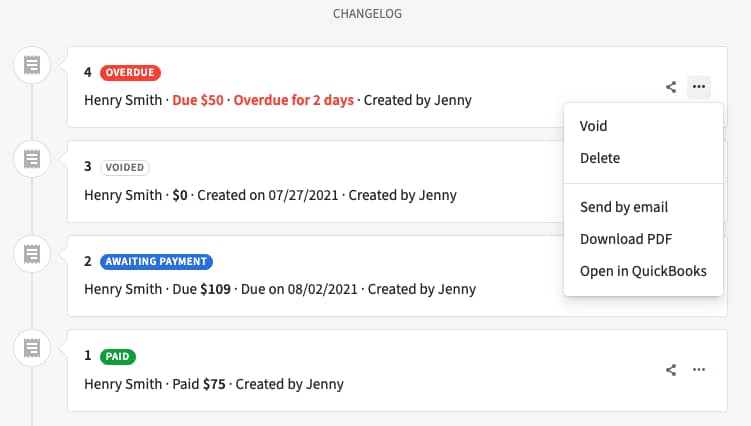

Pipedrive will store all invoice-related information within your deal view. The status of each invoice, such as whether it’s open, paid or overdue, updates automatically to give you real-time insights directly within your CRM.

Final thoughts

Efficient invoicing is one of the cornerstones of a successful business. Knowing the main types of invoices and using templates helps optimize your billing process and ensure timely payments.

Make the most of the 10 customizable invoice templates to tailor your invoicing to any business scenario, from recurring services to one-off projects. If you want to automate and seamlessly manage invoicing, consider leveraging Pipedrive’s powerful solution.

Start a 14-day free trial to discover how Pipedrive integrates directly into your overall business workflow, streamlining everything from invoice management to sales tracking.