Effective inventory management saves your business money, improves cash flow and reduces waste.

Monitoring inventory to sales metrics allows you to avoid stockouts, reduce storage costs and order the right amount of inventory.

In this article, you’ll learn what inventory-to-sales metrics are and how they can help you make better decisions. You’ll also discover how to manage inventory with Pipedrive’s CRM.

Key takeaways for inventory-to-sales ratio

Inventory-to-sales ratios are financial metrics that measure how effectively you manage inventory to help you stock products more efficiently.

Calculate three different values to analyze how much stock you have and its value over time.

Monitoring these metrics lets you track your company’s financial health.

Manage your inventory-to-sales ratio with the support of the Pipedrive software and seamlessly integrate your existing tool stack. Try Pipedrive free for 14 days to see how it helps.

What are inventory-to-sales metrics and why are they important?

Inventory to sales ratios show how effectively you manage your inventory to meet customer needs.

They help you spot sales trends, forecast demand and determine whether you stock the right amounts.

In the following sections, you’ll learn about the three main inventory to sales metrics, how to calculate them and how they can guide you in stocking more efficiently.

These metrics give you a clearer view of inventory operations planning, helping you boost sales, improve customer satisfaction and respond better to market fluctuations.

1. Inventory turnover ratio

The inventory turnover ratio measures how often you sell and replace the average stock value over a specific period.

It compares your sales (using the cost of goods sold) with the average amount spent on inventory.

This ratio helps you check if stock levels match the speed at which you sell stock (sales velocity).

It shows whether you carry enough products to meet customer demand without overstocking or understocking.

A high turnover ratio means you’re selling products quickly and maintaining healthy stock levels.

A low ratio indicates slower sales, meaning unsold stock is tying up your cash.

It could also suggest that your teams are failing to hit their sales quotas or meet key performance indicators (KPIs).

The longer your inventory remains unsold, the higher its risk of spoilage or becoming outdated.

Here’s how to work out your inventory turnover ratio:

Inventory turnover ratio = cost of goods sold / average inventory value

The cost of goods sold (COGS) is the cost of producing or acquiring the products you sell in a given period, including expenses like materials, labor and utilities.

To find your average inventory value, add the inventory value at the beginning and end of the same period, then divide by two.

Let’s work through an example.

Imagine a B2B construction wholesale company that supplies contractors with building materials, safety gear and related items.

Its annual COGS is $200,000 and its average inventory value is $50,000.

The company’s inventory turnover ratio would be $200,000 divided by $50,000 = 4, which means it sold goods costing four times its average inventory value over the year.

Track this ratio to judge how much stock to buy from distributors and when to purchase.

If your inventory turnover ratio drops, consider running a sale to clear excess stock, reducing the size of future orders or both.

If the ratio increases, you may need to reorder sooner, order more or both.

Note: Run a flash sale to turn unsold stock into cash. Offer deep discounts as cross-sells or upsells to current customers or promote the sale to attract new buyers. To increase sales opportunities, time these promotions to coincide with shopping events like Black Friday, Cyber Monday or holiday seasons like Christmas and Halloween.

2. Days sales in inventory ratio

The days sales in inventory (DSI) ratio shows how many days your current stock can last based on average daily sales if you did not buy new inventory.

While the inventory turnover ratio measures how often you sell and replace inventory, DSI focuses on how long the current inventory will last based on your current sales rate.

You may also refer to DSI as inventory days sales, days sales inventory or daily sales inventory formula.

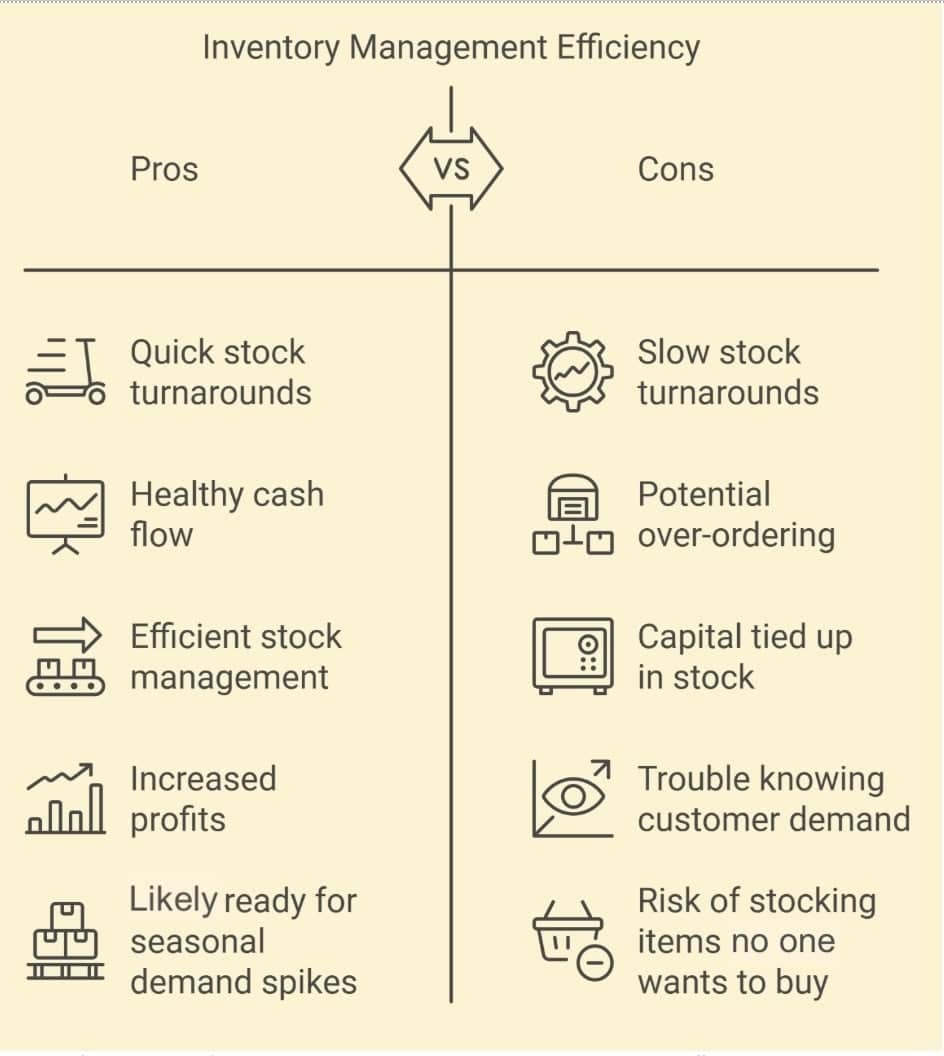

A low DSI means you’re selling inventory quickly and managing stock efficiently, which helps improve cash flow and increase profitability by minimizing the costs of holding stock.

It also means your business can respond better to seasonal demand spikes since you have the cash and storage space to restock quickly.

A high DSI might suggest sluggish sales or excess inventory tying up cash.

It could also indicate that you’re struggling to predict customer demand, leaving you with items that are hard to sell and take longer to convert into cash for restocking.

Here’s how to calculate your DSI ratio:

DSI = (average inventory value / cost of goods sold) × 365

Suppose the B2B construction wholesaler’s average inventory is $50,000 and COGS is $200,000.

The DSI would be ($50,000 divided by $200,000) multiplied by 365 = 91 days, meaning it takes approximately 91 days to sell through its average inventory.

Track DSI alongside cash flow and seasonal trends to ensure you’re financially healthy and have enough stock to meet demand.

A high DSI is fine when stocking up for a busy season. If it stays high, calculate the DSI for each product category to identify slower-moving products and fine-tune future purchasing decisions.

Note: Inventory turnover and DSI ratios differ significantly from sector to sector. According to recent Ready Ratios figures, DSI in manufacturing is 177 days, possibly because of longer production times and bulk sales orders. Compare thatis to a ratio of 9 for food and drink establishments – likely due to high demand and perishable products.

3. Inventory-to-sales ratio

The inventory-to-sales ratio (I/S ratio) shows how much stock you hold compared to total sales over a set period.

It’s a simple way to check if the money you spend on stock matches how quickly you sell products.

You need enough stock to meet demand, but not so much that it stays on the shelves too long.

The I/S ratio helps you strike the right balance by showing how stock levels compare to sales performance.

High stock levels with low sales volumes indicate overstocking, which leads to higher holding costs and tied-up cash.

Low stock levels with high demand suggest you’re missing out on sales opportunities.

Here’s the formula to work out your I/S ratio:

I/S ratio = average inventory value / net sales

To find the average inventory value, add the beginning inventory value to the ending inventory value over a given period, then divide by two.

Net sales are your total sales revenue minus returns, allowances and discounts.

Say the B2B construction wholesaler’s average inventory value is $50,000 and net sales are $200,000.

Its I/S ratio would be $50,000 divided by $200,000 = 0.25, indicating $0.25 in stock for every $1 in sales.

Track this ratio regularly to spot trends in your inventory management.

If the inventory-to-sales ratio increases, look for ways to boost sales, reduce stock levels or both.

If the inventory-to-sales ratio decreases, ensure you have enough inventory to meet customer demand and order more.

Other important inventory to sales metrics

Getting inventory management right means tracking more than your balance sheet’s turnover and DSI rates.

Here’s a rundown of other essential metrics, what they measure, why they’re important and how to calculate them:

Metric and insight | How to calculate |

Deadstock / spoilage Unsold stock that’s unlikely to sell, including expired or obsolete items | (unsellable stock / total available stock) × 100 |

Inventory shrinkage The difference between recorded inventory and physical stock that’s the result of theft, breakage, fraud or loss | end-of-period inventory value − inventory physically counted |

Available inventory accuracy How well your stock records match the inventory you physically have available | (counted items matching inventory records / total counted items) × 100 |

Gross margin percent The portion of the selling price that’s gross profit | [(total revenue − cost of goods sold) / total revenue] × 100 |

Inventory carrying cost The percentage of inventory value you spend on storage and maintenance (e.g., warehousing, insurance, rent and labor) | [(inventory service costs + inventory risk costs + capital costs + storage costs) / value of total inventory] × 100 |

Lead time The time it takes for customers to receive an order from the moment it’s placed | order processing time + delivery lead time + production lead time |

Order cycle time The average time to fulfill a customer order internally (e.g., get it to a courier) | (when the customer received the order − time the customer placed the order) / number of total shipped orders |

Stockouts The percentage of time products are unavailable when customers place orders | (number of days out of stock / 365) × 100 |

Fill rate The percentage of orders or items you fulfill from available stock | [(total items − shipped items) / total items] × 100 |

Monitoring metrics like gross margin provides valuable insights into your financial health.

Shrinkage, accuracy and deadstock reflect your operational efficiency.

Lead times, fill rates and stockouts directly impact how happy customers are with your service.

To improve your bottom line, focus on the metrics that address your most pressing challenges – like high inventory holding costs, slow sales or regular stockouts.

For example, if holding costs are high, adjust the quantity of stock you buy to match actual sales demand.

Once you’ve resolved each issue, expand your focus to other areas.

Compare results with industry benchmarks to pinpoint opportunities for better performance.

Your inventory turnover ratio might be four when the industry average is six, so look for ways to optimize stocking levels and improve sales velocity.

Note: Tracking and improving sales metrics like sales velocity and conversion rates can help you manage inventory more efficiently. These metrics show which products sell fast, so you can adjust stocking levels to match demand. They also signal to marketing and sales teams which items are in high demand, helping them hit targets.

How to use the Pipedrive software to support inventory-to-sales ratio management

A customer relationship management (CRM) solution like Pipedrive can handle inventory management for small to medium-sized businesses (SMBs) without specialized or costly software.

The added benefit is that you don’t need to onboard teams to a new tool or pay for an extra system.

Here are four ways the Pipedrive software can support inventory to sales management:

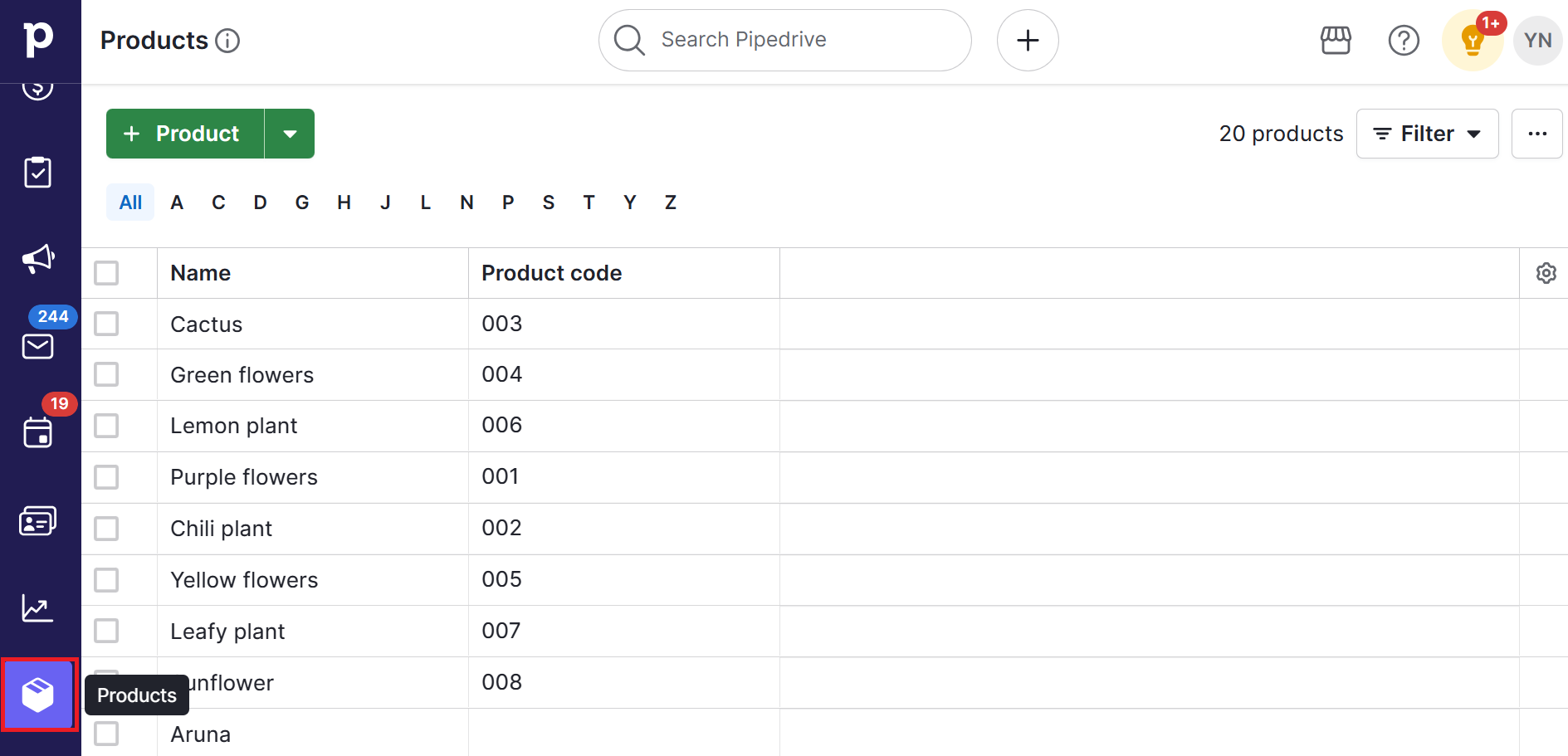

1. Leverage the Products feature’s capabilities

Pipedrive’s Products feature lets you create and manage a detailed product and service catalog.

It’s handy for SMBs with made-to-order items or multiple pricing options.

To enable the Products feature, go to Tools and apps > Products from the Pipedrive menu.

The dashboard also lets you set default tax preferences.

The Products tool allows you to:

Add product details, including names, prices, codes and tax info

Support multiple currencies and price points for the same product

Include tax percentages, discounts and promotions

Import existing product data from spreadsheets

Link products to deals for better sales tracking

Products can simplify inventory tracking by integrating Pipedrive with Google Sheets through Zapier.

Zapier connects Pipedrive and third-party apps like Google Sheets or Microsoft 365 using Zaps – automated workflows triggered by specific events.

This integration eliminates the need to enter the same data into different systems.

Product and sales data sync in real time on a Google Sheet or Excel spreadsheet.

Track stock levels and get the data to calculate sales inventory metrics.

This type of integration is ideal for smaller businesses, providing a flexible way to track inventory with Pipedrive.

Pipedrive’s Products feature lets you track potential sales, predict future stock needs and streamline the entire sales cycle.

2. Connect to your Shopify store

Connect Pipedrive to your Shopify online store with the Shopify app integration to simplify inventory management and sales tracking.

This integration syncs e-commerce data with your CRM system, making monitoring stock levels and analyzing sales performance easier.

Here’s how it helps:

Real-time inventory tracking. Get alerts about low inventory across all sales channels. You’ll avoid stockouts and maintain a balanced inventory turnover rate.

Sales data consolidation. View all your sales data in one place, making it easier to calculate key metrics like inventory-to-sales ratio and gross margin percentage. Track product performance across different channels and locations.

Customer insights. Use purchase history and preference data to better forecast demand and adjust stock levels, optimizing inventory investment and improving fill rates.

Automated reporting. Generate reports in Shopify to track inventory metrics over time. Monitor sales velocity and stock levels to make smarter purchasing decisions.

Integrating Shopify with Pipedrive lets you update the sales team with real-time inventory information.

Note: The Pipedrive-Shopify integration is particularly valuable for small- to medium-sized retail businesses that want to optimize inventory across offline and online sales channels.

3. Integrate your existing inventory management software with Pipedrive

Connect Pipedrive to Cin7 Core Inventory, SOS Inventory and inFlow Inventory using pre-built integrations from Zapier.

Linking Pipedrive to these specialist inventory management tools lets you align your data with pipelines to improve sales inventory and operations planning.

Pre-built Zaps allow you to:

Update inventory levels. When one of your salespeople closes a deal, inventory stock levels update immediately to prevent overselling and reduce the risk of stockouts.

Complete orders. Once you fulfill an order in the inventory system, Pipedrive updates the client record. The automation keeps your sales and support teams in sync, making follow-ups easier and improving customer service.

Share customers. Update customer information using Pipedrive or your small business inventory sales management software. The changes will sync automatically, avoiding duplication and minimizing errors.

Share new products. When you add a product in Pipedrive or Cin7 Core Inventory, it syncs across both platforms. Your sales team gets accurate and consistent information on pricing, availability and product details.

Note: To keep accurate financial performance data, log business records like revenue, costs and expenses on an income statement.

The seamless data flow between Pipedrive and your inventory system provides real-time insights into key metrics like inventory turnover, stock levels and sales performance.

These integrations help you make smarter decisions about restocking, pricing and sales strategies.

Connecting Pipedrive to inventory management tools helps you save time, reduce manual errors and stay agile when responding to changes in demand.

Your company can then boost sales performance and customer satisfaction.

4. Add the MRPeasy integration

If you already use a tool like MRPeasy, integrate it with Pipedrive to create a more efficient workflow that links your sales and manufacturing processes.

The integration is ideal for small and medium-sized businesses looking to automate their order-to-production process.

When a deal in Pipedrive reaches a particular stage, it converts into a customer order in MRPeasy.

The process allows your sales team to focus on closing deals while MRPeasy manages production, inventory, purchasing and order fulfillment.

Here’s how the Pipedrive-MRPeasy connection helps:

Automatic updates. As orders move through MRPeasy (e.g., when ready for shipment or shipped), linked deals in Pipedrive update automatically. Add notes to keep your sales team updated in real time.

Customer and product sync. Sync customer data and product information, keeping your data accurate and consistent.

Customizable workflow. Set actions in Pipedrive that automatically trigger actions in MRPeasy, so workflows fit your needs.

The MRPeasy integration bridges the gap between sales and production, streamlining operations and improving efficiency.

Real-time updates provide visibility at every stage, from production status and inventory levels to order progress and shipping.

As a result, your team has the latest information to manage customer inquiries quickly and accurately.

Download your guide to managing teams and scaling sales

Final thoughts

Tracking inventory to sales metrics helps you make smarter stock-buying decisions.

Having the right inventory on hand for your customers reduces waste and frees up cash for other business needs. You then get greater liquidity to invest in growth.

Your CRM’s native features and third-party integrations can handle inventory management needs like tracking and operational workflows.

Ready to maximize your inventory management? Sign up for a free 14-day Pipedrive trial to stay on top of your stock and sales.