Chasing every lead is a fast way to burn time and budget. Knowing your sales potential helps you focus on buyers most likely to convert, set achievable revenue targets and invest where it counts.

In this article, you’ll learn data-backed reasons why it’s crucial for SMBs to calculate sales potential, plus a simple three-step method for measuring it to grow profitably.

Key takeaways from sales potential

Sales potential is the total revenue your business or product can realistically earn within a set timeframe

Knowing your company or product’s sales potential helps you set achievable targets, while ignoring it can lead to chasing unlikely deals or inflated projections

Supporting metrics like average deal size, win rate and pipeline fit make your sales potential more accurate

Pipedrive helps you calculate, segment and track your sales potential using filters, custom fields and reports – try it free for 14 days

What is sales potential?

Sales potential is the total revenue your business or a specific product can realistically expect to earn within a certain timeframe.

Small businesses measure it to set company-wide targets, launch new products, plan campaigns or target niche market segments.

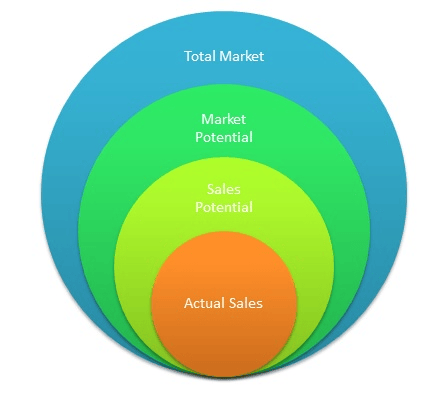

Sales potential sits within a hierarchy of market opportunities:

Total market (all hypothetical customers)

Market potential (buyers with genuine need and intent)

Sales potential (customers you can realistically reach and convert)

Actual sales (what you’ll likely achieve based on your current capabilities)

Here’s what that nested relationship looks like:

The basic sales potential calculation includes multiplying the number of potential customers available by the price of your product or service:

Potential customers × unit price = sales potential

When calculating potential for your entire business, include your total customer base and average revenue per customer. For a single product, input its price and target customers.

Note: While sales potential estimates the total realistic revenue opportunity available, sales forecasting predicts actual future sales based on the current pipeline and trends.

Measuring potential allows your small to medium-sized business (SMB) to focus on the right customers, allocate sales and marketing spend effectively and set achievable goals.

Instead of the “dream number”, sales potential is the sensible ceiling that factors in market demand, buyer readiness and your ability to deliver.

Imagine that your software-as-a-service (SaaS) company offers a project management tool for $2,000 per year. Your total market includes 5,000 companies in your target market, and your market potential might be 2,000 companies actively seeking solutions. However, only 20% (1,000 customers) meet your ideal customer profile (ICP) and have the budget.

Your sales potential works out as:

1,000 potential customers × $2,000 = $2,000,000

With this data, you can prioritize marketing and sales efforts toward the 1,000 high-fit prospects to focus resources where they’re most likely to convert.

While this is a basic calculation, many other factors influence sales potential for SMBs. For example:

Buyer needs and budget. Determines if your target audience has both the desire and funds to purchase.

Market size and sales trends. A growing market expands your potential for total sales, while a shrinking one limits it.

Competitor positioning. Strong competitors may capture more market share and reduce your sales potential.

Product-market fit. The closer your product matches market needs, the higher your customer conversion potential will be.

Internal capacity to fulfill demand. Even if demand is high, production and delivery limits cap your sales potential.

Sales team skills and outreach capacity. A skilled sales force with the right tools can capture a larger share of the available market.

These factors show market trends, buyer readiness, competition and your team’s capacity all influence your sales potential.

Smart SMB owners consider them alongside to set realistic growth goals, prioritize hot leads and make data-driven business decisions.

What does the latest data say about measuring sales potential?

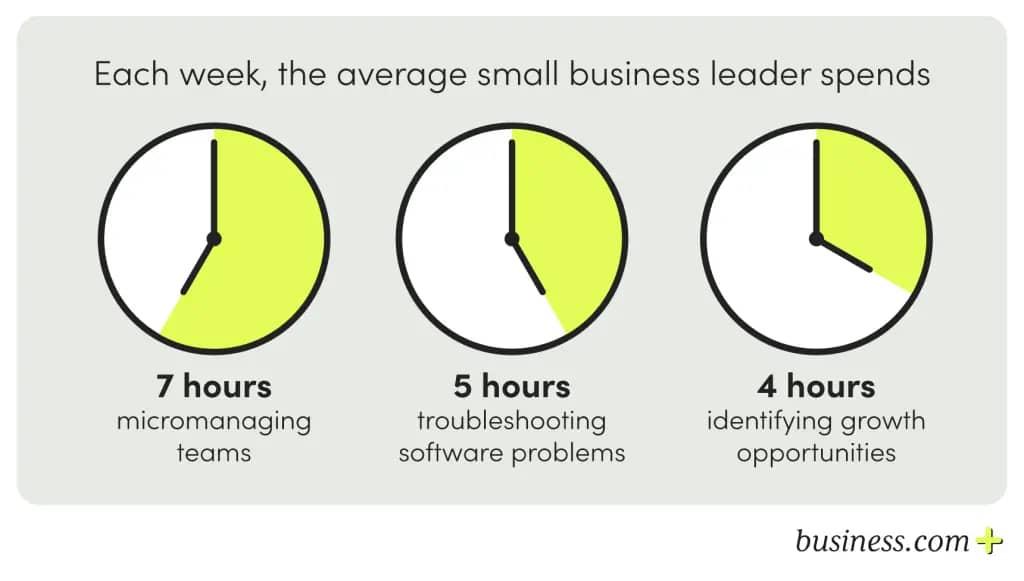

In 2025, SMBs face tighter budgets, shifting customer priorities and more competition than ever.

On average, leaders manage just four hours a week on growth initiatives, while losing three times as much to multitasking and distractions.

In the current climate, considering these specific market conditions is essential to spot the most profitable opportunities and avoid wasting resources.

When you calculate accurately, you’ll focus on what’s achievable instead of chasing every possible deal.

Here’s what the latest data says that helps SMBs understand the importance of sales potential.

Customers are redefining what value means to them

Changing buyer priorities and purchasing capacity can shrink or expand your sales potential overnight. By cutting spending in one area, today’s buyers invest more in what matters most.

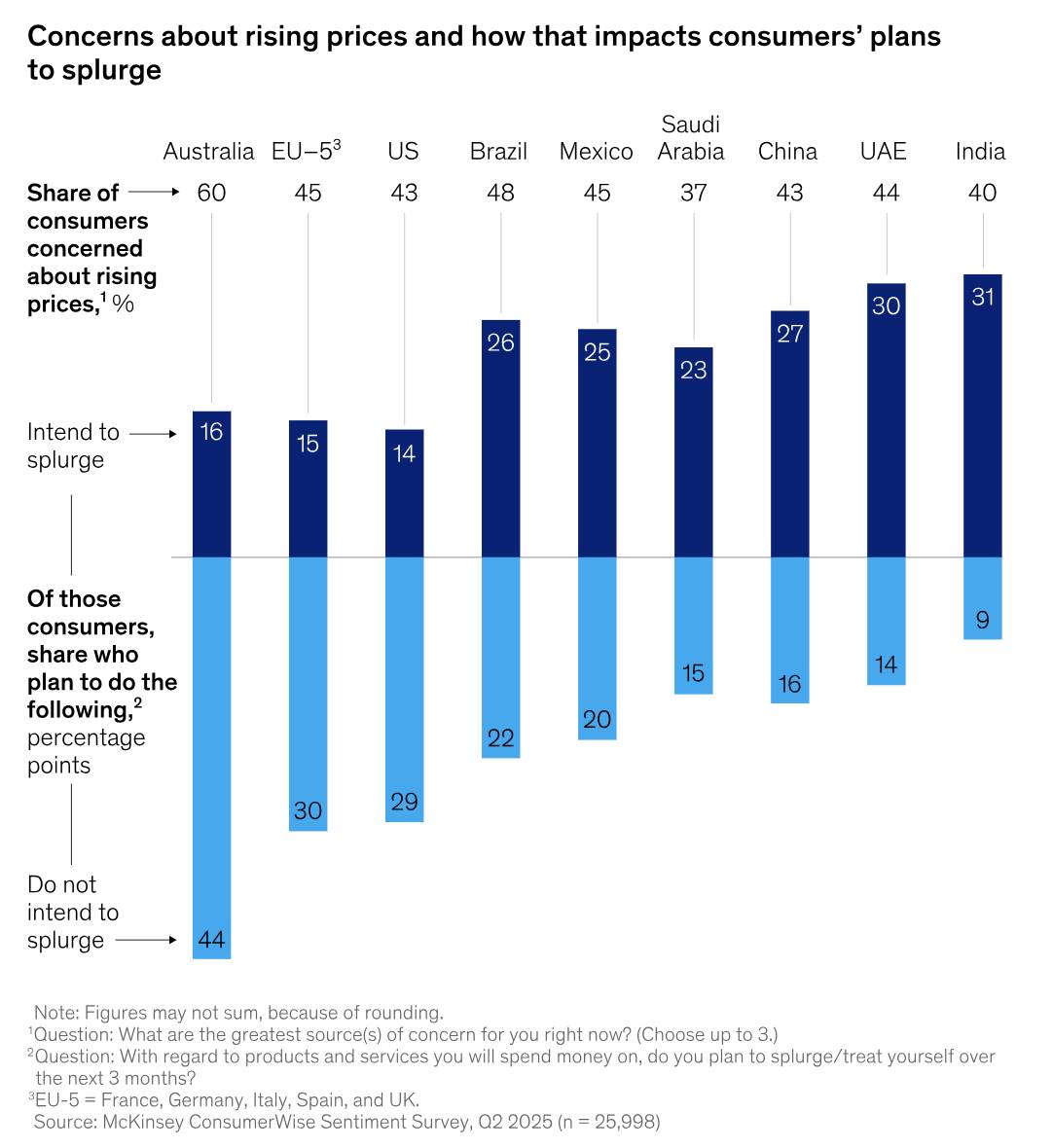

According to McKinsey research, increasing prices are the top concern for global consumers in 2025.

While over a third say they’ve “traded down” in one category, they still plan to “splurge” in another.

Salespeople are feeling the impact of these rapidly changing markets. Gong Labs research suggests that only 27% of teams are highly confident that they understand their customers’ needs.

However, learning where your product sits in your buyer’s priority list is crucial for accurately estimating your sales potential.

Let’s say your marketing automation company targets mid-sized retailers. Many potential customers have cut ad budgets but are doubling down on retaining tactics.

If you recognize this shift early, you can focus your upselling and marketing strategies on your customer retention features rather than chasing low-priority ad automation deals.

Many sellers rely on gut feeling instead of data

When reps rely on hunches instead of measurable indicators, they can inflate sales potential projections and risk win rates.

Conversely, sellers who use data-driven decision-making are more likely to invest time in best-fit buyers and high-probability sales deals to hit targets.

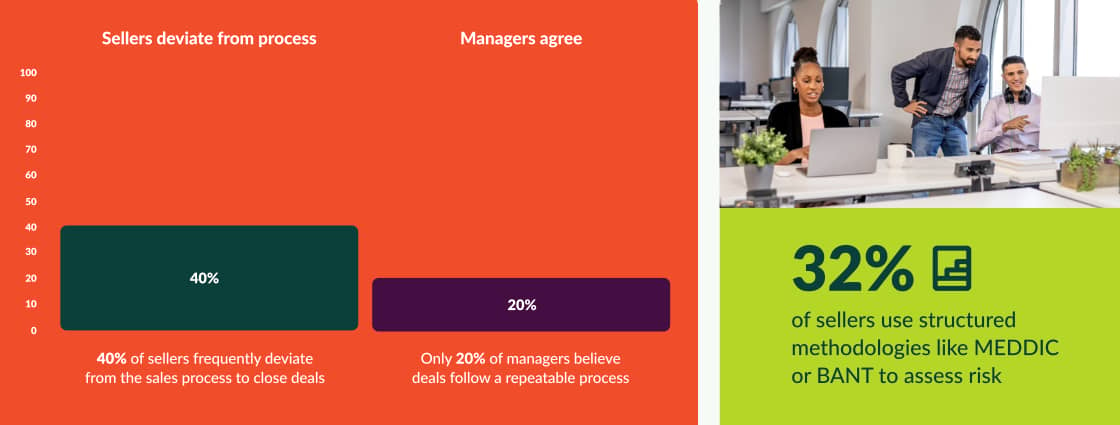

Gut instincts can be valuable, but they’re inconsistent. Despite this, Salesloft findings indicate that 40% of sellers often deviate from set sales processes.

Some 43% of salespeople in the same study prioritize which potential buyers to engage with based on personal judgment. However, this approach can backfire.

For example, a SaaS startup’s sales team may spend three weeks courting a big-name lead that “seems interested” but ignores a smaller account actively asking for a sales proposal. While the big lead never buys, the smaller one eventually signs with a competitor.

By focusing on accounts that show real buying intent in the future, the team turns a missed opportunity into more closed deals that boost overall sales performance.

Download our sales pipeline course e-book

You can’t improve what you don’t measure

If you don’t track why deals are won or lost, you can’t spot patterns that would help you capture more of your true potential.

According to Clari, 98% of companies consistently fail to measure those reasons. It’s no wonder Ebsta research suggests that 56% are trying to counter this lack of insight by shifting to full-cycle sales models and better aligning sales and marketing.

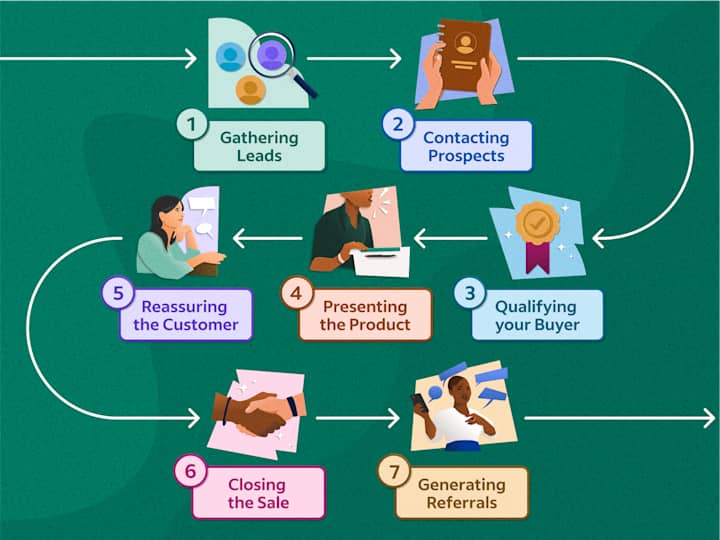

A full-cycle approach is when one team manages and measures the entire sales process, from prospecting to post-purchase follow-up:

Understanding why you lose or close deals allows you to adjust your tactics to capture more of your true sales potential. You’ll reveal trends and scale more easily without guesswork.

Imagine an IT services firm that wins several manufacturing clients and records “industry” as a data point in their customer relationship management (CRM) software.

As a result, leaders realize that the manufacturing sector has a much higher close rate (and overall potential) and launch a new sales strategy to target similar accounts.

7 crucial metrics that help with understanding sales potential

The most basic sales potential formula takes the number of potential customers available and multiplies it by your unit price. However, different pricing tiers and uneven buying readiness all impact the real number.

The calculation is a good starting point, but it’s rarely that simple. Not every lead will be ready to buy now, and not all will be a great fit for your offer.

Here are seven supporting metrics that refine your sales potential calculation:

Sales metric | Why it’s important |

Total addressable market (TAM) | Defines the maximum possible customer base in your market. |

ICP fit score | Filters TAM down to high-probability buyers – your realistic customer base. |

Lead engagement score | Helps identify which potential customers are actively in-market. |

Average deal size | One-half of the core formula, which estimates sales revenue per customer. |

Close rate by segment | Adds realism by factoring in the likelihood of converting potential customers. |

Sales cycle length | Indicates how much of your sales potential is reachable within a given time period. |

Combines deal size, win rate and speed to forecast potential over time. |

Let’s say you’re a business-to-business (B2B) company selling accounting software with three monthly pricing plans: $50, $100 and $200.

Multiplying all potential customers by your highest-tier price would result in a wildly inflated figure. Instead, calculating your average deal size (weighted by the number of customers who typically choose each plan) helps you set more realistic targets and forecast cash flow more accurately.

For example, if 75% of your customers pick the $100 plan, your projections should reflect that.

You can calculate these metrics using a comprehensive CRM system like Pipedrive and its third-party integrations via Marketplace.

So, while the basic sales potential formula gives you a theoretical ceiling, working out the relevant benchmarks keeps your targets ambitious but achievable.

How to calculate sales potential and close deals using Pipedrive

Pipedrive is ideal for calculating and applying sales potential, giving you a complete overview of your product, team and pipeline management and deal performance in one platform.

Use it to size your market, prioritize opportunities and track how much of that potential you’re actually capturing.

Here are three steps to doing so successfully.

Note: You can run these calculations for your entire business or a single product or service. Adjust your filters (e.g., product category, deal type, etc.) in Pipedrive so you only count relevant opportunities.

1. Understand your target market through research

Market research helps you learn about your target customers – including buyer demographics and behavior – and competitors to determine sales potential more accurately.

Gathering this information helps narrow your focus to your realistic customer base. In other words, you home in on the portion of the market that:

Fits your ICP

Can afford your product

Isn’t locked into a competitor’s solution

For example, your sales potential will likely be higher if you have a unique product with few competitors and customers with strong purchasing power.

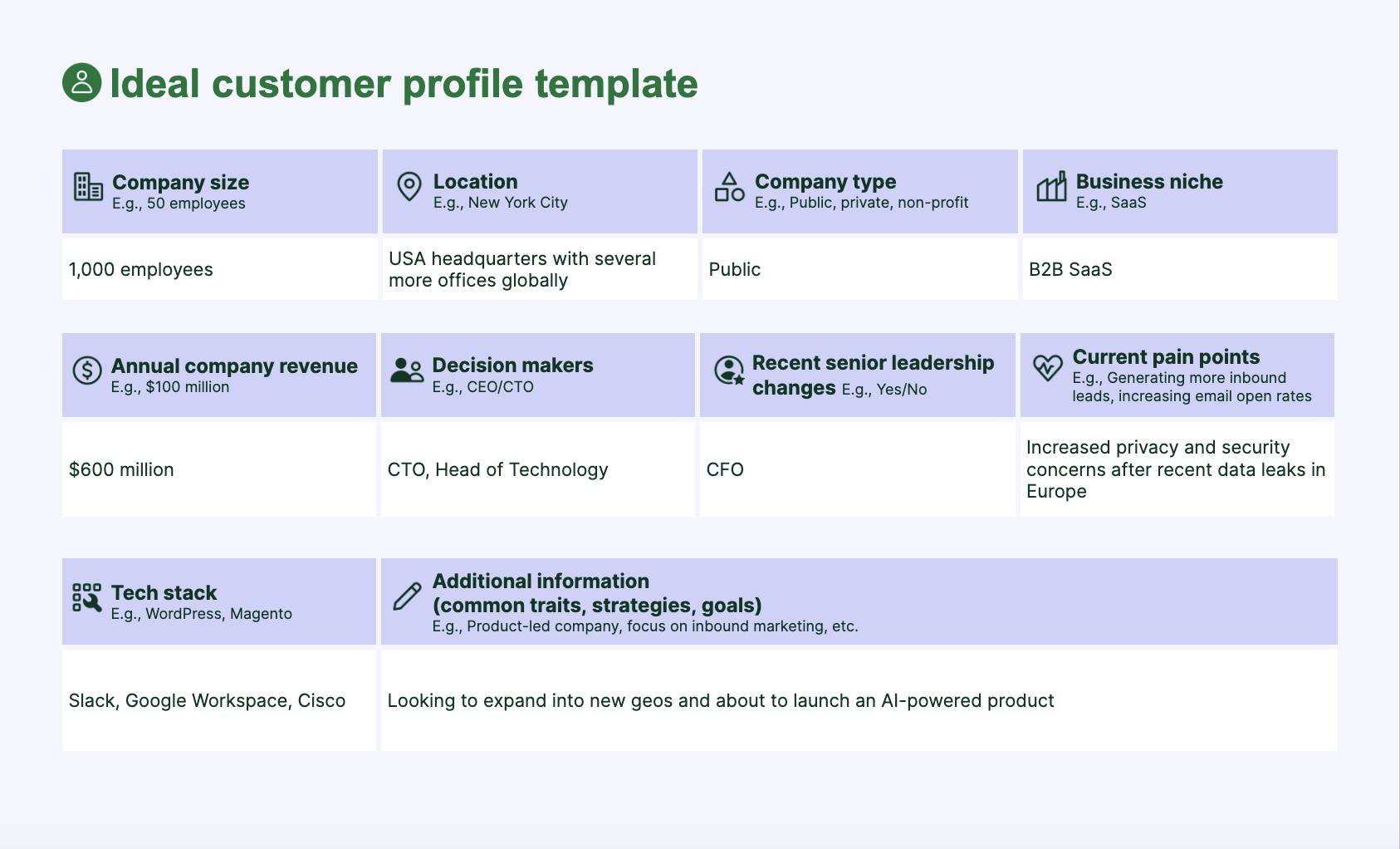

Here’s an ICP template for reference to start building out your own:

Filling this in will help you quickly spot your best-fit buyers, size your realistic market and focus on the opportunities most likely to drive revenue.

A robust market research strategy includes tactics like:

Customer surveys and questionnaires. Gather insights on buyer needs, budget and decision-making criteria.

Interviews and focus groups. Understand motivations, customer pain points and purchasing triggers.

Industry reports and whitepapers. Identify market size, growth trends and demand shifts to evaluate your full potential.

Internal data assessment. Spot high-value customer segments and past win patterns.

Competitive analysis. Map competitor offerings, positioning and pricing.

With those refined numbers, you have enough information to estimate sales potential in Pipedrive and start spotting opportunities.

2. Calculate your sales potential in Pipedrive

There are two main ways to estimate sales potential in Pipedrive, based on your entire market or active pipeline.

Both approaches build on the basic formula but adjust for scope and deal readiness based on your sales goals.

Entire market – ideal for setting company-wide revenue targets and improving long-term business growth rates

Active pipeline – best for prioritizing current deals and short-term sales efforts

Let’s say you want a big-picture view of your market. Start by using filters and lists to find every potential customer who fits your ICP.

For example, you can filter by industry, company size or geography. Here’s where you’d find these filtering options in Pipedrive:

Multiply that count by your average deal size (not your highest-tier price) to get a realistic, top-down estimate of total potential.

For instance:

1,200 ICP-fit accounts × $8,000 average deal size = $9.6M sales potential

For a pipeline-focused view, apply similar filters, but only to deals already in play. Filter deals with the same criteria (e.g., deal size > $10K or industry = SaaS) and use custom fields to tag leads with ICP fit or engagement scores.

Here’s how you add custom fields in Pipedrive:

Segment your pipeline by deal stage and likelihood to close to understand the number of high-fit deals.

Once you have these insights, use this formula:

(Number of high-fit deals) × (average deal size) × (win rate)

This equation gives you a reachable revenue figure, based on the portion of your overall potential that’s in motion and winnable within your current sales cycle.

It’s essentially the same as the basic sales potential formula, but weighted by how near you are to closing and the probability of success.

3. Apply your sales potential insights to hit targets

Turning a single calculation into ongoing action makes sales potential the foundation for hitting your business goals.

This clarity makes it easier to decide where to invest resources and chase opportunities that will likely result in future sales.

Imagine an analytics platform with a four-person team discovers that most revenue comes from mid-sized B2B clients. Focusing sales and marketing on tailored demos and personalized outreach increases conversion rates by 25% and drives significant revenue growth from that segment.

Pipedrive in action: By using Pipedrive to track potential sales, the family-run McKeon Group grew annual revenue by 186% over four years. The CRM helped the construction company identify high-value opportunities early on and leverage sales potential insights to allocate resources effectively.

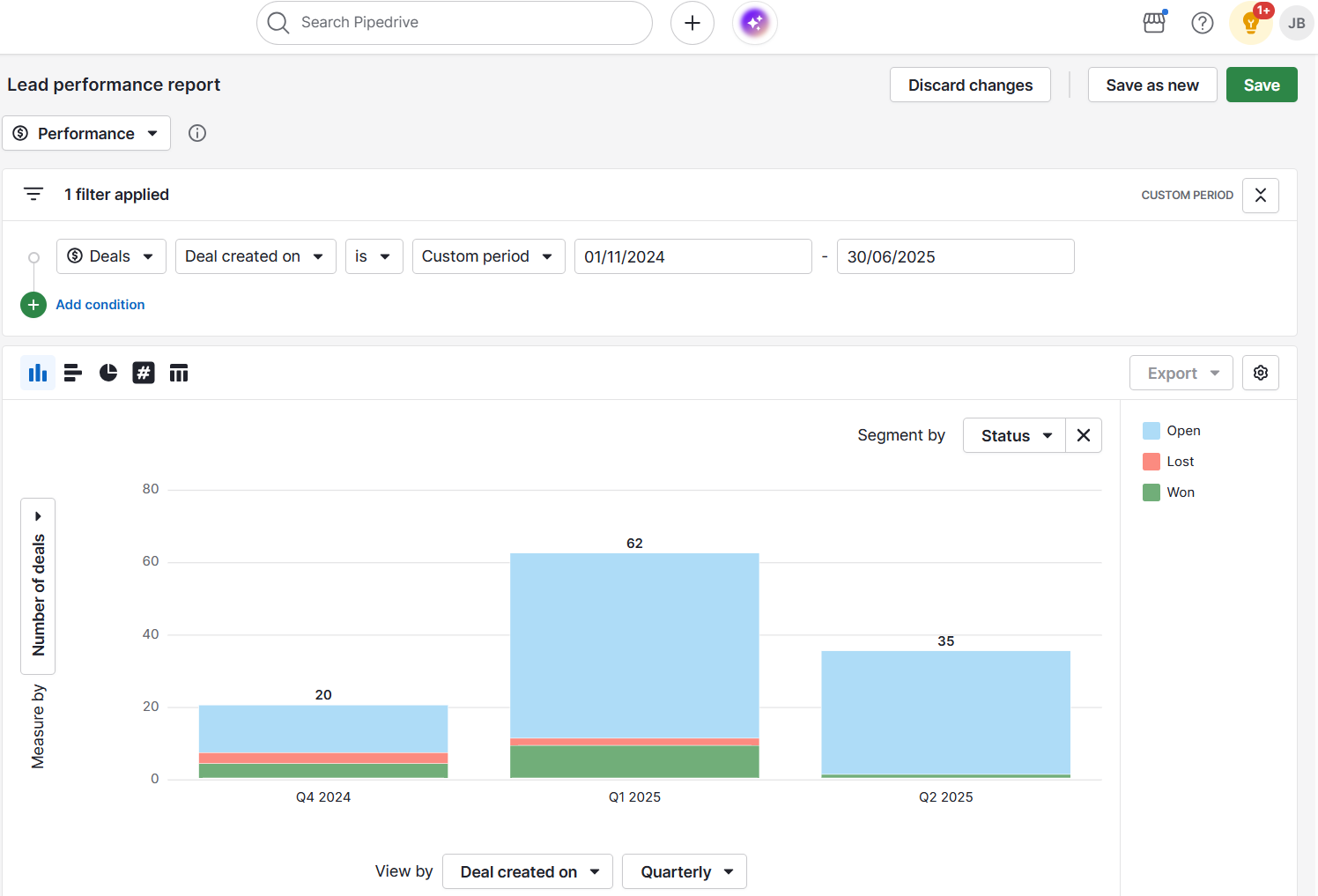

Here’s where you can view relevant insights within Pipedrive’s sales reports:

Use these insights to track sales performance progress and see how much of your market potential you’re capturing over time.

Note: You can create reports manually or by using natural language prompts through Pipedrive’s AI report generator.

Here are some ways to apply your new findings about your company’s sales potential.

Set realistic revenue targets: Use the figure to shape company-wide or product-specific goals to increase profitability.

Allocate resources: Decide where to invest time, budget and staffing based on the most significant opportunities.

Prioritize pipeline deals: Focus sales efforts on high-fit, high-value prospects most likely to convert.

Plan marketing campaigns: Match spend and messaging to segments with the highest potential.

Knowing and applying your sales potential transforms vague goals into clear, actionable targets. It empowers your team to focus efforts where they matter most – maximizing return on investment (ROI) and accelerating growth.

By aligning resources with your highest-value opportunities, you build a more predictable and scalable sales engine.

Final thoughts

Calculating sales potential gives you a clear picture of your genuine revenue opportunity. Use it to set realistic goals, focus on the right prospects and allocate resources where they’ll have the biggest impact.

Accurately measuring sales potential depends on having the right tools. You need CRM software that gives you an overview of your buyers’ and pipeline performance in one place.

Try Pipedrive free for 14 days to show precisely how much of your sales potential you’re capturing and where to focus your efforts next to boost profitability.