Gaining strong customer insights doesn’t have to be complex. The RFM model provides SMB marketers with a simple, data-driven way to segment their customer base and find the best growth opportunities.

In this guide, you’ll learn how RFM analysis works, see practical examples of how businesses apply it to marketing strategies and discover ways to act on these insights.

Key takeaways for RFM

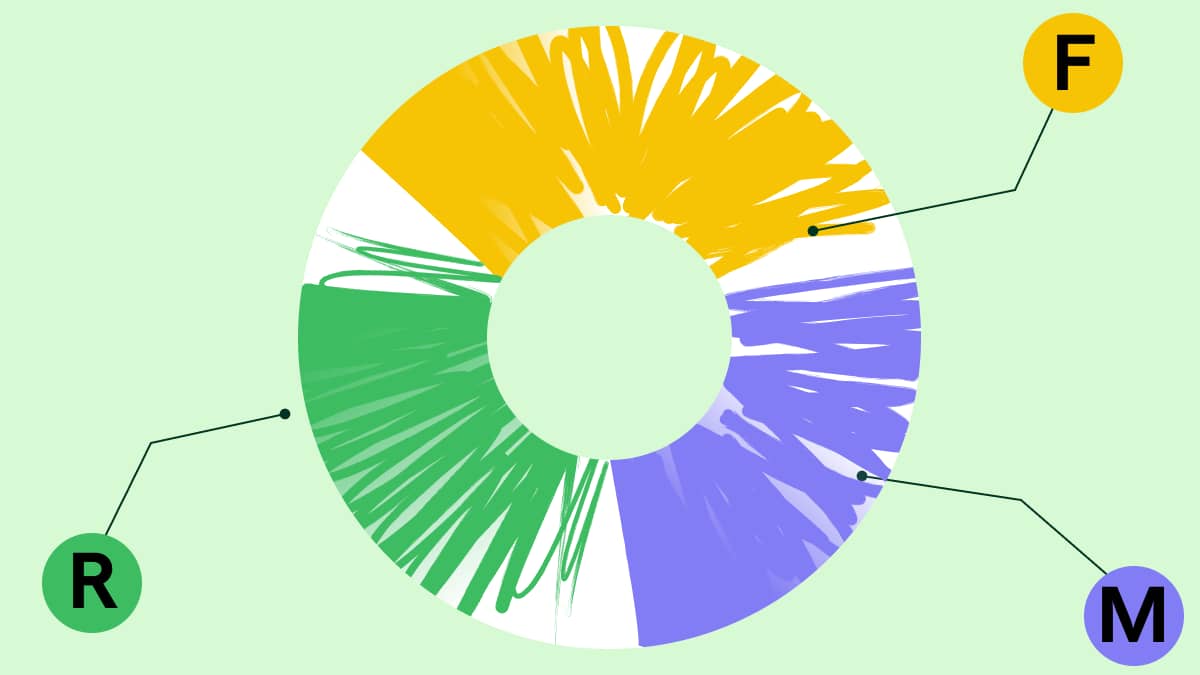

RFM stands for recency, frequency and monetary value and offers a simple way to segment customers by purchasing behavior.

RFM analysis helps SMBs identify their best customers, spot at-risk accounts and improve loyalty through data-driven marketing.

By transforming raw transaction data into actionable insights, RFM enables SMBs to personalize marketing, boost profitability and optimize resources.

Use Pipedrive to track customer insights and run targeted campaigns for your customer segments – try it free for 14 days.

What is RFM analysis?

The RFM model, which measures recency, frequency and monetary value, is a tool for segmenting customers to identify top buyers, understand purchasing behavior and guide marketing strategies.

RFM analysis is a simple way for businesses to evaluate customer behavior based on the following factors:

Recency. How recently the customer made their last purchase.

Frequency. How often they buy from your business in a given period.

Monetary value. How much the customer spends.

By scoring customers on these three factors, small businesses can quickly identify their most valuable customers and pinpoint areas for improvement in loyalty.

For small and mid-sized businesses, RFM is especially useful because it helps prioritize limited time and resources.

As a customer segmentation method, RFM identifies which customers are worth nurturing, which are likely to respond to upsell offers and which would benefit from re-engagement activities.

For example, a local coffee subscription service might find that customers who ordered within the last month, purchase regularly and spend more than average are its most valuable group.

As a result, the company could target that group with exclusive offers to boost loyalty.

How RFM analysis works

RFM analysis is a structured method for turning customer data into practical insights.

It begins by scoring recency, frequency and monetary value, then grouping customers into clear segments.

Calculating RFM scores

To calculate an RFM score for individual customers, assign a score for each factor in the model. Many businesses use a 1–5 scale, with 5 representing the strongest performance.

Here’s an example of how a company might score each factor based on its business model:

Factor | Scoring example |

Recency | Customers who bought very recently get high scores:

|

Frequency | Frequent repeat buyers score higher:

|

Monetary value | High-spending customers earn higher scores:

|

A simple formula for an overall RFM score is:

Recency score + Frequency score + Monetary score = RFM score

The higher a customer’s total RFM score, the more likely they are to do business with the company again in the future.

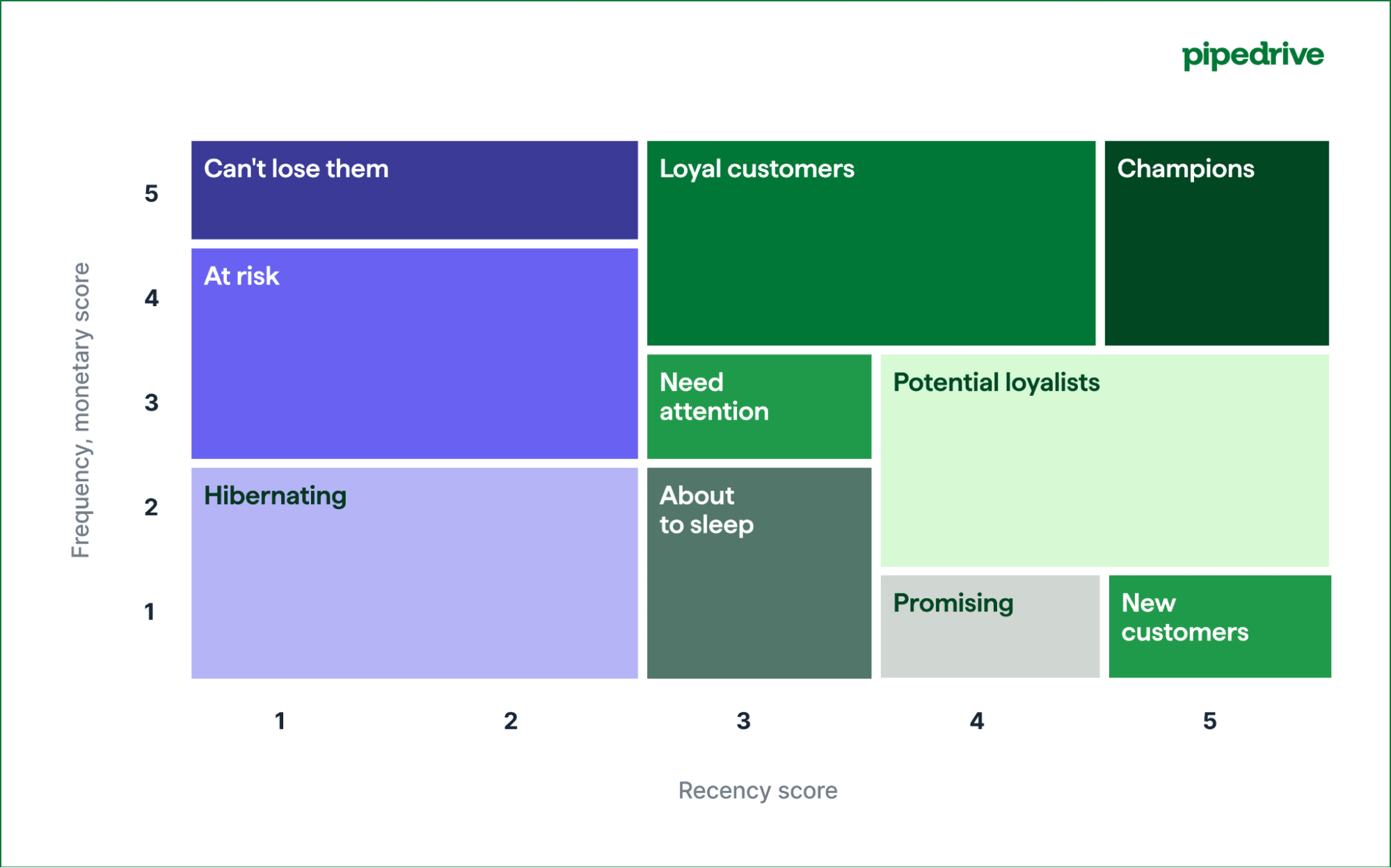

This simple visualization illustrates how a company might approach its customers in light of RFM analysis.

Combining the scores for recency, frequency and monetary value creates a picture of customer engagement that marketers can use to make strategic decisions.

Creating customer segments

Once you have RFM scores for your customers, the next step is to group them into segments. Many businesses categorize their customers as follows:

High-value customers. Top scorers across all three elements of the RFM model. These are loyal, active and profitable buyers who should receive VIP treatment or exclusive offers.

Medium-value customers. Customers with a steady but smaller number of transactions. Discounts or special offers may encourage these customers to buy more and become high-value customers in the future.

At-risk customers. Strong spenders or frequent buyers in the past who have not made a recent purchase. They may respond well to win-back campaigns.

New customers. Recent buyers with low frequency and monetary value. They need to be nurtured to encourage repeat purchases.

Inactive customers. Low recency, low frequency and low monetary value buyers. While some may be lost, selective reactivation offers can still work.

With customers categorized in this way, you can make better-informed decisions about which marketing activities to invest in for each group of customers.

Making RFM metrics actionable

Scoring and segmenting buyers gives you a structured view of your customer base, but it’s important to prepare this data for action. Here are three practical ways to do that:

Spreadsheets and manual methods. Spreadsheets, such as Excel or Google Sheets, work well with a small customer base. You can calculate RFM scores using simple formulas and filter the results by segment to identify your most valuable customers.

Charts and graphs. Visualizing your RFM data can make customer behavior easier to see and understand. For example, a bar chart can show whether your number of high-volume customers is growing or shrinking.

CRM platforms like Pipedrive. For larger customer bases, CRMs enable SMB marketers to scale RFM segmentation without manual work. In Pipedrive, you can automate follow-ups, set reminders for at-risk customers and build targeted campaigns around high-value groups.

Once your RFM data is organized, you can start connecting the insights to your marketing strategies and customer engagement efforts.

Download Your Sales and Marketing Strategy Guide

How to apply RFM insights to SMB marketing

Once you’ve completed the analysis, it’s time to implement the findings around RFM, meaning you apply the insights to your SMB marketing activities. Here’s how.

Designing campaigns for different customer segments

RFM segmentation provides the insight you need to tailor promotions and communication to different customer groups.

Instead of sending the same message to everyone, businesses can adjust their marketing campaigns to match customer needs.

For example, a B2B SaaS company offering analytics software might offer incentives to different customer segments as follows:

Customer segment | Marketing activity |

Best customers | These customers get early access to new products, VIP offers and invitations to loyalty programs. |

Medium-value customers | These customers receive targeted marketing campaigns with bundled pricing to optimize profitability. |

New customers | These customers receive a personalized onboarding sequence that highlights quick wins, accompanied by a discount code for their next purchase. |

SMB marketers can also use RFM insights to improve customer retention and support reactivation activities.

Improving retention and reactivation

When the RFM model flags at-risk or inactive customers, businesses can act in real time to re-engage these users and combat customer churn:

At-risk customers. Personalized marketing, such as tailored email marketing reminders, special offers or feature updates, could win them back.

Inactive customers. Re-engagement emails and targeted marketing campaigns may reactivate some inactive users.

SMBs can use RFM segmentation to create data-driven marketing strategies that optimize customer experience, strengthen customer loyalty and increase long-term profitability.

Download the State of Sales and Marketing Report for 2024/2025

5 best practices for RFM analysis

To get the most value from RFM analysis and avoid common mistakes, marketers in SMBs should follow these five best practices.

1. Keep scoring simple

RFM metrics don’t need to be complicated to be effective.

Many small businesses fall into the trap of over-engineering their scoring system with too many brackets or weighted formulas.

In reality, a basic scale of 1–5 for recency, frequency and monetary value is usually enough to identify the most critical segments:

Loyal customers

At-risk customers

Inactive groups

The key is to choose thresholds that make sense for your customer base. For e-commerce businesses, frequency might be measured in terms of purchases per month, while a B2B software firm might measure it in terms of renewals or feature usage.

2. Pay attention to smaller segments

Although it can be tempting to focus on the top customers or the largest groups in your database, RFM segmentation may reveal smaller groups with significant potential.

For example, a group of recent, new customers could become repeat customers if they receive targeted marketing campaigns early in their journey.

A large segment that’s shrinking could indicate risk. Fewer loyal customers may be an early sign of declining customer engagement or a poor product fit.

By noticing these signals, you can optimize marketing efforts and protect customer lifetime value (CLV).

3. Consider wider context when interpreting scores

RFM scores are only as useful as the context you give them.

To interpret the data effectively, you need to benchmark the scores against your own customer base rather than industry averages.

For instance, for a SaaS platform where the average client logs in less than once per week, high frequency might mean four or more logins per month. However, an e-commerce store with repeat customers who buy weekly would set a much higher bar for this figure.

It’s also important to consider complementary marketing metrics when reviewing RFM scores.

Combining behavioral segmentation with other data, such as customer demographics or engagement survey results, can help uncover why users behave the way they do.

This data-driven approach ensures your marketing strategies target the right groups with the right messages at the right time.

Download our customer journey map template

4. Prioritize privacy and ethical considerations

RFM segmentation relies on data about customer transactions and purchasing behavior.

Businesses must handle this information responsibly to comply with GDPR and other relevant privacy regulations.

Best practices in this area include:

Only collecting the data you need for relevant marketing campaigns (e.g., a B2B e-commerce retailer might use RFM metrics to identify at-risk customers and send them a reminder email about items left in a cart)

Being transparent about how customer data is used

Avoiding over-personalization that could feel invasive (e.g., referencing a customer’s purchasing history in detail)

Ensuring real-time data storage and processing are secure

These best practices aren’t just about compliance. Handling data responsibility also helps build customer satisfaction and brand trust.

5. Update RFM calculations regularly

Because customer behavior changes over time, marketers should regularly update their RFM calculations to ensure they continue to work with up-to-date and helpful insights.

There’s no single best-practice timeframe for updating RFM scores. However, e-commerce businesses may need to do so monthly to keep pace with purchasing cycles.

B2B SaaS companies, on the other hand, may only need quarterly updates, since subscription renewals and feature usage follow longer timelines

Updating your RFM score regularly allows you to identify shifts in customer engagement, such as loyal customers becoming inactive or new customers moving into the high-value segment.

How Pipedrive brings RFM insights to life

Pipedrive makes it easier for small businesses to conduct RFM analysis and put the insights into practice.

Instead of managing spreadsheets manually, SMB marketers can track high-value customers and set automated follow-up tasks to maintain customer engagement.

With Pipedrive, you can create targeted marketing campaigns for customer segments identified through RFM analysis.

Pipedrive in action: Marketing agency NJ Media has used Pipedrive to identify a new niche market with high returns – and win seven new clients within it. Using Pipedrive’s email automation to personalize emails and warm up prospects, the agency has reduced its sales process from 20–40 days to an average of 11 days.

You can also use Pipedrive to automate outreach sequences such as email marketing, renewal reminders or reactivation campaigns.

Pipedrive makes it easy to monitor RFM metrics in real time, with visual dashboards that highlight changes in customer behavior.

Now, let’s examine how a company might conduct RFM analysis and use Pipedrive to act on the insights gained from this exercise.

An example of RFM analysis in action with Pipedrive

Imagine a SaaS company offering accounting and invoicing software.

Following RFM analysis, the CMO sees that clients with both high recency and high monetary value are enterprise accounts due for renewal.

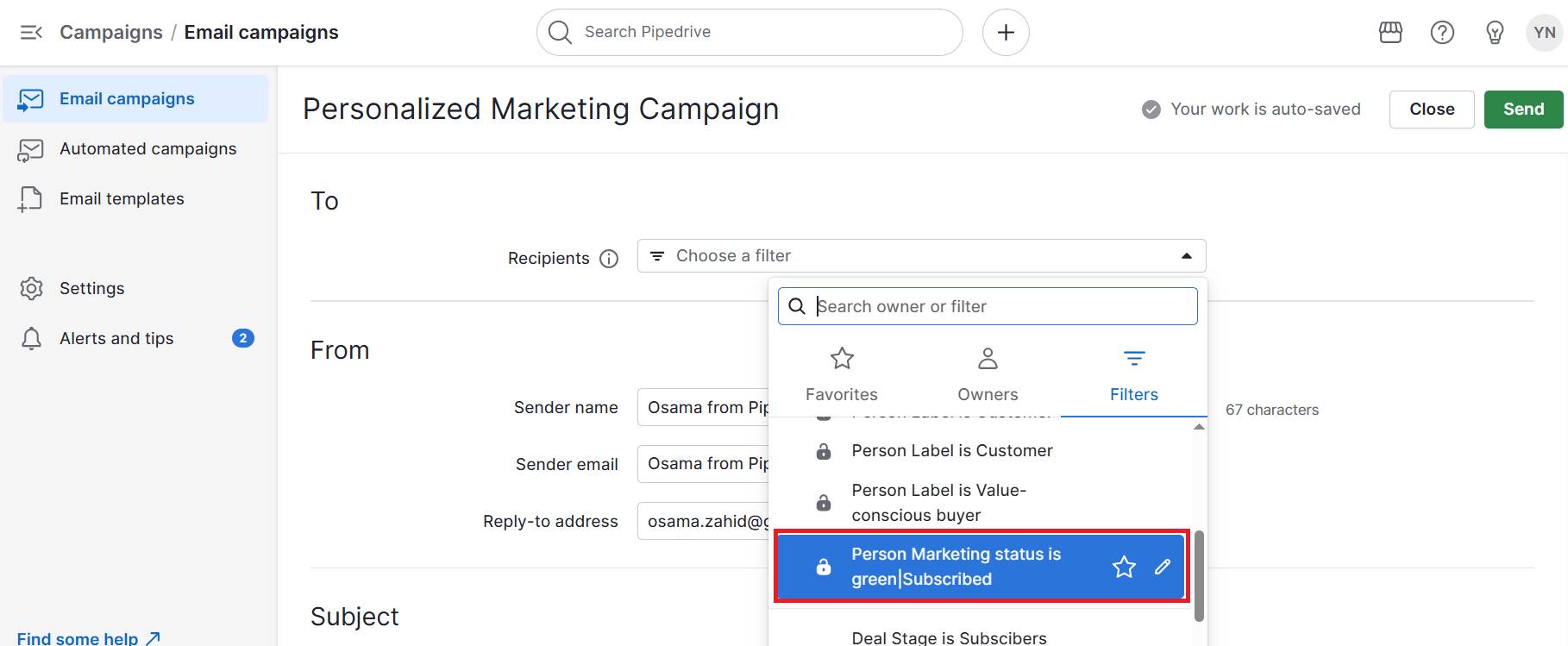

In Pipedrive, the CMO uses Campaigns to create and schedule personalized marketing emails for this customer segment, highlighting premium features.

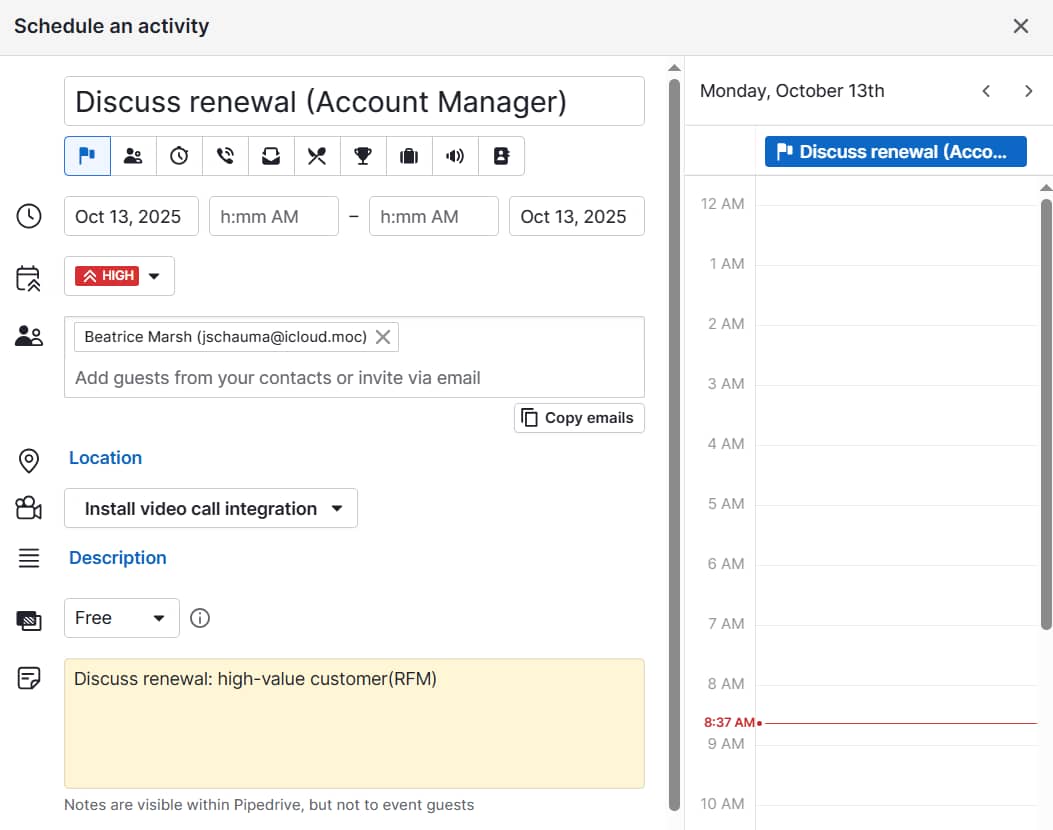

The CMO also uses Pipedrive to set reminders for the account management team to follow up with these customers and discuss their upcoming renewal.

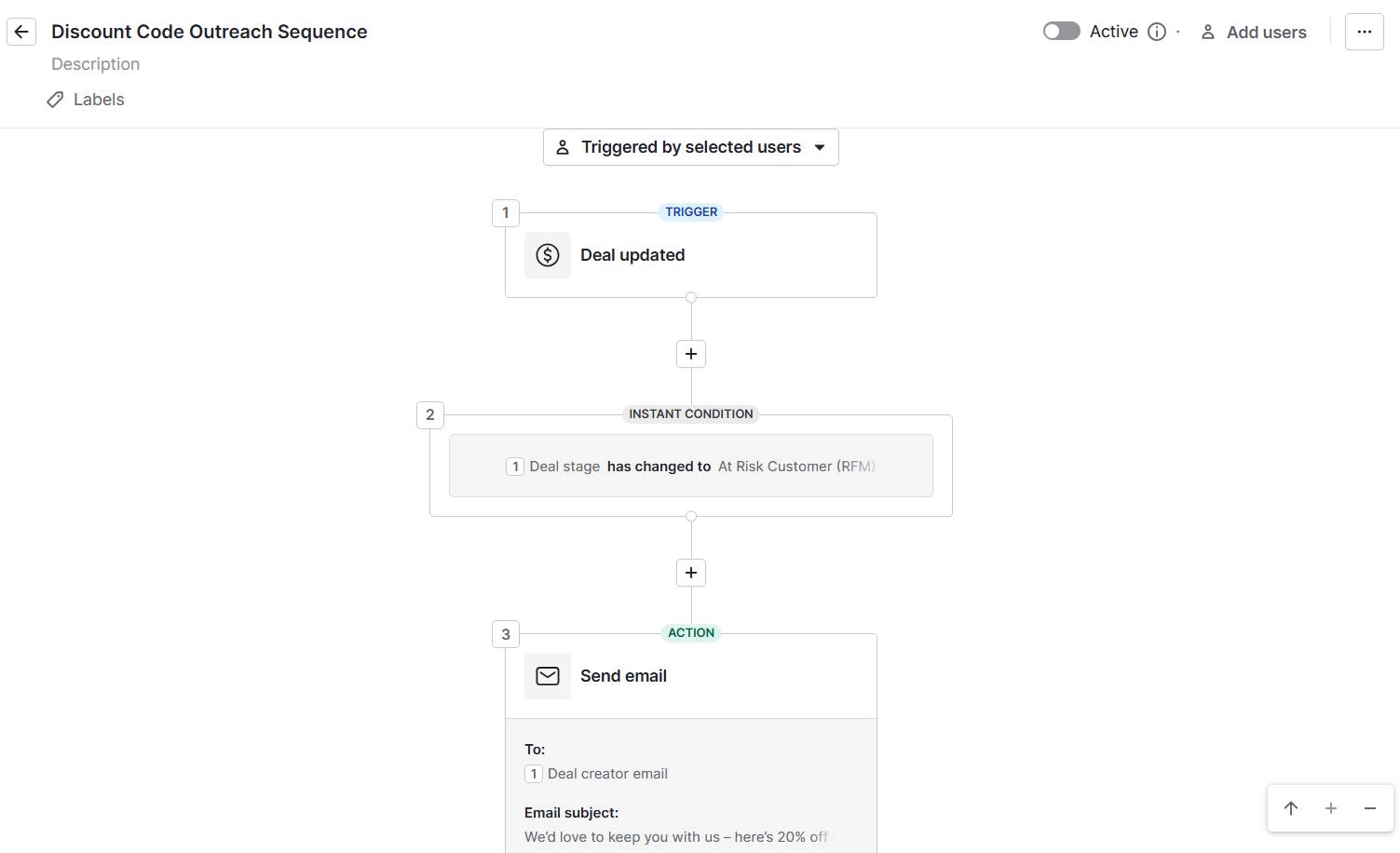

Meanwhile, the CMO flags the company’s at-risk customers for reactivation in Pipedrive. This designation triggers an outreach sequence in the software that includes a customer email with a discount code and a follow-up call task for account managers.

With automated workflows and real-time customer insights, Pipedrive helps SMBs act on RFM analysis to strengthen retention, boost reactivation and drive growth.

Final thoughts

RFM analysis turns raw customer transactions into clear insights that small businesses can use to optimize their marketing efforts, improve customer retention and increase profitability.

With a CRM like Pipedrive, you can automate RFM segmentation, monitor metrics in real-time and ensure that your loyal customers, at-risk accounts and new buyers all receive the right level of attention. Start your free 14-day Pipedrive trial today.