Annual sales are the cornerstone of business profitability and growth. Whether you’re an experienced business owner or just starting out, understanding how to track annual sales can vastly improve strategic planning and decision-making.

In this guide, we’ll explain everything you need to know about annual sales, along with its significance and how to calculate it.

What are annual sales?

Annual sales refers to the total amount of revenue generated by a company’s sales transactions over one fiscal year. This metric, also known as annual sales revenue, includes two components, gross revenue and net revenue:

Gross sales revenue or gross income is the total amount of money a company makes from the sale of goods and services

Net sales revenue or net income is the total sales revenue after subtracting costs and other expenses

Gross sales revenue is a good measure of how well a company is doing, but it doesn’t reflect key aspects like the company’s profit margin. Net sales revenue helps show how much money a company makes from its sales (also known as the return on sales ratio).

What is annual revenue?

Annual revenue includes not only sales revenue but also non-operating revenue generated from other activities like investments, royalties or licensing fees.

This calculation is also known as “gross receipts” on income statements.

What’s the difference between annual sales and annual revenue?

Annual sales and annual revenue are often used interchangeably, but as you read above, there is a clear difference.

| Annual Sales | Annual Revenue |

The total yearly revenue produced through sales, focusing specifically on revenue generated from the sales of goods and services | A broader term that encompasses all sources of income or revenue for a company, including annual sales revenue |

The bottom line is annual sales focus on money generated from sales transactions, while annual revenue takes into account all forms of income.

How often should you report sales revenue?

Companies detail sales revenue in monthly, quarterly and annual financial reports. It’s also common practice to calculate revenue streams separately to get a clearer picture of how much cash flow each stream contributes to the overall revenue.

How often you should report sales revenue depends most on who you’re sharing the information with. If you’re sharing it with your sales team to improve performance, then weekly or biweekly meetings might be best for you.

On the other hand, if you’re primarily reporting revenue to shareholders, then weekly is probably too often. Instead, they’ll benefit most from monthly or quarterly reports that can show sales trends more effectively.

To work out the best reporting frequency, ask yourself these questions:

Do frequent reports improve sales? Or do they increase performance anxiety in your sales team?

How often do stakeholders need or want to see sales data?

Do any other business processes (like a new product launch) rely on this sales data?

Depending on your answers, you’ll be able to tell whether you’re better off running weekly, monthly or quarterly sales reports.

6 reasons to track annual sales

Annual sales are one of the most important metrics for organizations to track because they determine other fundamental aspects like the company’s valuation, sales forecasts and projected growth.

Tracking annual sales is also necessary for legal and reporting reasons because it determines your eligibility for business loans and contract opportunities.

Below are six reasons to track annual sales.

1. It’s crucial for evaluating sales performance

Tracking annual sales allows you to evaluate performance and determine if you’ll reach sales targets or need to reassess approaches. By comparing projected sales with actual annual sales, you can identify areas of success and areas that need improvement.

Consider a company that has a sales target of $1 million annually. At the end of the year, the company’s annual sales were $900,000, indicating it fell short of its target by $100,000.

Based on the evaluation, the company conducts a deep analysis to identify what contributed to the shortfall in sales performance. It discovers sales in one product category were lower than expected. The company then implements new marketing and sales strategies for the underperforming product category, tracking the impact of these changes over the next year.

For example, the company’s sales team could offer targeted promotions for the product to increase sales. Methods might include temporary discounts or bundle offers that entice customers to make a purchase.

Likewise, they could try to reposition their product in the market after analyzing the reasons behind its underperformance. This repositioning could include updating the pricing structure or packaging to make it more appealing to a different audience.

2. It’s necessary for accurate financial analysis

Tracking annual sales allows you to perform in-depth analyses, assessing key sales metrics like revenue growth, profitability and overall financial health. It also gives you insight into sales trends and enables you to find strengths and weaknesses in the market.

For example, you might have a unique selling point that gives you an advantage over competitors, or there might be growth potential in an untapped market that you can position your product to target.

Once again, consider the hypothetical company that fell short of its sales target by $100,000. The shortfall triggers an in-depth look at the company’s financial health.

It discovers the decline in sales is due to increased competition, with some customers switching to new or rival products. Based on this discovery, the company readjusts its pricing strategies and introduces new product features to regain some of its market share.

Through the detailed financial analysis, the company also realizes its profit margin decreased compared to the last year. To address this, it reviews its cost structure and negotiates new supplier contracts.

With the updated product in hand, the sales team can implement new strategies. For example, they might hold live product demonstrations to showcase the new features and highlight how they can address customer pain points. They might also identify new ways to upsell and cross-sell the product to existing customers based on their needs.

3. It helps improve budgeting and forecasting

Annual sales data also acts as a foundation for budgeting and forecasting. It provides insights into seasonal trends, market demand and customer behavior while helping you plan for future growth.

This knowledge is especially powerful if you can tap into a few years of sales data. By analyzing your performance over several years, you can identify consistent sales trends during certain months and seasons. You can then use that data to forecast your sales for the upcoming year.

For example, imagine a three-year period for a hypothetical company. Sales increase in the first year, plateau in the second and begin to drop in year three.

After some digging, it becomes apparent that the company failed to adapt to changing market dynamics. In the first year, it introduced a new product that hit the market successfully. But it failed to innovate after, resulting in a drop in sales.

To prevent further reductions, the company decides to diversify its product portfolio, implementing targeted sales strategies that complement the new products.

With an accurate sales forecast in hand, you can allocate resources (like marketing budgets and inventory investments) more effectively. You can also use this data to increase your sales and marketing efforts over the busiest parts of the year.

4. It helps optimize sales and marketing strategies

Monitoring annual sales helps you measure the effectiveness of your sales strategies and marketing campaigns. By tracking annual sales, you can find out:

Which products are selling well

Which customer segments are most profitable

Which sales activities and marketing channels are generating the most sales

You can then use this data to optimize your campaigns and activities.

For example, if you find most of your sales are coming from a targeted social media platform like LinkedIn, you could invest more into expanding those efforts. Your salespeople could implement social selling strategies, like developing buyer-centric relationships and boosting brand credibility.

You might also find shoppers between 25 and 35 years old make up a significant portion of your sales. Based on this, you could create a sales playbook that defines these customer profiles, outlines key selling points and explains how to handle common objections.

You could then create tailored social media ads, email marketing campaigns and website content to resonate with that audience specifically, driving more sales.

5. It helps streamline inventory management

Annual sales data plays a crucial role in inventory management. It helps you forecast demand accurately, adjust stocking levels and optimize inventory turnover. Planning in this way can help prevent overstocking or running out of stock.

For example, you might find a particular product experiences higher demand during certain months. Using this information, you can forecast the demand throughout the year and anticipate the expected sales volume, adjusting stocking levels accordingly.

Likewise, you might identify products that are slow-moving at certain parts of the year. For example, winter coat sales might drop off in summer. Based on this data, you can make informed decisions about how to manage your inventory and save on costs.

6. It helps you evaluate your sales team’s performance

By tracking annual sales, you can measure and track your sales team’s performance effectively. This data helps identify top performers, recognize achievements and design incentive programs to motivate your sales staff.

If you discover there’s a significant performance gap in your sales team, you can conduct performance reviews, analyze sales activities and ask for feedback from customers.

For example, say a few top-performing reps are landing 40% more sales than underperforming reps.

You might find these more successful reps use a structured sales process to communicate your value propositions effectively. You could then implement sales training to get underperforming reps up to speed.

Based on customer feedback, you might also find that one sales rep in particular is struggling to understand customer needs, explain your products and offer effective solutions. You could then provide that rep with sales battle cards or ongoing training that help them engage customers proactively and sell more effectively.

How to calculate annual sales revenue

There are a few ways to calculate annual sales revenue. You can use a simple formula and do it manually, or you can use sales reporting or accounting software solutions to do it for you. Below, we’ll show you how to calculate annual sales using a simple formula.

How to calculate annual sales

To calculate annual sales, you need to determine the total revenue generated from sales transactions over a year. The revenue formula is:

Annual sales = Quantity sold x Price per unit

Here’s an example:

Let’s say a company sold 10,000 widgets in a year for $50 per widget. To calculate the annual sales, you multiply the number of units sold by the price per unit:

Annual sales = Quantity sold x Price per unit

Annual sales = 10,000 widgets x $50/widget

Annual sales = $500,000

How to calculate annual revenue

To calculate annual revenue, you need to consider all sources of income for the company. Those sources include sales and other activities like investments, rentals, royalties and licensing fees. Here’s an example:

Consider the same widget company from the previous example. In addition to its sales revenue of $500,000, it earned $20,000 from rental income. To calculate their annual revenue, you add up all sources of income:

Annual revenue = Sales + Other sources of income

Annual revenue = $500,000 + $20,000

Annual revenue = $520,000

How to calculate gross profit, operating margin and net profit

Annual sales is a topline metric. Meaning it’s reported at the top of a company’s annual income statement.

From annual income, it’s possible to calculate other crucial metrics, including gross profit, operating margin and net profit. Here’s how:

First, find the gross profit by subtracting the cost of goods from the sales revenue. The cost of goods is how much it costs to produce and sell the goods you sold throughout the year.

Gross profit = Sales − Cost of goods sold

Say the example widget company spent $120,000 developing their latest widget. Its gross profit calculations would be:

Gross profit = $500,000 − $120,000

Gross profit = $380,000

Next, you need to find the operating margin (also known as earnings before interest and taxes or EBIT). You can do this by subtracting all depreciation, administrative and general expenses from your gross profit:

Operating margin = Gross profit − Operating expenses

To continue the example, say the widget company spends $160,000 a year on a software developer’s salary and rent for a small office.

Operating margin = $380,000 − $160,000

Operating margin = $220,000

Finally, you can calculate the net profit by subtracting sales taxes:

Net profit = Operating margin − Taxes

If the widget company’s effective tax rate is 15%, then their taxes would equal $33,000. For example:

Net profit = $220,000 − $33,000

Net profit = $187,000

Try our free sales tax calculator to work out exactly what your taxes should be.

How to forecast annual sales accurately

Sales forecasting is much harder than tracking yearly revenue, as so many market factors can influence outcomes. To forecast your annual sales accurately, you should:

Use high-quality, accurate sales data. Your predictions are only as good as the data and predictive model you use. If you input bad data, you’ll get an inaccurate forecast. Because of this, it’s important to have consistent, accurate recording procedures in place.

Base predictions on historical trends. Historical data can help you determine future trends in sales. For example, you might find patterns in the previous calendar year’s sales that indicate better or worse performance in the coming year.

Refine your forecast as needed. Unexpected changes occur all the time – look at what happened to the global market when the COVID-19 pandemic hit. Being able to adjust your forecast when unexpected things happen will help you respond to changes more effectively.

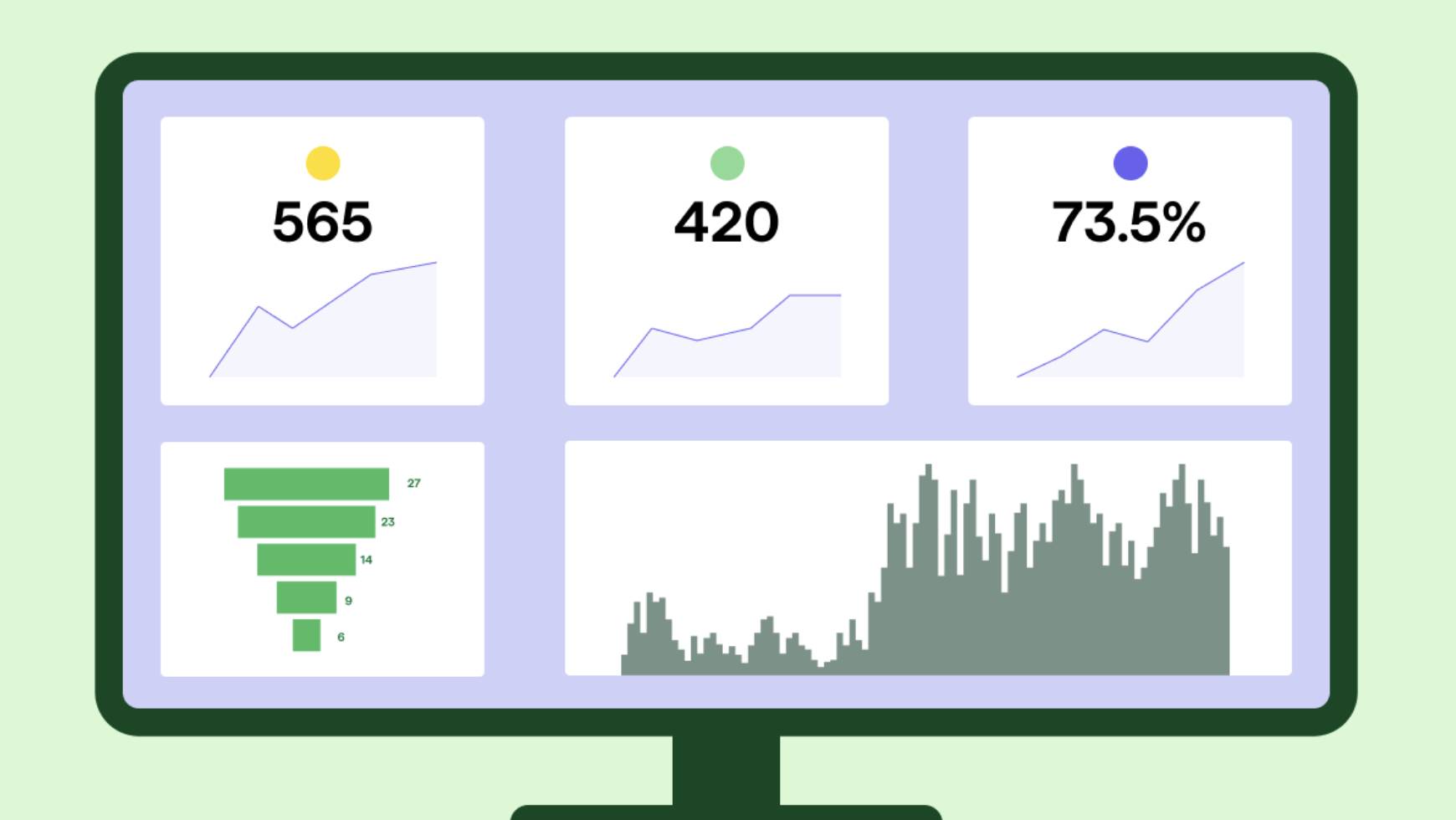

Invest in a customer relationship management (CRM) solution. Pipedrive’s CRM system can help calculate and track annual sales without the painstaking manual work. With Pipedrive, you can input sales data automatically and then generate insights and reports at the push of a button.

Final thoughts

Annual sales are a foundational sales metric. They are crucial for reporting your company’s health in financial statements and they also help optimize business operations. With this knowledge in your back pocket, you can make data-driven decisions, set realistic targets and outshine your competition.