One of the best ways for you to determine the health of your business and sales is by looking at your return on sales ratio (you can also use the ROS finance acronym). The return on sales ratio is a financial ratio that shows how much of your overall revenue is actually profit and how much is being used to pay down operating costs.

Business owners, investors and creditors utilize ROS in finance to find their return on sales ratio analysis, which is useful because it shows the percentage of money shows the they make on its revenues during a period. In short, ROS is used to analyze the current performance of a business as it compares to other companies in the same industry, regardless of size.

In this article, we’ll explore the importance of the return on sales ratio to a company’s performance, the ROS calculation and how to apply it to various aspects of your business.

What does return on sales mean?

Return on sales is one of the most important measurements in testing the logic behind your budget and sales strategies. It gauges the overall health of your business and shows how much of your sales revenue is actual profit versus operating costs.

Ideally, as your company grows, your goal should be to increase your ROS because the higher your ratio, the more profitable you are.

Return on sales is not to be confused with a sales return. So what is a sales return? It’s when a customer returns an item to the seller, usually for a refund, voucher or equivalent product.

Understanding ROS: Return on Sales (ROS) measures the percentage of revenue that becomes profit after covering operating expenses, helping gauge business efficiency.

Importance of ROS: A higher ROS indicates better profitability and is crucial for comparing performance to competitors and assessing overall business health.

How Pipedrive can help: Pipedrive's insights and reports feature assists in tracking ROS, creating visual aids and generating accurate sales forecasts to optimize your sales process. Try Pipedrive free for 14 days.

How to calculate return on sales (example)

The rate of return on sales formula is calculated by dividing your businesses’ operating profit by your net revenue from sales for the period.

For example, say your business made $600,000 in sales and spent $500,000 in expenses this past quarter. To calculate your ROS ratio, you would need to subtract your expenses from your revenue. In this example, the profit would be $100,000. Then you would divide $100,000 profit by your total revenue of $600,000, which would result in a ROS of .17. In other words, you make 17 cents in profit for every dollar of sales.

Since ROS is usually reported as a percentage, you will need to multiply the final number by 100 and use that number as your ROS. In this case, your ROS calculation would be 17%. Here’s how to use your ROS calculator to determine the rate of return when it comes to sales:

Rate of return on sales formula

Revenue - Expenses = Profit

$600,000 - $500,000 = $100,000

Profit ÷ Revenue = Return on Sales (ROS)

$100,000 ÷ $600,000 = 0.17

0.17 x 100 = 17%

It’s important to keep in mind that the return on sales ratio formula does not take into account non-operating activities like financing structure and taxes. Things like interest expense and income tax expense, for example, are not included in ROS calculation because they aren’t considered operating expenses. Not including these figures enables leadership, investors and creditors to understand the core operations of your business and its profitability.

For sales insights and help creating customizable reports based on your return on sales ratio and other financial figures, we recommend checking out Pipedrive’s Insights and Reports feature (or getting started with our sales report templates).

Here are some more formulae to calculate your returns.

How to calculate return on assets

Return on Assets (ROA) is calculated by dividing net income by average total assets and expressing it as a percentage. The formula is:

ROA = (Net income / Average total assets) x 100

ROA assesses how efficiently a company generates profit from its assets.

How to calculate return on equity

Return on Equity (ROE) is calculated by dividing net income by average shareholders’ equity and expressing it as a percentage. The formula is:

ROE = (Net income / Average shareholders’ equity) x 100

ROE measures how effectively a company generates profit from shareholders’ investments.

How to calculate sales

Sales are calculated by multiplying the quantity of goods or services sold by their respective unit prices. The formula is:

Sales = Quantity sold × Unit price

This formula calculates the total revenue generated from the products or services sold during a specific period.

Why is return on sales an important metric?

Return on sales is one of the most tell-tale figures for determining a company’s overall performance. Creditors and investors are interested in the return on sales ratio because it provides an accurate picture of a company’s ability to pay back loans, the reinvestment potential, and any potential dividends.

Since a company’s expenses and revenue could vary over time, higher revenue might not be the best indicator of a company’s profitability. Therefore, companies rely on the return on sales ratio as one of the more dependable figures for measuring yearly performance.

The importance of the return on sales metric can be seen in this example:

Say a company generates $900,000 in net sales but requires $800,000 of resources to do it while another company can generate the same amount of revenue by using $400,000 in resources. In this example, the company that is better at cutting expenses will have a higher return on sales ratio and, therefore, be more profitable and attractive to potential investors.

How should you use your company’s return on sales ratio?

Your company’s ideal return on sales ratio depends on a few factors:

- Competitors. Your competitors and your business operate in similar environments. Your labor and material prices and costs are similar. Therefore, you can beat your competition if you generate a better return on sales ratio.

- Industry Benchmarks. Benchmarks in your industry will give you a gauge for the level of profitability you should be generating. If return on sales average 15% in your industry, an 18% ROS is considered reasonably good.

- Company Trends. If the returns on your sales are on the up year after year, your company becomes more profitable. A 10% increase in ROS means your sales are increasing and you’re managing expenses well.

By reviewing your ROS regularly, you can make the necessary changes to improve business:

- Increase revenue. Probably one of the most effective ways to increase revenue is to increase sales. Higher sales can be realized by reaching out to your existing customer base by using things like sales promotions, testimonials or rewards.

- Operational Efficiency. Utilize technology solutions to work more efficiently. A Customer Relationship Management (CRM) software like Pipedrive’s CRM Tools, can help your sales team run more efficiently and make sure leads and other customer service issues aren’t slipping through the cracks.

- Decrease the cost of labor. This may involve investing more up front to decrease costs later. An example is investing more in sales training, so your employees work more efficiently or paying a higher salary to attract the best and most efficient workers.

- Reduce the cost of materials. This can be done by contacting your suppliers and seeing if you can negotiate lower pricing or analyzing production to ensure that materials aren’t being wasted.

Free templates to track sales

Return on sales versus…

Return on sales is often confused with other metrics, which we will explore here. Although these metrics are quite different, when used in conjunction with the return on sales ratio, they can give you a good overall view of your company’s financial performance.

Return on sales vs. profit margin

In accounting and finance, return on sales and profit margin are often used interchangeably to describe the same financial ratio. They are both computed by taking net income and dividing it by sales. The difference between the two is that return on sales uses earnings/income before interest and taxes (EBIT) as the numerator (or top part of the equation).

Say, for example, you pay $8,000 for goods and sell them for $10,000. Your profit is $2,000 (this is your earnings/income after interest and taxes). You would then divide this figure by the total revenue to get your profit margin of 0.2. Finally, multiply this figure by 100 to get your profit margin percentage, which is 20 percent.

Do not confuse earnings before interest and taxes (EBIT) with earnings before interest, taxes, depreciation and amortization (EBITDA). While these profitability ratios are similar, EBITDA does not exclude the cost of depreciation and amortization to net profit. For this reason, many investors feel that it is not a true measure of the operating cash flow and overall financial health.

Return on sales vs. operating margin:

Although return on sales and operating margin are often used as the same financial ratio, they are different. The difference between return on sales and operating margin lies primarily in the numerator used for each calculation. While both are key financial metrics, return on sales uses earnings before interest and taxes (EBIT), whereas operating margin relies on operating income.

Understanding the difference between return on sales and operating margin is crucial for accurately assessing your company’s profitability and operational efficiency, as these metrics provide distinct insights into financial health.

For example, Company A has a revenue of $150,000, its cost of goods sold was $55,000, and its operating expenses were $50,000. Its operating margin is calculated as follows:

$150,000 - ($55,000 + $50,000) = $45,000

Operating income is then divided by total revenue:

Operating Income ÷ Total Revenue = Operating Margin

$45,000 ÷ $150,000 = $0.30 (or 30%)

This means for every $1 in sales that Company A makes, it’s earning $0.30 after expenses are paid.

Return on sales vs. return on equity:

Unlike return on sales, which measures efficiency, return on equity (ROE) measures return on investment. Return on equity is calculated by using net income and dividing it by the shareholder’s equity (which is found by subtracting debt from assets of the company).

For example, if a business has average equity of $300,000 and net income (also called earnings or profit) of $100,000. The ROE is $100,000 divided by $300,000, or 0.33. So, the company made 33 cents in profit for every $1 invested.

Return on sales vs. return on investment:

As the name suggests, return on investment (ROI) is a valuation metric used to calculate an investment’s return to a shareholder. It is calculated by taking Net Income / Cost of Investment or Investment Gain / Investment Base. It can also be calculated by dividing Earnings Before Interest and Tax (EBIT) by Total Investments. Unlike return on sales, this financial ratio measures return on investment not efficiency.

Return on investment can be seen in this example:

Say an investor buys 1,000 shares of a company at $10 per share. A year later, the investor sells his shares for $12.50. Over the 1 year holding period he earns $500 in dividends. The investor also spends $125 on trading commissions to buy and sell the shares. The ROI is calculated:

ROI = ([($12.50 - $10.00) * 1000 + $500 - $125] ÷ ($10.00 * 1000)) * 100 = 28.75%

Return on sales vs. price to sales ratio

Price-sales ratio is a metric that describes how much one share of a company generates in revenue for the company. While the p/s ratio is based on sales figures (revenue) and does not take into account cash flow or profits, it is an invaluable tool when assessing the stock price and market value of relatively newer companies where income statements and other financial statements may not reflect its true value.

To figure out a company’s market capitalization, you multiply the number of outstanding shares with their current market price.

Number of shares outstanding x Company’s share price = Marketing capitalization

What does a good return on sales ratio look like?

Now that you know how to calculate return on sales ratio, let’s take a look at what a good ROS looks like.

When analyzing return on sales, it’s important to keep in mind that the higher the percentage, the more profit a company is generating directly from sales vs. some other source of income like interest on investment.

Also, return on sales can provide more meaningful information for a business when it’s studied over a period of time to see trends. For instance, if you see profits declining during a certain time period despite increasing sales, it could be a sign that the company is taking advantage of less profitable sales opportunities to grow. Unfortunately, this is not a good trend and can be a result of over-saturation of more lucrative markets or poor management planning.

Here are a few more examples of what a good return on sales ratio looks like and/or how to best achieve it:

- Restaurant ‘A’ generates a yearly revenue of $1,000,000. The operating profit is $200,000. Return on sales = $200,000 / $1,000,000 = 20%.

In this example, 20% of the revenue generated by Restaurant A is converted to the operating profit margin of the business. This means that 80% of the revenue is used by Restaurant A to run the business and generate 20% profit. If the standardized profit of Restaurant A is more than 20%, then Restaurant A would need to decrease their expenses and increase revenue to increase the operating incomes on a net basis.

- Company A makes an operating profit of $2,000,000 and their yearly revenue is $10,000,000, so the company has a return on sales ratio of 20%. On the other hand, Company B makes an operating profit of $200,000 and their revenue for the same time period is $500,000, then their ROS is 40%.

As this example shows, the amount of profit doesn’t determine how efficient a business is. Company B is making more profit out of their revenue while Company A, having 20 times more revenue, generates less profit percentage.

How to communicate your return on sales ratio to key stakeholders

Key stakeholders of a company such as investors, creditors and other debt holders rely on the return on sales ratio to accurately convey the percentage of profit a company makes on its total sales. If you’re looking to build the confidence of stakeholders to invest and work with your company, do not just focus on your gross profits and net profit margins, a good ROS is important.

However, the best ROS in the world won’t help win your stakeholders over unless you are able to effectively communicate your ROS and how their investment dollars are better spent with your company vs. your competitors.

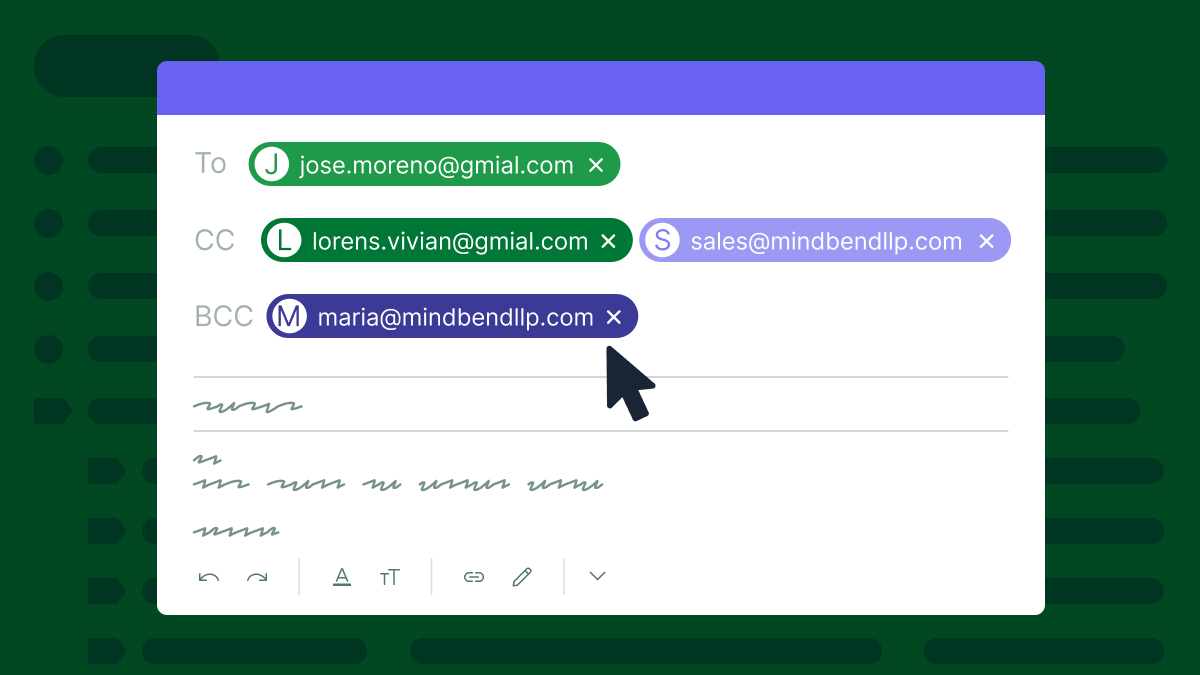

Giving stakeholders a visual representation of your ROS and how it compares to other companies in the same industry along with sales forecasting reports and graphics will give them the information they need to see where your company stands and its growth potential in the future.

For help creating great visual aids (i.e. graphs, pie charts, etc.) and accurate sales forecasts to communicate with your key stakeholders, check out Pipedrive’s Insights and Reports feature.

Can you motivate your team with your return on sales ratio?

Since a good return on sales ratio is based on how well a company uses its resources to produce profits from sales, it’s important that you keep your most valuable resource, your sales team, motivated!

When it comes to sales, although it’s easy to just measure your team’s performance by how much money they bring in, this isn’t always a sign that your company is going in the right direction. In fact, focusing on results-oriented or monetary goals will make it more difficult to motivate your team because these results are not something they can control.

Instead, we recommend keeping your team motivated by having them focus on smaller, more obtainable goals that they can control like contacting “X” number of customers a day. Having your team focus on constant activity, instead of waiting to close a sale, is what will keep your sales process thriving and moving forward even if there’s a sales slump.

Here are some tips to keep your sales team motivated:

- Personalize. Rather than focusing on what they can do for the company try focusing on what drives them personally, beyond money. Find out what their personal motivators are? What are their personal and professional goals?

- Familiarize. Make sure your team is comfortable with what they’re selling. It’s important to spend more time training them instead of rushing them to make the sale. They should fully understand your mission and goals, where they stand in the company, how they’re doing and where they’re headed.

- Incentivize. Whether it’s professional development, bonuses, or recognition, you should always have something for their efforts. These incentives give salespeople the drive to move quickly along the sales pipeline and keep them motivated to achieve your mission and goals.

How to use your return on sales ratio to improve your sales process

The return on sales ratio can be instrumental in helping improve your sales process. Your company’s sales process or “formula for success” is typically developed based on the metrics that are most important to your company.

When using the return on sales metric, efficiency and profitability should be the driving factors in your sales process. Your return on sales ratio should, ultimately, reflect a well-planned and efficient sales cycle that will generate more profitability with less effort and resources.

Let’s look at an example to see how calculating return on sales can help improve sales process and profits:

Company Y generates $500,000 of business each year and shows an operating profit of $100,000 before any taxes or interest expenses. Their return on sales ratio is calculated:

20% = $100,000 / $500,000

In this example, Company Y converts 20% of their sales into profits and spends 80% of the money they collect to run their business. If Company Y wants to increase its net operating income, it can either increase revenues or reduce expenses.

If Company Y can maintain revenues while reducing expenses, the company will be more efficient and, ultimately, more profitable. If, however, it isn’t possible to reduce expenses, they should keep their expenses the same while striving for higher revenue numbers.

This is where having a well-planned sales process, mapping out exactly what your team needs to do to close more sales, becomes instrumental in the success of your company by improving efficiency and profitability, consequently, increasing ROS.

You should also work to identify the best sales technology to keep costs down and processes efficient. This doesn’t mean spending as little on technology as possible; in fact, with the right automation tools and sales CRM at your team’s disposal, you can increase sales at a small cost, improving your return on sales ratio.