An investment proposal is your chance to showcase your business to potential investors and secure the funding you need to grow.

Translating deep company knowledge into a compelling pitch that builds investor confidence takes a clear structure and strategic approach. Done well, it answers every question and secures the capital you need.

In this guide, you’ll discover what makes up a successful investment proposal and how to write one that convinces investors to back your business.

Key takeaways from investment proposal

An investment proposal outlines your market opportunity and financial forecast so investors feel confident funding you.

It builds credibility by telling them a data-backed story about the problem you solve, your unique solution and your growth plan.

To write a successful proposal, research your market deeply and present a clear business strategy.

A CRM like Pipedrive helps you manage investor outreach like a sales pipeline. Try it free for 14 days and see how it streamlines the fundraising process.

What is an investment proposal?

An investment proposal is a formal document or pitch deck a business presents to potential investors to secure funding.

The goal is to make a compelling case for why your company is a valuable investment. A strong proposal achieves this by outlining your plan, market opportunity and how you’ll use the funds to generate a solid return on sales.

When done well, an investment proposal helps you:

Raise capital. It’s a professional tool for unlocking the financing needed for business expansion, new hires or product development.

Clarify your strategy. Writing a proposal forces you to analyze your business goals and model, strengthening your overall plan.

Build credibility. A well-researched proposal shows investors you’re serious and have a clear vision for the future.

To achieve these benefits, your proposal needs to contain the essential sections every investor expects to see.

What should an investment proposal include?

Your investment proposal should guide an investor through your brand story, from the big picture to the finer details.

While the exact structure will vary from business to business, here are the essential sections and what they need to cover:

Investment proposal section | Purpose and key information |

Executive summary |

|

Company overview |

|

Problem and solution |

|

| |

The team |

|

Marketing and sales plan |

|

| |

Funding request |

|

Remember that your investment proposal format doesn’t have to be overly formal.

Many small businesses use pitch decks and PowerPoint presentations to keep things brief.

Your free investment proposal template

In the next section, you’ll learn how to create a business investment proposal. To streamline the process, download our free investment proposal sample.

Download Pipedrive’s free business proposal template

Once you’re ready to draft the final document, you can write it out and add your branding.

How to create an investment proposal in 6 steps

Creating a strong proposal begins with research and planning, then drafting the core sections and polishing the final document.

Follow these six steps to turn your business idea into a professional, investor-ready proposal.

1. Define your strategy and target investors

Before writing, you must decide who you’ll ask for money from and how much you need.

Since a real estate investment proposal will target a completely different type of sponsorship than a nonprofit proposal, this needs serious thought.

You’ll need to:

Research and identify the right investors for your business

Determine a specific and justifiable funding amount

Create a master outline to guide your writing process

It’s crucial to get your strategy right from the start. Your funding source determines your investors’ expectations, their level of involvement and your company's future.

Target investors who fit your specific business stage and industry perfectly. The two most common types for sales SMBs are angel investors and venture capital (VC) firms:

Angel investors | Venture capital firms |

Who they are: Wealthy entrepreneurs who are investing their own money. | Who they are: Professional firms investing other people’s money from a large fund. |

Investment size: Typically smaller, between $25,000 and $500,000. | Investment size: Much larger. Usually $1 million and up. |

What they look for: A great team and a promising idea, often in an industry they know well. | What they look for: Proven traction, a large investment opportunity and a clear path to a strong return on investment (ROI). |

Involvement: Can be very hands-on as a mentor or completely hands-off. | Involvement: Almost always take a board seat and are a highly involved stakeholder in the company's strategy. |

Finding the right investors takes research. Create a target list by:

Using corporate social platforms like LinkedIn and Crunchbase to find investors who have funded similar companies in your industry

Attending local industry and startup networking events to meet investors and other founders

Asking for warm introductions through your existing network – this is the most effective way to get a meeting

Once you know your target, you need a specific and justifiable asking amount. Your goal is to secure enough finance to operate and grow for the next 12–18 months, which is known as your “runway”.

To calculate your ask, create a detailed budget that includes all projected expenses for that period. Think about salaries, sales and marketing, operating costs and unexpected expenses.

Finally, with your target investor and funding goal clear, create a master outline for your proposal.

This roadmap keeps you focused and ensures the final document flows logically. Include all the key sections listed in the table above.

When you finish this step, you should have a clear plan, a target and a structure to follow.

2. Conduct market and competitor research

To convince investors, you need to use complex data to prove that a paying market exists for your product and that you have a clear advantage over the competition.

The next step is to:

Find credible data to define your market size

Build a detailed profile of your ideal target customer

Analyze your competitors to find your unique advantage

Investors need objective, third-party proof that your opportunity is significant. The standard way to present this is by using the TAM, SAM, SOM model:

TAM, SAM, SOM framework | What it means |

Total addressable market (TAM) | The entire global demand for a product or service, which represents the biggest possible picture of the market |

Serviceable available market (SAM) | The segment of the TAM that your business can realistically target with your products and sales channels |

Serviceable obtainable market (SOM) | The specific part of your SAM that you can immediately target in the next three to five years |

Start by looking for credible reports and statistics from reliable sources.

Industry reports: Search for market research reports from firms like Gartner, IBISWorld or Statista.

Government data: Use official sources for customer demographic and economic data that can help define your customer base.

Bottom-up analysis: You can also build your own estimate. Multiply the number of potential customers you can reach by the average annual revenue you expect from each customer.

Once you’ve defined the market, show investors you know precisely who you’re selling to. A business that targets everyone is less appealing, so you need a detailed customer persona.

The persona should be a snapshot of your ideal buyer.

Demographics: Age, location, job title and income.

Goals and challenges: What they’re trying to achieve and what’s in their way.

Pain points: The urgent problems that your product solves.

Where to find them: The social media platforms, blogs or forums they use.

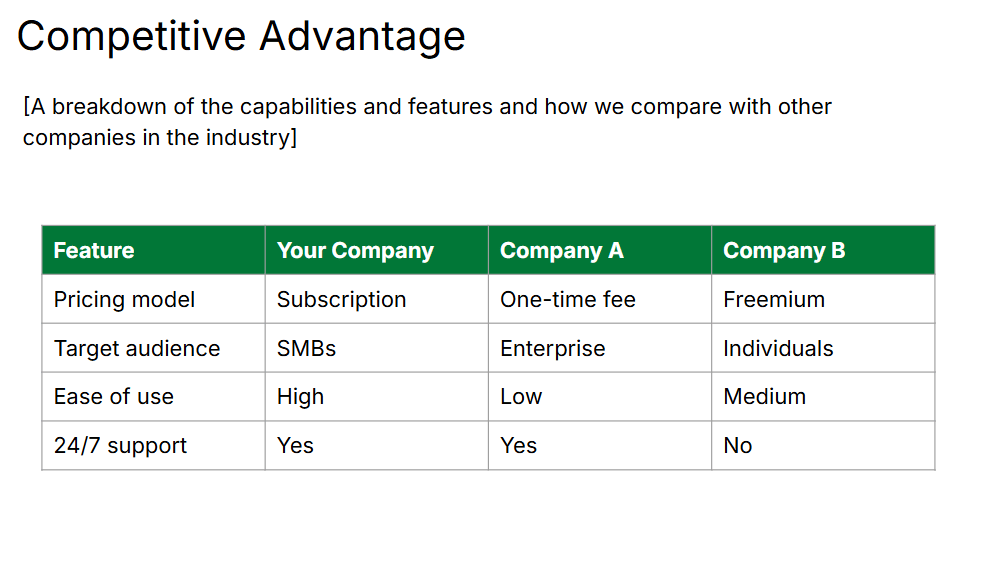

After defining your market and customer, analyze the competition. A competitive matrix is the best way to compare your business to others and highlight your unique advantage.

Here’s an example:

Your market analysis should help you pinpoint your unique selling proposition (USP) – what you do better than anyone else for your target customer.

3. Write your core narrative: Company, problem and solution

With your research complete, it’s time to tell investors who you are and why your solution is worth funding.

During this phase, you’ll:

Introduce your company name, mission and values

Frame the problem from the customer’s perspective

Present your solution and focus on its unique benefits

Start by drafting the company overview section. It should set the stage and define your business’s identity and purpose.

A great way to do this is by defining your mission and vision:

Along with these statements, provide the essential facts about your business, like:

Your company’s legal name and structure

Your location and founding date

A brief origin story or a few of your most important milestones to date

With that written down, frame the problem you solve. Investors need to see that the pain is widespread and costly, which creates a clear business opportunity.

Quantify the problem to show its scale and impact:

How many people does it affect? For example, “over 10 million US-based SMBs still rely on manual spreadsheets rather than CRM solutions.”

What is the economic cost? For example., “...costing them an estimated $50 billion annually in lost productivity.”

Why are existing solutions failing? For example, “current software is too expensive, too complex or not designed for service-based businesses.”

After establishing a clear problem, present your solution as the answer. Avoid technical jargon and focus on the value you create:

Feature or functionality (what it is) | Benefit (what it does for the customer) |

Saves the user 10 hours per week writing emails. | |

Gives users a clear overview of your entire sales process. | |

Eliminates repetitive admin by sending follow-up emails and scheduling activities. |

This section is also where you’ll state the USP you identified during the research stage. After reading it, investors should see who you are and why you’re uniquely positioned to win.

4. Frame your go-to market plan to prove profitability

In the go-to-market section, you prove you have a credible engine for turning an investor’s capital into profits.

You need to:

Frame your pricing strategy to show its value and profitability

Present your marketing plan as a predictable system for attracting customers

Outline your sales process and show it’s efficient and scalable

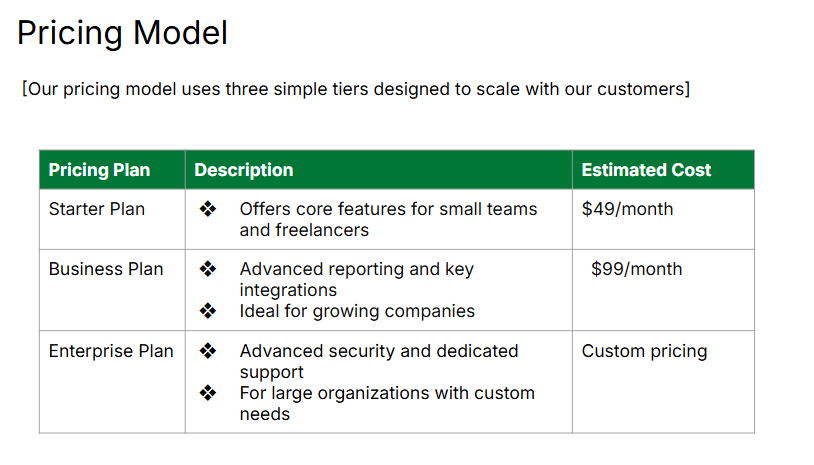

Your pricing strategy is the first piece of evidence. Show investors that you’ve chosen the right model to maximize customer lifetime value (LTV) and ensure predictable revenue streams.

Choosing a standard, justifiable model gives investors confidence. Here are some key examples:

Pricing strategy | Best for (+ examples) |

Subscription | SaaS companies and services that need recurring revenue. Examples: Pipedrive, Microsoft 365 |

One-time purchase | Physical goods, software licenses and digital downloads. Examples: Office equipment or legal document templates |

Freemium | Products that attract a large user base with a free offering, then upsell later. Examples: Slack, Trello |

Usage-based | Services where costs scale with the number of interactions or transactions. Examples: Stripe (charges per transaction) and some email marketing plans |

Next, show how your business plan guides the customer acquisition funnel. Investors want to see how putting “X” dollars in at the top produces “Y” qualified leads out of the bottom.

Define your marketing channels and use specific metrics (like customer acquisition cost) to prove your marketing is a wise investment.

Finally, present your sales process as a well-oiled machine that’s efficient and ready to scale. Investors need to see that if they invest, your sales team has the know-how to handle an increased volume without breaking.

A repeatable process gives investors confidence that you can grow reliably. Outline how your sales team addresses each of these stages:

Lead generation – the initial point of contact, like a website form submission

Lead qualification – a discovery call or survey to determine if the lead is a good fit

Business proposal or sales demo – a formal investment proposal presentation of your solution to the qualified lead

Closing sales – he final steps of sales negotiation and signing a contract

Customer onboarding – the process of welcoming a new customer and ensuring their immediate success

Using a customer relationship management (CRM) system like Pipedrive shows investors you have a single source of truth for all sales data. You can forecast funding accurately and prove your business is ready for growth.

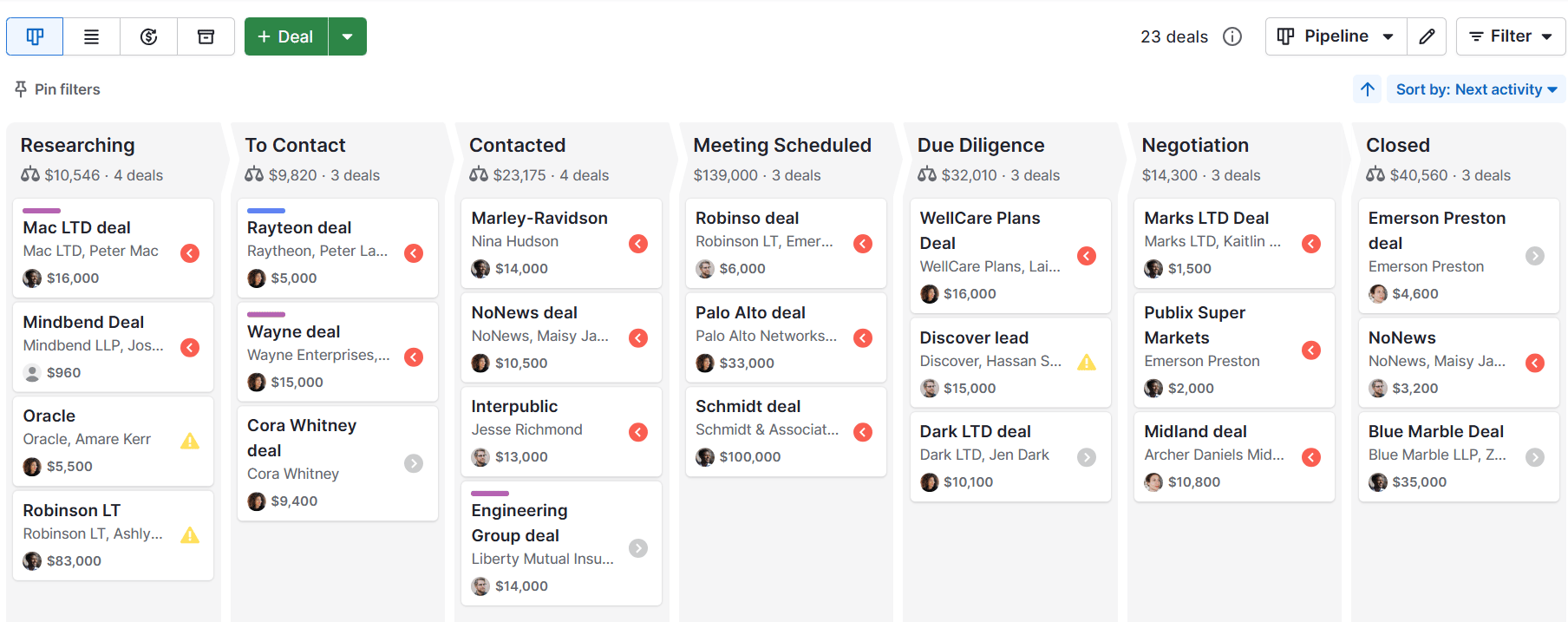

With Pipedrive, you can build a dedicated investor pipeline to track outreach and progress, using custom fields and reporting to monitor every stage. Your pipeline might look something like this:

Once you’ve set up your pipeline, attach proposals and pitch decks to deals to keep everything organized. Share real-time progress updates with stakeholders and build long-lasting investor relations.

5. Build your financial projections

The financial section proves your plan is profitable by forecasting future revenue and outlining the assumptions behind your numbers.

In this step, you’ll:

Prepare your key financial statements

Create a three-to-five-year financial forecast

List the main assumptions that justify your projections

Investors want to see data that clearly shows your company’s financial health.

If you have an operating history, get up to three years of these statements ready for due diligence:

Financial statement | Purpose |

Income statement | Shows your revenues, costs and profitability over a period of time |

Balance sheet | Gives investors a snapshot of your assets, liabilities and equity at a single point in time |

Shows how cash moves in and out of your business |

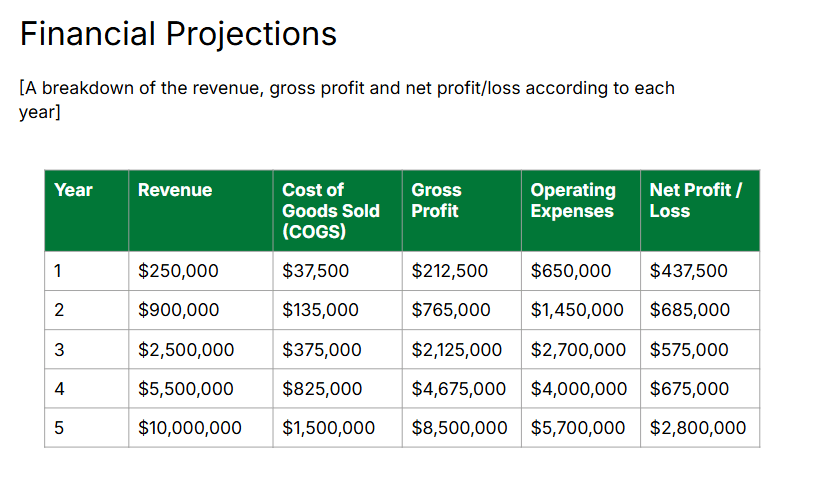

Your proposal itself shouldn’t include all the detailed statements. Instead, present a high-level summary table showing the big picture and your growth trajectory.

The table shows key metrics like your revenue report, gross profit, operating expenses and net income.

Most importantly, it lists the core assumptions that you based your forecast on. They should be direct, like:

We will grow sales by 40% year-over-year by hiring two new sales reps

Our customer acquisition cost will be $250, based on current Google Ads performance

Our gross margin will hold steady at 70%, matching our historical average

You also need to outline your potential exit strategy. Investors need to see how they will get a return on their financial support, typically within a 5–10-year timeframe. Usually, you’ll plan for another company to buy you out or sell shares on the stock market.

You don’t need a specific buyer, but showing you understand these options proves you are thinking about the long-term return for your investors.

Pipedrive in action: To secure funding, you must prove your business is scalable. Accentuate, a marketing agency, struggled to scale its sales process, limiting its revenue potential.

It began using Pipedrive to organize its sales workflow and track every deal, creating a sales model that grew revenue by 1,000% over four years. This quantifiable growth proves to investors that a business is ready to scale.

With your financial projections complete, the final step is to bring everything together.

6. Assemble the final sections and review

The final sections of your project proposal build an investor’s confidence that you can execute your plan.

In this step, you’ll:

Showcase your team and its expertise

Detail your use of funds

Write a powerful executive summary

Create a short bio for each key team member to show your team has the relevant experience to execute your plan and overcome challenges.

Each bio should focus on:

Relevant experience – highlight past successes, especially in the same industry or in a startup environment

Key skills – mention specific skills that are critical to the business (e.g., software engineering or sales management)

Roles and responsibilities – clearly state each person’s job in the company

Investors also need to see a strategic plan for their money. Vague statements like “for business growth” won’t get you funded. Instead, you need a clear idea of what you’ll spend it on.

Here’s an example investment plan for a $500,000 funding request:

Funding area | What we’ll do |

Product development ($200,000 – 40% allocation) | Hire two senior software developers |

Sales and marketing ($150,000 – 30% allocation) | Launch Google Ads campaigns and hire a sales representative |

Operating costs ($150,000 – 30% allocation) | Cover 18 months of software subscriptions, rent and inventory |

You should also list the key milestones this funding will help you achieve to connect the investment to tangible results. For example, it might help you reach 10,000 users or achieve $500,000 in annual recurring revenue.

The executive summary is the final piece you’ll write, even though it comes first in your proposal.

A one-page overview of your proposal hooks investors and convinces them to read past the cover page.

Review your completed sections and pull the most potent point from each, including your mission, problem, solution, market size and asking amount.

Once your draft is complete, use this final checklist to polish it to a professional standard:

Business investor proposal area | Key question to ask |

Story and flow | Does the proposal tell a clear and compelling story from start to finish? |

Clarity and tone | Is the language simple, confident and jargon-free? |

Design | Is the document clean and easy to read? |

Feedback | Has a trusted advisor or mentor reviewed it for weaknesses? |

Proofreading | Have you checked every line for typos and grammatical errors? |

Your completed proposal is the key to getting a meeting. Now it’s time to win the funding.

How to present your proposal to investors

A confident and well-prepared presentation secures your business funding for the future.

The following tricks will make your presentation far more effective:

Practice the 10-minute pitch: Investors are busy. Try to deliver your core pitch in 10 minutes, leaving the rest of the time for questions and discussion.

Lead with the story, follow with data: Don’t open with metrics. Hook them emotionally with a relatable story about the problem your business solves.

Read the room: Pay close attention to body language and engagement. If an investor seems particularly interested in one area, spend more time there.

Prepare for hard questions: Investors will be skeptical. Treat tough questions as an opportunity to address concerns and demonstrate your expertise.

Define the following steps: End the meeting by stating what will happen next, whether it’s a follow-up meeting or a timeline for their decision.

A successful presentation is about building rapport and demonstrating credibility and trustworthiness.

The proposal provides the facts, but your presentation provides the conviction, which is the final step in making your investment case.

Investment proposal example for SMBs: Buffer

Buffer, a social media tool, used a pitch deck to raise $500,000 in 2011. It’s the perfect investment proposal example for SMBs because it focuses on clarity and proof:

Here’s what made its pitch so effective:

Clear and relatable problem: Buffer engaged investors with a simple question about a universal business challenge: “How do you use social media to drive traffic?” This made the need for a solution obvious.

Visual solution: The company used a simple screenshot instead of a wordy explanation, quickly demonstrating the product’s value.

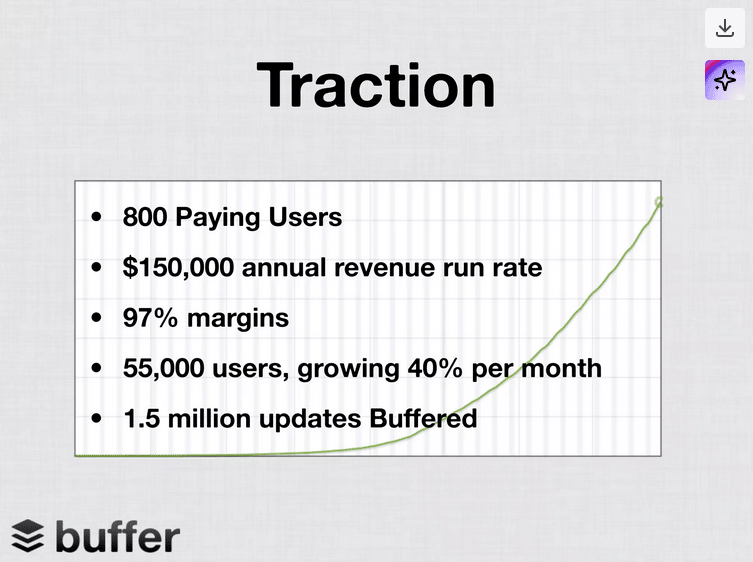

Data-driven traction: It presented complex numbers (users, sales revenue, growth) as the ultimate proof. This approach immediately reduced risk and built credibility by showing that people had already paid for the product.

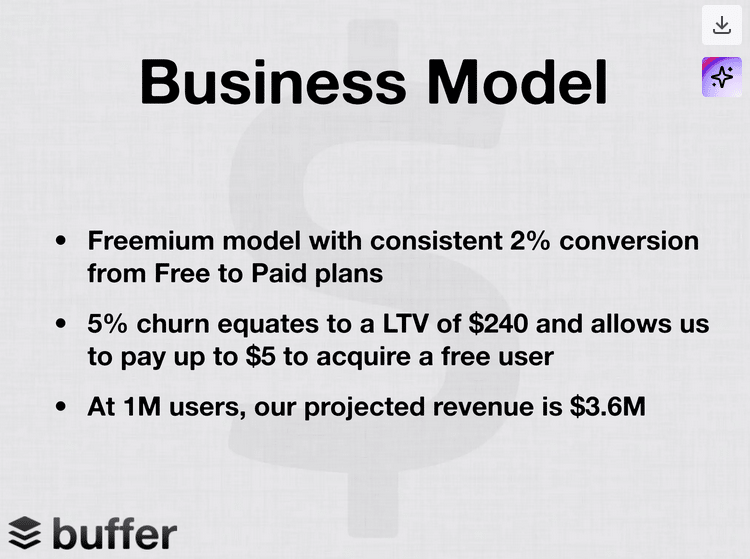

Simple business model: Buffer explained how the company makes money, answering the investor’s core question about profitability and proving the model was ready to scale.

Now that you have the blueprint, the next section will walk you through how to research and write each part to build a clear and persuasive proposal.

Final thoughts

An excellent investment proposal organizes your plan, tells your story and gives investors confidence to fund your business. It does the hard work of explaining your business on paper, freeing you up to focus on your pitch.

Whether you’re just starting or looking to grow an existing company, a strong proposal is the tool that helps you raise the money you need.

Start managing your investor pipeline today with a free 14-day trial of Pipedrive.