Your brilliant business idea deserves funding, but the banks say no and investors won’t call back. If this frustration sounds familiar, you’re not alone – and crowdfunding could be the answer.

By pitching to potential supporters directly instead of waiting for one gatekeeper’s approval, you can raise money and build a loyal following simultaneously.

This guide to crowdfunding for small businesses explores the best approaches, platforms and practices for turning community support into commercial success. It also includes a free campaign calendar and checklist to help you keep your crowdfunding efforts on track.

Key takeaways from small business crowdfunding

Crowdfunding is an audience-powered way for entrepreneurs to raise capital. It involves collecting small amounts of money from a large number of people, instead of a lump sum from an individual investor.

The best campaigns combine strategic planning, consistent promotion and strong visuals to build early momentum. Most successful projects target $10,000-$50,000 and run for 30-45 days.

Success with crowdfunding depends on having a compelling story, solving a real problem and treating your campaign as a dedicated marketing project rather than a passive fundraising effort.

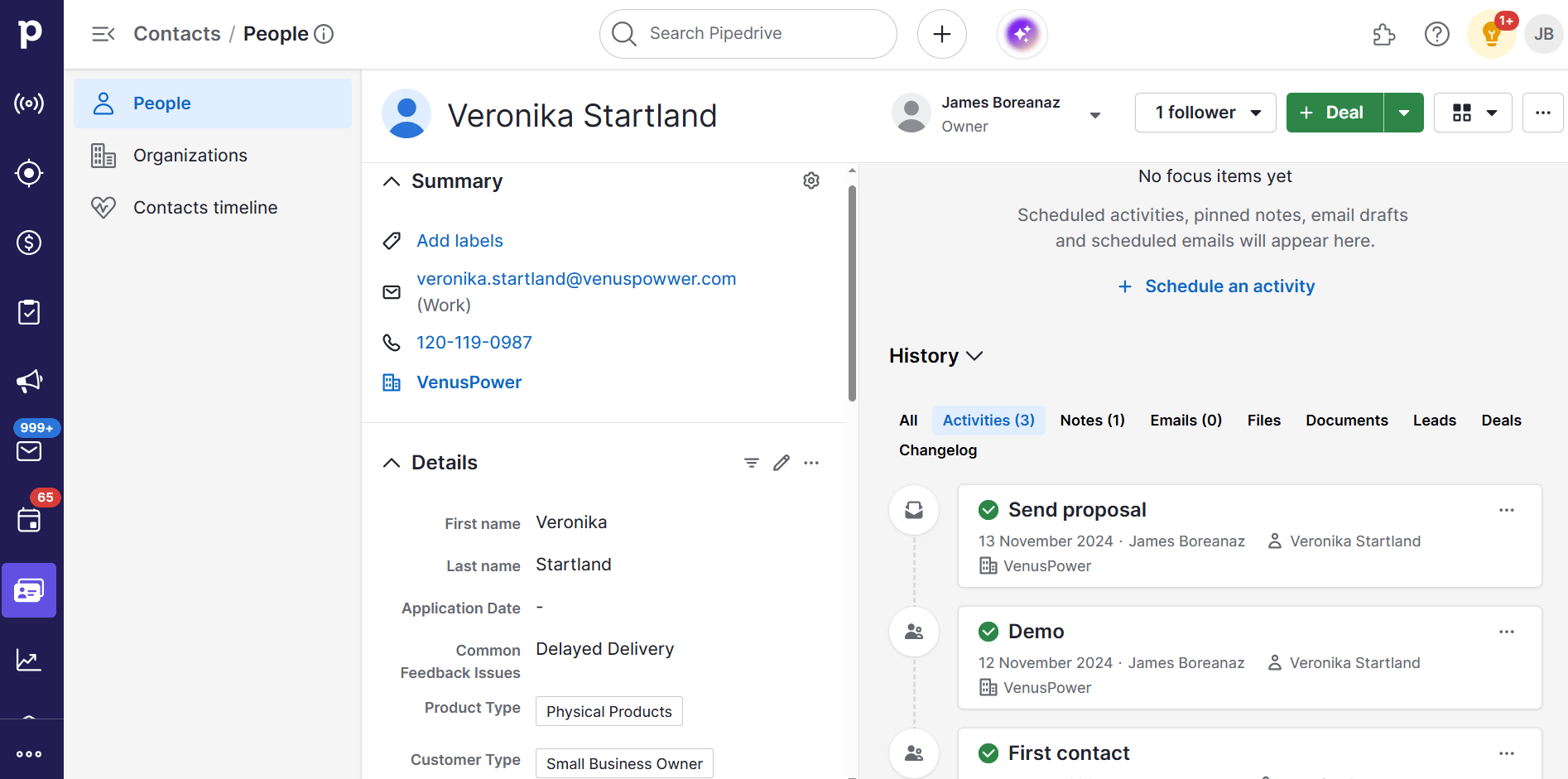

Use a CRM system like Pipedrive to capture and nurture crowdfunding supporters and convert initial interest into long-term customers through targeted follow-ups, automated sequences and data enrichment tools. Start your 14-day free trial to turn campaign backers into paying clients.

Why crowdfunding works for small businesses

For a small business, crowdfunding bypasses traditional lenders by raising capital directly from communities of supporters who back your mission, product or vision.

Many small business owners use crowdfunding as an alternative to traditional funding options like venture capital and angel investment. However, it’s more than just a “plan B”.

There are four different types of crowdfunding. Each helps new businesses and entrepreneurs in its own way:

Crowdfunding method | How it works |

Donation-based crowdfunding | Investors give money to support a cause or project without expecting anything in return. Donation crowdfunding works best for non-profits and social enterprises, as people give more if they believe in the mission or want to help others. |

Rewards-based crowdfunding | Backers contribute to receive a perk, like a new product, sample, gift or early access to a service. Rewards crowdfunding suits startups and creative projects as people can be part of a new brand story while still getting a return on their investment. |

Equity-based crowdfunding | Investors pay for a small share of ownership in the business (typically much smaller than an angel investor might expect). Equity crowdfunding helps high-growth companies hit funding goals faster without taking on debt. |

Debt-based crowdfunding | The business borrows money from many backers before paying them back at an interest rate later. Debt-based funding suits companies with steady cash flow. They can repay investors over time, often in order of investment, without losing ownership. |

More than just a way to meet fundraising goals, crowdfunding lets you validate business ideas by testing demand before production. If a pitch doesn’t land, backers get refunds and you start over (with the right crowdfunding model). Venture capitalists and credit cards aren’t as forgiving.

With crowdfunding, you also get to build an engaged customer base of people invested in your brand journey before it’s truly started. That early-stage emotional connection can have long-term value, as Matthew Chow and Shirie Ho wrote:

So, even if you can use traditional funding sources, crowdfunding might still be the best way to finance your business plan, especially if your product differs significantly from what already exists.

5 of the best crowdfunding sites for small businesses

Now that you know the different types of crowdfunding loans for small businesses, let’s look at six standout sites and why they work for SMBs.

The right crowdfunding platform can impact how you promote your campaign and its likelihood of success.

These sites suit different business models, so consider your audience, funding type and long-term goals before choosing one. The US Small Business Administration (SBA) also recommends reading the fine print and understanding your full financial and legal obligations.

1. Kickstarter

Kickstarter is the most well-known online platform on this list. Since launching in 2009, it has facilitated over 283,000 successful crowdfunding campaigns (as of August 2025).

.

Key facts and features:

- Best for: Product launches and creative projects

- Funding type: Rewards-based

- Key benefit: The all-or-nothing model protects both sides

- Fee model: 5% platform fee + payment processing fees

Kickstarter is known for its all-or-nothing model, meaning creators only receive backers’ money after meeting their fundraising goal.

This low-risk approach protects both sides: small businesses don’t have to complete projects without proper funding, and supporters know they’ll always get something back for investing.

Success story: PopSockets started in 2012 as an $18,600 Kickstarter project with 520 backers. It’s since sold more than 275 million phone grip accessories in 75 countries.

2. Indiegogo

Indiegogo provides SMBs more freedom than Kickstarter, letting you choose between all‑or‑nothing or flexible funding (meaning you keep whatever you raise).

.

Key facts and features:

-Best for: Tech products and flexible campaigns

- Funding type: Rewards-based

- Key benefit: Option to keep funds even if the goal isn’t met

- Fee model: 5% platform fee + processing fees

Indiegogo has a strong background in tech. Many backers use it to look for the next big thing, so it’s a natural fit for unique product launches and gadgets. The platform’s “Gogofactor” algorithm also helps promote trending projects to the best-matched potential investors.

Success story: HOVERAir’s X1 professional photography drone raised more than $2 million in one day on Indiegogo, eventually reaching $4.7 million from nearly 6,500 backers.

3. GoFundMe

GoFundMe is donation-based, so businesses don’t have to offer rewards or give up equity. Campaigns receive funds whether or not they meet a goal, making it ideal for time-sensitive issues or mission-led local business financing.

.

Key facts and features:

- Best for: Urgent needs and personal/community causes

- Funding type: Donation-based

- Key benefit: No rewards or equity required

- Fee model: 0% platform fee (payment fees apply)

GoFundMe is helpful for small businesses suffering setbacks, like natural disasters or break-ins, or those with strong community ties. It works best when you have a personal story to share: most backers give because they care, not because they expect something in return.

Success story: Buffalo Brewing launched a GoFundMe campaign to pay for equipment repairs after vandals halted production. At time of writing, it’s raised almost 90% of a $20,000 goal.

4. Fundable

Fundable is an equity crowdfunding website where backers invest to get a share of your business. It can be a good fit for startups that want to scale fast without taking on debt.

.

Key facts and features:

- Best for: High-growth startups seeking investors

- Funding type: Equity-based

- Key benefit: Connects with accredited investors

- Fee model: Monthly subscription (starts at $179)

Fundable connects entrepreneurs with small groups of accredited investors who want to diversify their portfolios. It’s popular with founders of enterprise tech, life sciences and consumer brands that need significant investment and are prepared to share long-term expansion plans.

Success story: Rubix Life Sciences raised $1.25 million to expand its digital tools for connecting underrepresented patients to clinical trials, surpassing its target by 25%.

5. Patreon

Patreon helps creators earn recurring revenue by offering monthly memberships to fans or supporters. Instead of one-time crowdfunding, the platform focuses on long-term engagement and steady cash flow.

.

Key facts and features:

Best for: Creators building recurring income

Funding type: Membership-based

Key benefit: Builds long-term supporter relationships

Fee model: flat 10% of income (from August 25) + processing fees

Patreon suits creative microbusinesses like sales coaches and podcasters. If you want to build a community and get paid directly by your audience, this could be the best place.

Members often get exclusive content or behind-the-scenes perks, helping to deepen loyalty over time.

Success story: SaaS sales pro Rob Jeppsen uses Patreon to share leadership insights and interview top industry voices. His “Elite Sales Leader Membership” offers exclusive content for $12 per month.

How you’ll know if crowdfunding is right for your small business

Crowdfunding has changed many entrepreneurs’ lives, but it doesn’t work for everyone.

Knowing when to choose this route over traditional lenders and small-business loans helps you make a confident, sustainable decision when launching or developing your company.

Here are three vital boxes to tick before using crowdfunding as a small business:

Crowdfunding criteria | Why it matters |

1. You have a compelling story or mission | Successful campaigns need a reason for people to care. Explain clearly why your business exists and what makes it different, and crowdfunding should help turn your story into profitable support. Example: Pleasant State is a female-owned cleaning brand on a mission to eliminate single-use plastics. It raised around $57,500 from over 1,500 backers. |

2. There’s a real need for your product or service | Crowdfunding works best when offering something new and exciting to solve a real problem. You must be able to show the value of your product, service or cause before it’s even available, ideally with strong visuals. Example: Boxabl raised over $140 million from 40,000+ investors to create affordable prefabricated homes, having seen a gap in the real estate market. |

3. You’re ready to promote and manage the campaign | Crowdfunding can be hard. Building an audience, sharing updates and handling setbacks takes time and effort before you even make money. Increase your chances of success by treating the campaign like a mini marketing project. Example: Glowforge broke crowdfunding records by building an audience early, offering polished demos and sharing regular updates to keep momentum. |

Hitting all three criteria means you’re almost ready to launch, but attracting interest is only half the battle. The real value lies in capturing and nurturing that interest after your campaign.

That’s where a customer relationship management (CRM) system can make a difference. Having one set up before you launch makes it easier to store every contact, whether pledged or simply expressed interest, and turn those connections into long-term supporters.

Instead of letting those connections fade, a CRM helps you:

Tag and segment supporters based on their engagement level

Schedule follow-ups and reward delivery reminders

Share updates about product launches or new offers.

For example, with Data enrichment in Pipedrive, you can automatically add company info and social media profiles to email signups, giving you richer context for future outreach.

If someone registered for updates on the campaign but didn’t contribute, retarget them with a more tangible offer when your product launches.

Likewise, you can use an email marketing campaign to provide plenty of social proof and answer frequently asked questions (FAQs).

How to run an SMB crowdfunding campaign: step-by-step (with a free checklist)

The best crowdfunding for a small business always involves strategy, timing and consistent effort.

Here’s how to apply each aspect, from early planning to post-launch success.

Phase 1: Campaign planning (8-12 weeks before launch)

Start with your story, your offer and your goals. Explain why your product matters and outline the rewards backers will receive. This basic information forms the foundation of any good pitch.

For example, the Cargado team makes their product and perks clear in this Indiegogo pitch for a commercial powerbank rental system, so backers know precisely what they’re paying for:

Then, choose a platform that matches your business model and target audience. Use this guide to compare the top options, factoring in the types of companies they’ve helped to succeed, repayment processes and platform fees.

Set a realistic funding target, plan your campaign page, and gather content. You’ll need images, videos and testimonials to persuade people to back a product they can’t yet hold.

Now, collect email addresses from interested users and tag them in your CRM to track engagement. Good preparation gives your campaign credibility and momentum from day one.

Phase 2: Pre-launch (4-6 weeks before launch)

This phase is all about building anticipation. Share teasers on social media, send preview emails to your list and offer early-bird rewards.

If you’re an established brand launching a new product or raising general investment, collect reviews from existing customers that you can add to marketing content. Studies show that 75.5% of consumers trust feedback from other users.

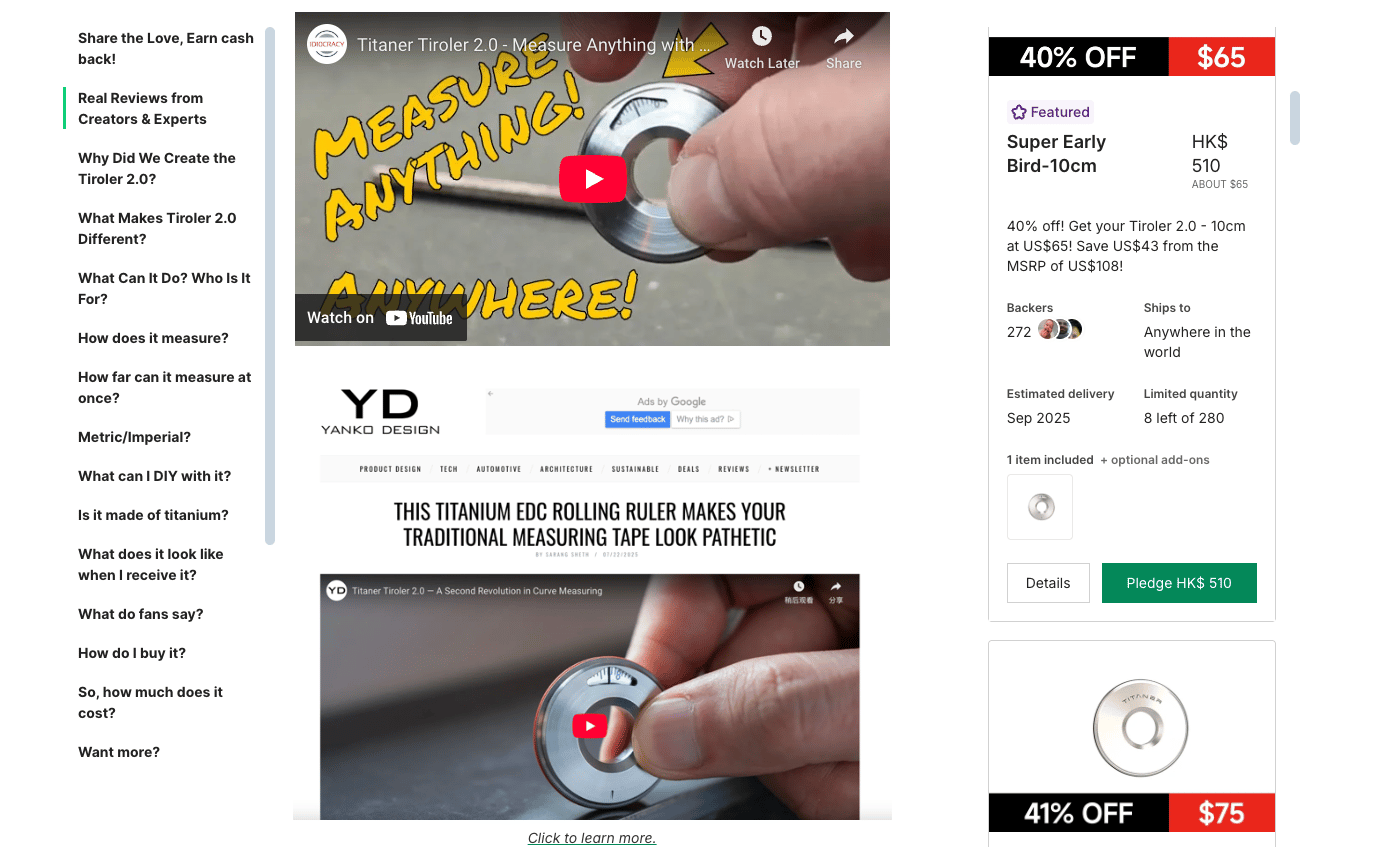

For example, Titaner included expert reviews in a highly successful Kickstarter pitch for its measuring tool:

You could also reach out to influencers or partners who could help promote your campaign – a professional contact with a big social following, for example.

Lastly, finalize logistic details like how you’ll fulfill reward promises and respond to queries while the campaign runs. If you won’t handle it yourself, choose or check who will provide customers with public updates.

Phase 3: Launch and management (the big day and beyond)

On launch day, activate your whole email list and social channels. Campaigns that build early momentum tend to outperform others, so post updates regularly, respond to questions quickly and use your CRM to follow up with warm leads.

Here’s the home improvement brand Lick promoting a new funding round to its email list:

This opening image is clear and bold. The rest of the message tells the story of Lick’s growth, making a compelling case for potential investors.

Track performance closely in your chosen platform (most make this easy via notifications and progress bars). If something’s helping you generate interest and conversions, double down. If not, tweak your messaging or even reconsider your rewards.

Most importantly, keep your momentum going. Consistent energy and visibility will set you apart from many crowdfunders who fade once they realize how much work is involved.

Download your free crowdfunding campaign calendar and checklist

Final thoughts

Crowdfunding is as much a marketing tool and community builder as it is a way to raise capital.

A well-run campaign helps you test demand, grow an early audience and tell potential customers your brand story. It’s also an opportunity to create advocates who believe in your goal and want to help achieve it.

There are no guarantees, but if you plan carefully, communicate consistently and use the right tools, you’ll give yourself the best shot at building lasting momentum for your small business.