Missed revenue targets, weak marketing strategies, failed product launches – all of these classic disappointments have one common cause: guessing what drives customers instead of knowing.

Business-to-business (B2B) market research tells you what buyers want, enabling you to build stronger sales and marketing strategies and more profitable customer relationships.

This guide shows how small- to mid-sized B2B companies can conduct in-depth market research quickly, simply and with limited resources.

What is B2B market research (and how is it different from B2C)?

B2B market research means gathering and analyzing customer data, industry trends, competitors and market dynamics. It equips sales, marketing, product and customer success teams to make informed decisions that lead to more deals and repeat business.

Thoughtful market research helps you achieve four things:

Understand your audience so you can tailor offers and user experiences

Spot market gaps and emerging trends to launch new products that meet real needs

Track competitors so you can position your brand clearly

Measure demand to plan resources, validate ideas and set realistic sales goals

B2B market research and B2C market research focus on different customer types: buying groups for the former and individuals for the latter. That means they sometimes need different tactics and tools.

For example, B2B purchases usually involve complex sales cycles and more stakeholders, so research focuses on quality over quantity. In-depth interviews are better at capturing those decision-making nuances than large-scale customer surveys.

Interviews and surveys are just two of many market research techniques. Getting valuable insights requires choosing the right ones, and often combining multiple.

What kind of market research should small businesses use?

A well-rounded strategy usually blends different types of research. Start by understanding these two main categories.

Primary research vs. secondary research

One way to group market research is by where the data comes from, whether you collect it yourself (primary) or use what others have already gathered (secondary).

Here’s a more detailed look:

B2B research type | Example techniques |

Primary research is first-hand data collection, straight from your target audience |

|

Secondary research means analyzing data that other people have collected |

|

Secondary research helps shape hypotheses and unearth benchmarks, while primary research validates and enhances those insights.

While it sounds counterintuitive, it’s often more helpful at an SMB level to start with someone else’s research and dig deeper via your own.

For example, let’s say you sell online sales courses.

You learn from Pipedrive’s State of Sales and Marketing Report that only 48% of salespeople in micro companies hit their sales goals in 2024, compared to 57% across all company sizes. That’s secondary research because Pipedrive collected the data.

Then, you follow up by interviewing your sales team and others from your clients’ businesses. You ask detailed questions about goal-setting and confirm whether Pipedrive’s findings apply to your B2B audience. That’s primary research because you collected the data.

If you need more specific ideas for collecting data, here are some low-cost, high-impact research methods that work well for SMBs:

Method | Effort and value |

Customer interviews | Effort: Medium, high value Best for: understanding pain points |

Survey tools | Low effort, medium value Best for: quantitative insights |

Competitor analysis | Medium effort, high value Best for: brand positioning |

Social media polls | Low effort, medium value Best for: quick audience validation |

Social media monitoring | Low effort (with the right tools), medium value Best for: sentiment analysis |

Industry reports | Low effort, high value Best for: understanding market trends |

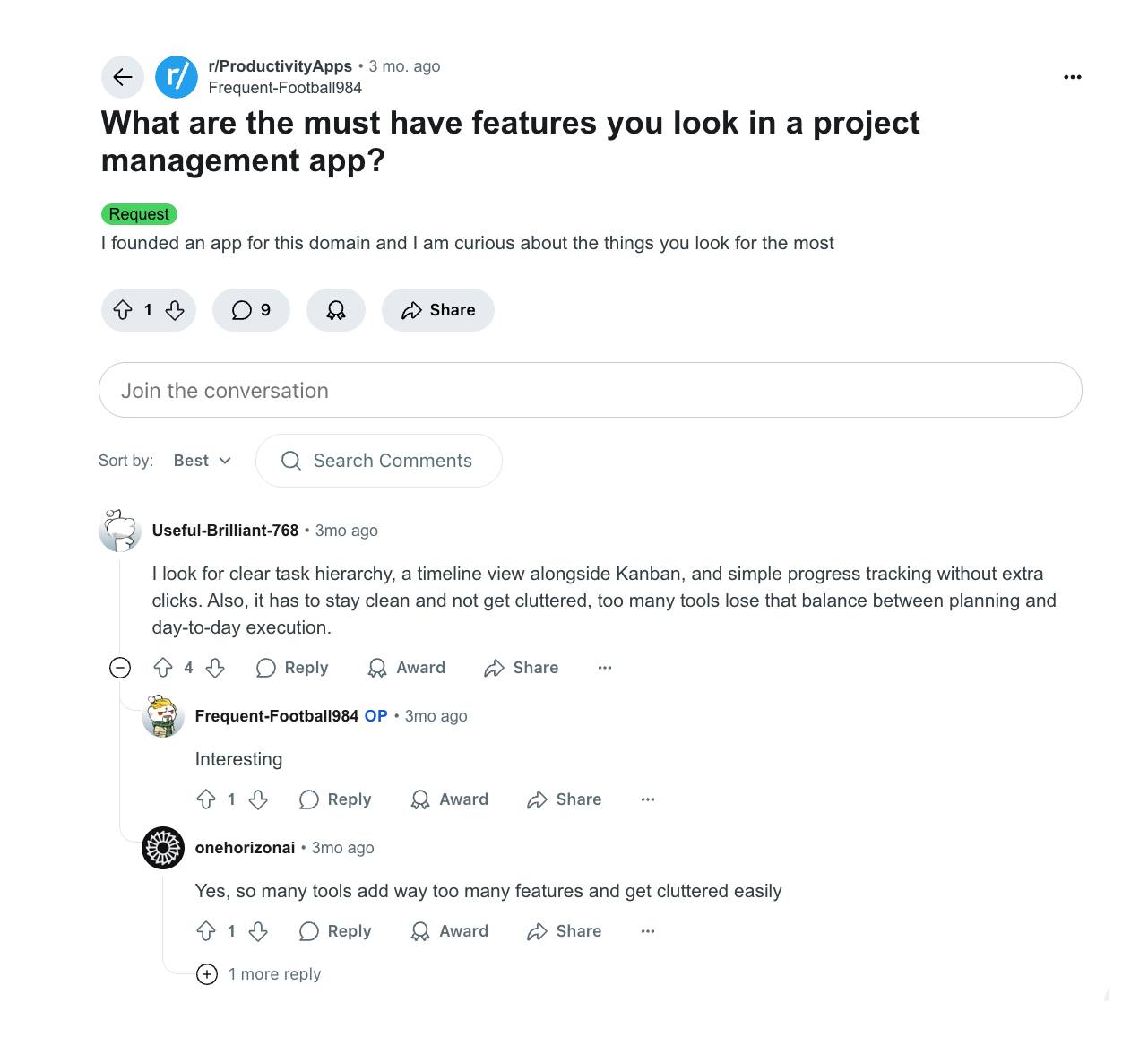

Don’t ignore informal market research sources. Reddit threads, Quora discussions and industry forums have helpful first-hand insights on customer pain points and preferences.

Look for patterns in complaints and feature requests that you can use to improve product marketing. For example, this project management software founder asked Reddit users what they value most in their apps:

People share opinions more openly in these spaces because they feel more natural. They’re not set up for research purposes.

Note: Enlisting a B2B market research agency is an expensive way to learn about your customers, but it may make sense if you need access to hard-to-reach respondents. Start small with informal sources and simple tools if your budget’s tight. You’ll be surprised how much clarity you can get from honest conversations and comments.

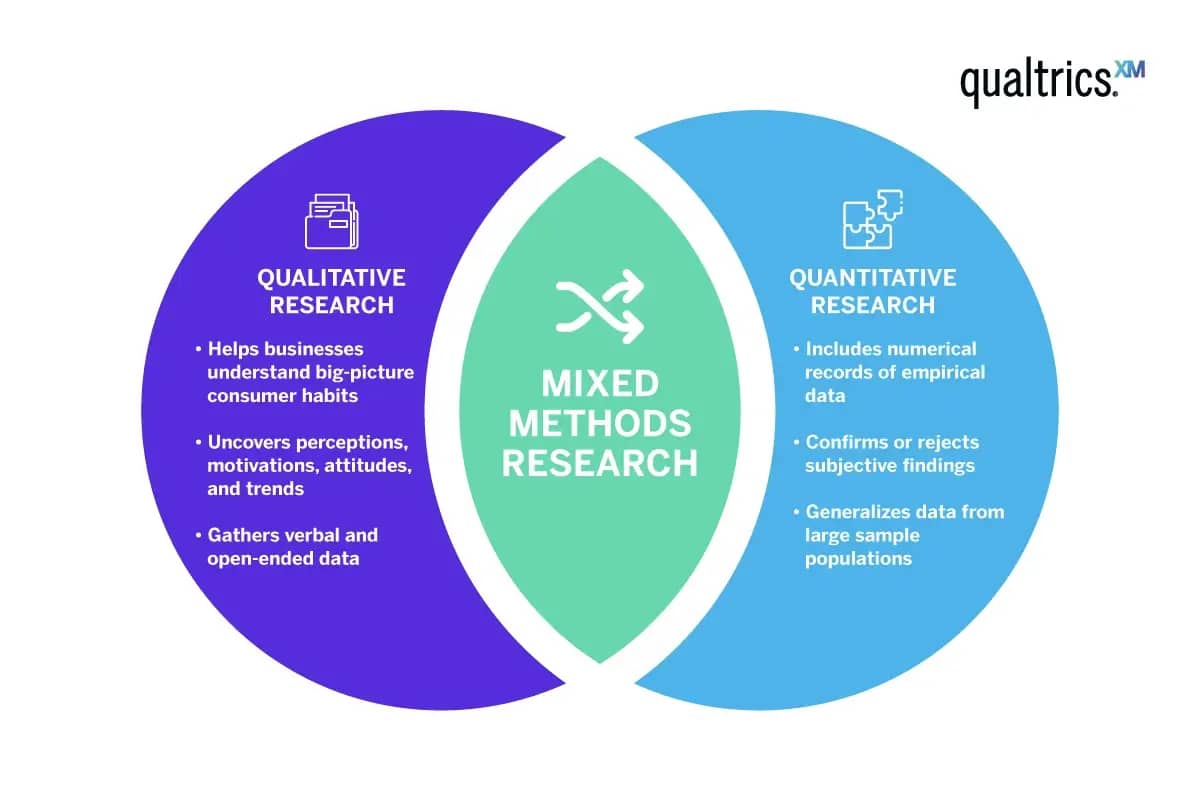

Quantitative research vs. qualitative research

Another way to categorize market research is by the type of data it gives you.

Quantitative research gives you complex numbers you can count, compare and use to spot trends across a broad sample. It’s ideal when you want to measure how common something is or track changes over time.

Qualitative research investigates the “why” behind people’s decisions. It reveals motivations, opinions and pain points that don’t always appear in charts or spreadsheets.

Here’s a breakdown from one of the bigger B2B market research companies, Qualtrics:

For example, an online survey with scaled responses (e.g., 1–10 scores) gives quantitative data for directly comparing and spotting trends.

An online survey with open-ended questions generates qualitative data. People explain their thoughts in more detail, but measuring or comparing them directly is more difficult.

How to do B2B market research: a step-by-step guide

You don’t need endless amounts of time and money to conduct impactful research, just a clear roadmap and the right tools.

Before we get to the tech, here’s how to run a simple B2B market research project and unlock better business decisions fast.

Step 1: Set an overarching research goal

Before collecting data, choose what you want to learn. This’ll shape the questions you ask, the methods you use and the people you contact.

Your goal should lead to market insights that help you create better user experiences, sell more – or both.

The following focused research goals are helpful to most B2B companies:

Validate messaging for our new product feature

Understand why prospects choose competitors over us

Identify the most significant operational challenges in our target market

Test pricing strategies with potential customers

If you want to learn something specific to your target customers or sector, sharpen your focus by making your research goal SMART: specific, measurable, attainable and time-bound.

For example, saying, “We want to learn about B2B buyers’ attitudes to buying new tech” is too vague. It doesn’t help you focus on your audience or choose a helpful methodology and questions.

It’s better to say, “We’ll speak to 10 startup decision-makers in the next 30 days to learn what they prioritize and avoid when choosing new digital marketing software”. These insights will help the sales team focus on essential features to close deals faster.

A strong research goal keeps you focused and ensures the results are helpful.

Step 2: Get even more specific about your target audience

Once you know what you want to learn, you must be clear about who you’ll learn it from.

Start by identifying the decision-makers, influencers or users to engage. Depending on your research goal, this could include:

C-level buyers (e.g., CFOs, CIOs, CMOs)

Department managers (e.g., heads of HR or sales)

End users (e.g., customer support reps or SDRs)

Procurement or IT gatekeepers

You don’t need a massive sample to validate your assumptions, just the right one. For example, if you’re testing pricing sensitivity for a software-as-a-service (SaaS) add-on, product users won’t have the insight you need, but finance or procurement teams will, as they make the buying decisions.

Here’s a simple template you can use to define your B2B audience:

Job title | [e.g., procurement manager] |

Industry or vertical | [e.g., corporate travel] |

Company size (headcount or revenue) | [e.g., 500+ employees] |

Geographic market (if relevant) | [e.g., North America] |

Role in the decision-making process | [e.g., has the final say] |

If you’ve already built buyer personas in your customer relationship management (CRM) or marketing software, now’s the time to use them.

Tools like Pipedrive, LinkedIn Sales Navigator and email segmentation platforms can help you quickly narrow down the right list of contacts to research.

Better understand your customers with our Buyer Persona Templates

Step 3: Choose your B2B market research method

You know the “what” and the “who”. Now figure out the “how”, starting with your research method.

The right choice or combination for your research project depends on a few factors:

What you’re trying to learn

How detailed your insight needs to be

How much time and budget you have

For example, if you need detailed feedback to learn about real buyers’ intricate purchasing habits and aren’t in a rush, one-on-one interviews let you ask complex questions and go on tangents.

Surveys uncover patterns faster if you’re in a rush to measure something’s prevalence (e.g., cart abandonment reasons).

If you’re curious how people talk when no one’s asking questions, just observe. Forums, reviews, social media and even podcasts are all goldmines for honest customer feedback if you target influential decision-makers.

For example, here’s a tech company CEO discussing CRM preferences on LinkedIn:

You can combine methods to build a clearer picture, if time allows.

For instance, you might interview individual buyers about pain points, use surveys to test assumptions on a large sample and browse Reddit and Quora for unfiltered opinions. That way, you’re collecting both qualitative and quantitative data to analyze.

Step 4: Plan and ask the right questions

Thoughtful, well-crafted questions prompt clear, helpful answers. They help you find out how your audience feels, what they care about and how they make decisions.

In short, those questions give you insights you can act on.

You’ll tailor your questions to company-specific goals, but most B2B market research services explore topics like:

Priorities and frustrations in the buyer journey

Decision-making processes

Perceptions of a product, brand, category or competitor

Experiences around specific touchpoints (e.g., checking out, onboarding processes or getting support)

Understanding these topics better is how you’ll create better customer experiences that drive more deals.

As with your goals, be specific and purposeful. Match your question style to the type of data you need.

For qualitative research methods, ask open-ended questions that give respondents space to explain their thinking. For example:

“Do you like our new user interface (UI)?” has only two possible answers, telling you very little

“How would you describe your experience using the interface?” reveals emotions and friction points. It helps you choose practical next steps

For quantitative research methods, avoid binary yes/no questions for quantitative research methods. Scaled responses provide richer detail and make it easier to spot meaningful trends.

For example, “On a scale of 1-10, how easy was our new interface to use?” gives you measurable data while capturing some nuance. You can always add a comments box to get more information.

Step 5: Collect your data and prep for analysis

Treat your data collection process like its own mini-customer journey. The easier and more relevant it is to your users, the more likely they are to “check out” and provide what you need.

Keep questionnaires and surveys short so they don’t waste respondents’ time too much.

SurveyMonkey found that surveys with five questions or fewer have an 85% completion rate, while those with more than 30 questions drop below 20%. That’s a big gap and a great reason to keep things focused.

Personalization is vital for interviews and other more intimate research methods. Tailor questions to individuals or small groups and be clear why you’re asking. Tell people what you’ll do with the information and how their responses will contribute to better experiences for everyone involved.

Once you have responses, your mission is to turn raw feedback into something your team can use. That means looking for patterns and the most relevant quotes.

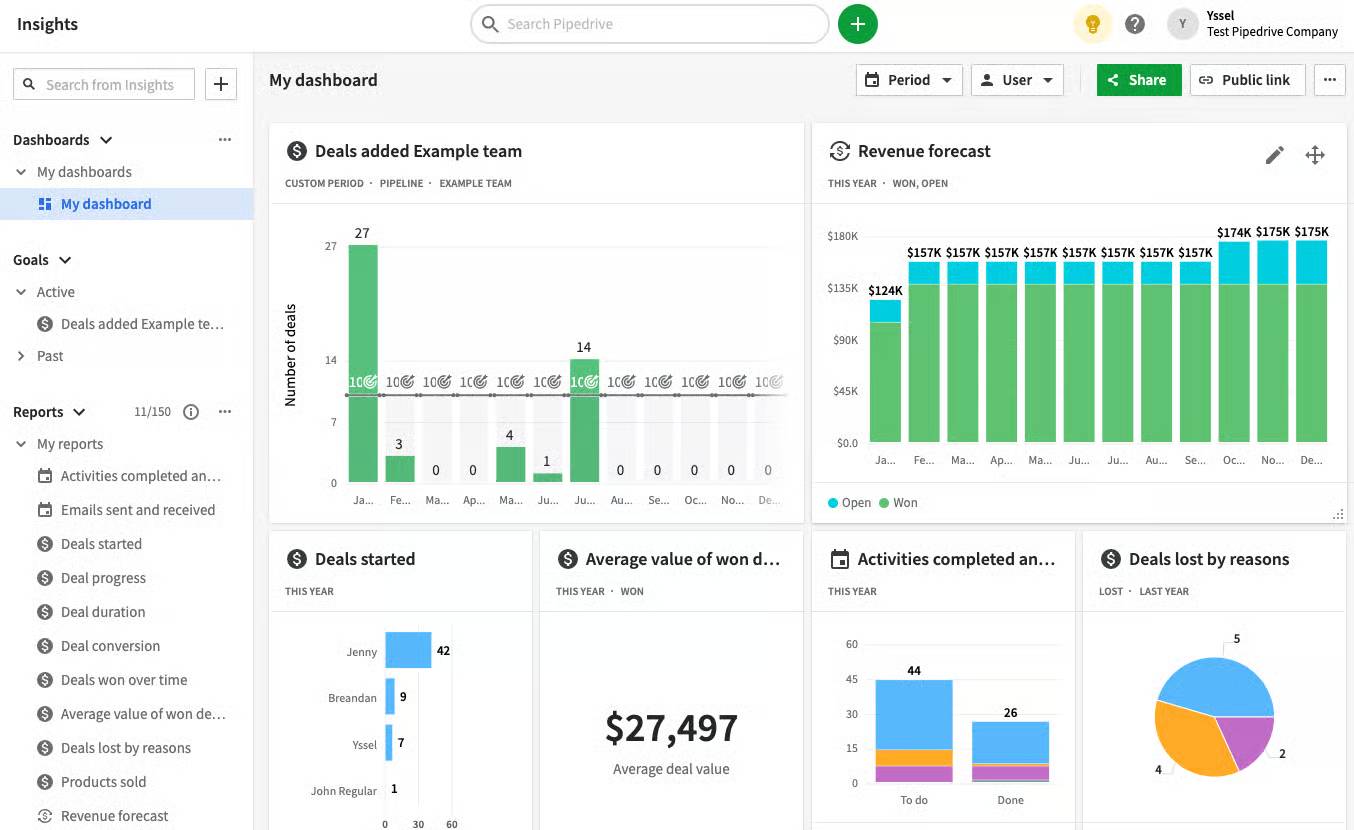

Some B2B market research tools have built-in data analysis features to make this part faster – like Pipedrive does with its insight reports and AI-powered Sales Assistant.

These types of sales insights help you track win rates by industry or average deal duration, which is helpful if you’re researching customer behavior across segments.

Note: Exactly how you collect customer insights depends on many factors, like which tools you have, your budget for new tech, your social media standing and brand authority. This topic needs a guide of its own, so we created one: learn how to capture the voice of the customer.

Where and how to apply your market research findings

Research is only helpful if it leads to action. Once you’ve gathered insights, apply them across your business to improve performance, reduce risk and better serve your B2B audience.

Here are three practical ways to turn research into action, organized by team.

Product team: build what customers want

If every other customer mentions the same friction or feature gap, it’s a signal that you need to address it. The same goes for positive feedback on popular functions.

Feeding both positive and critical insights into your product roadmap helps you focus on essential features.

For example, if customer research reveals that mid-sized healthcare providers struggle with workflow integrations, their product team can prioritize an API update and track results in the CRM to optimize future product development.

Marketing team: clearer messaging, smarter content

Use real customer language to update web pages, social media content and other inbound marketing efforts. If buyers keep mentioning speed or simplicity, for instance, emphasize those aspects when describing products.

You could also build case studies around the same themes to provide compelling social proof.

If interviews show buyers don’t understand how your platform differs from competitors, you can create a go-to-market (GTM) campaign focused on clarity and backed by competitive intelligence from your research process.

Sales team: tighter outreach, stronger pitches

Pass insights on to your business’s front line so salespeople can speak more directly to specific customer needs in cold calls, pitches and sales proposals.

The more reps understand what matters to buyers, the better they can position your offer and the more deals they’ll close.

For instance, if feedback from customer interviews shows decision-makers in large firms care most about forecasting accuracy, reps can adjust their pitch to highlight relevant metrics and use CRM data to tailor follow-ups by market segment.

5 tools to make research easier for lean teams

You don’t need a B2B market research agency to collect valuable insights.

These five tools are lightweight, intuitive and affordable, making them ideal for small B2B teams with limited resources.

Tool | What it excels at |

Segmenting contacts, tracking responses and surfacing key insights during the research process. With strong reporting and dashboard features, it’s also the best option for seeing how market research impacts sales performance. | |

Typeform | Creating clean, mobile-friendly surveys with logic branching and the option to add comments. |

Dovetail | Organizing interview notes and tagging qualitative data to spot patterns faster. |

Google Trends | Tracking keyword interest over time and spotting early shifts in demand or interest (i.e., helpful secondary research to inform your investigations). |

Finding and filtering respondents by role, industry or company size for better filtering. Connect it to your CRM if your research targets existing customers. |

An honorable mention goes to the generative AI tools that help you write research questions and outreach messages.

For example, tell ChatGPT your research goals and target audience to get a list of relevant question ideas. You don’t have to use all its recommendations, but they should spark some ideas to build on.

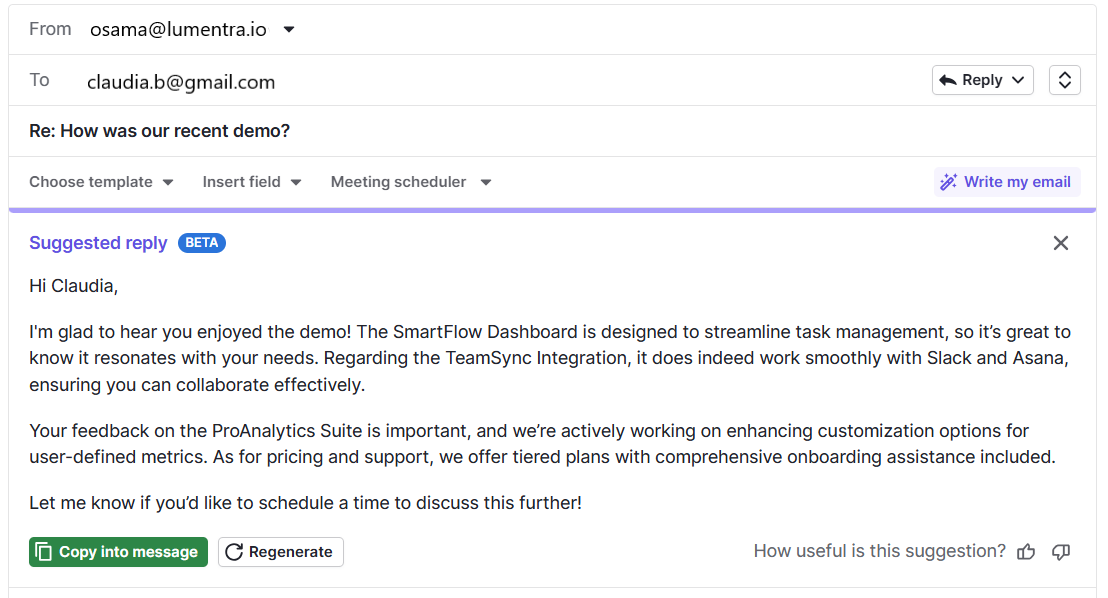

When you’re ready to contact participants, have Pipedrive’s AI Email Writer craft a compelling invite. This feature eliminates writer’s block and improves how you communicate with prospects and customers, increasing your chances of getting a positive response.

Here’s what the interface looks like:

All you need to do to use the AI Email Writer is type a conversational prompt and choose your message’s tone and length. Click “Copy to email”, polish the content to your liking and hit “send”.

Final thoughts

With a clear goal, the right questions and a few lightweight tools, even the smallest B2B team can collect insights that make sales easier and customer relationships stronger.

Start with the software you already use. Your CRM is one of the most helpful, as it already holds valuable customer data you can use to segment audiences and personalize outreach.

From there, add others only where they fill a real gap in your tech stack. Before long, you’ll have a well-rounded toolkit for keeping tabs on your audience’s wants and needs.

Lastly, don’t treat research as a one-and-done task. Keep asking, testing and refining. The more current your knowledge, the faster your market share can grow.